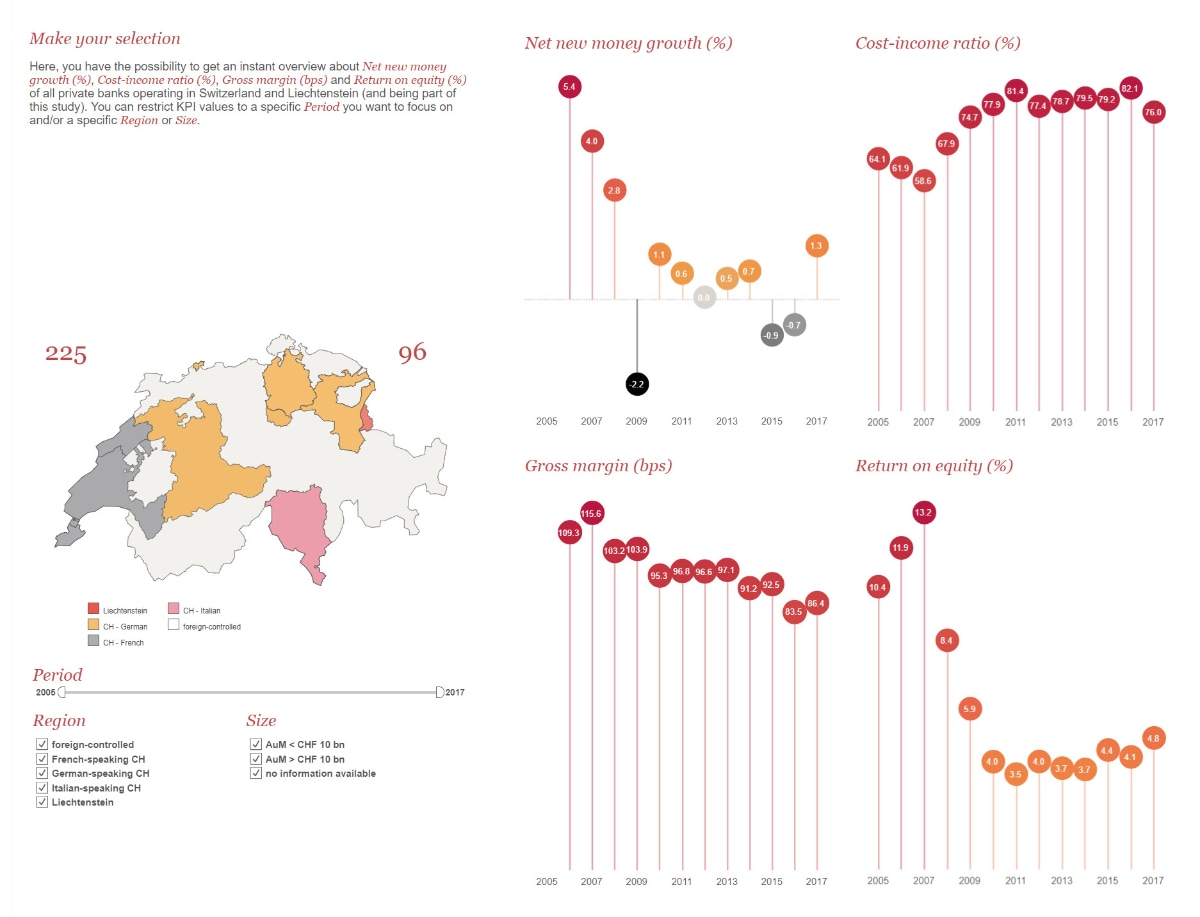

An overview of the most critical key performance indicators

PwC’s Private Banking Benchmarking Tool offers the latest insights into the most critical key performance indicators of more than 225 private banks in Switzerland and Liechtenstein between 2005 and 2017, of which 87 were active in 2017 (75 in Switzerland, 12 in Liechtenstein).

Within seconds our interactive benchmarking tool shows the market position and performance of your peers. With such insights you are well equipped to identify areas for further optimisation and learn from the best.

- The interactive benchmarking tool shows the market position and performance of your peers.

- KPIs of more than 225 private banks in Switzerland and Liechtenstein

- 87 banks were active in 2017 (75 in Switzerland, 12 in Liechtenstein)

Methodology

For the purpose of comparability between individual peer groups, all graphs and KPIs in this presentation show median values. As such, we are not making any statements about the market as a whole, but rather presenting the current trends of individual groups.

Our Private Banking Database covers more than 225 private banks, of which 87 were active in 2017 (75 in Switzerland, 12 in Liechtenstein). The private banks in our sample primarily focus on wealth management activities. In this presentation we differentiate between private banks of different sizes and regions, including a split between local and foreign-owned banks (i.e. banks under the control of a bank outside Switzerland or Liechtenstein). Our sample does not include the two big banks UBS and Credit Suisse.

Moreover, please note that we have not normalised any of the numbers. It is therefore possible that certain KPIs are impacted by one-off effects.

Uncover your Potential

We are looking forward to presenting to you the full capabilities of the Private Banking Benchmarking Tool, allowing you to create your individual peer group of direct competitors.

The KPI Tree provides an at-a-glance view of how your bank generates value and how your revenue and cost drivers perform in relation to those of your direct peers. In this rapidly changing and increasingly competitive industry, such insights will enable you to take timely action for further optimisation and give you an edge over your peers.