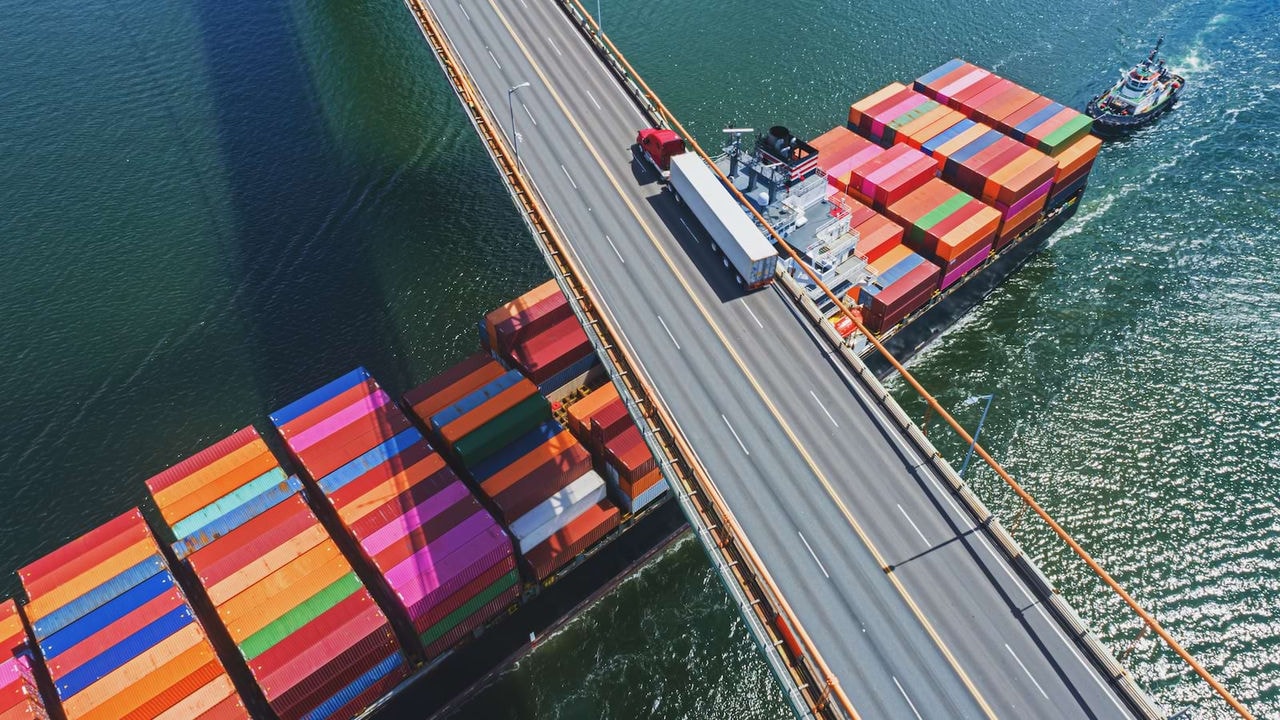

Navigate customs and global trade with PwC expert guidance and tailored solutions

Customs and international trade consulting

Meet the experts behind your customs and trade success

In the fast-paced world of global business, navigating customs and international trade regulations can feel overwhelming. Whether it's understanding intricate trade rules, optimising duty savings, or exploring new export avenues, staying competitive is crucial.

Our expert team delivers comprehensive support across your entire supply chain, ensuring you're in control and making strategic decisions. From navigating customs processes and free-trade agreements to managing export controls and implementing IT automation, we provide the expertise to thrive globally.

We believe that embracing cutting-edge technologies is vital for meeting your company's strategic needs. With a focus on processes, people, technology and governance, our aim is to offer tailored advice that empowers your business to succeed.

“From navigating customs complexities to staying ahead in environmental compliance, we're here to empower your success.”

Simeon L. ProbstPartner, Customs & International Trade, PwC SwitzerlandServices and solutions

Customs consulting services

Navigate the complexities of global customs and trade flows with PwC. Our experts ensure compliance, efficiency and optimisation in your operations. From preferential origin management to customs valuation, we streamline processes and maximise benefits for your business.

- Comprehensive guidance: Benefit from PwC's expertise in navigating the intricate landscape of global customs and trade flows. We provide tailored solutions to ensure compliance, efficiency and optimisation throughout your trade operations.

- Preferential origin management: Our specialists assist in managing preferential origin rules, helping you qualify for preferential tariffs and reduce international customs duty exposure significantly.

- Tariff classification review: Ensure accurate tariff classifications for your goods, aligning with the latest customs regulations to prevent costly penalties and streamline customs processes.

- Customs valuation and transfer pricing adjustments: Receive specialised advice on customs valuation of goods, including transfer pricing adjustments, to ensure accurate, compliant and optimised valuations for your financial benefit.

CBAM and environmental taxes (e-taxes) services

Stay ahead in the global trade landscape with PwC's CBAM and environmental tax services. Our assessments, compliance solutions, and governance strategies empower your business towards sustainability leadership and regulatory compliance, enhancing your competitive edge.

- Thorough assessment: Navigate CBAM and environmental tax regulations with expert assessment services. Gain insights into their impact on your business and identify strategic opportunities for optimisation and compliance.

- Compliance solutions: Utilise cutting-edge technology solutions and compliance services to meet CBAM regulations with precision and innovation, ensuring accuracy, efficiency and compliance.

- CBAM governance: Benefit from specialised services in emissions calculation, supplier management and process organisation to effectively manage CBAM requirements.

- Sustainability partnership: Partner with PwC to advance your sustainability goals, leveraging expert advice, tailored strategies and technology solutions.

SAP GTS and automation solutions

Optimise your global trade approach with PwC's SAP GTS and automation solutions. From trade compliance management to customs management and trade preference management, we offer tailored strategies and support for seamless operations.

- Tailored trade compliance management: Automate business partners validation, goods movements, customs declarations and trade preference management for seamless compliance.

- Customs management: Automate creation and filing of customs declarations globally, along with support for special customs regimes like processing relief and bonded warehouse management.

- Trade preference management: Leverage international trade agreements efficiently to cut costs and enhance compliance, including agreements such as the USMCA or regions and international associations like Switzerland / the EFTA, the EU and ASEAN.

- Comprehensive support: Beyond SAP GTS implementations, receive guidance on developing global trade strategy, lowering operational hurdles, mitigating financial risks and utilising trade data analytics.

Export control and sanctions compliance

Ensure compliance and maintain a competitive edge with PwC's export control and sanctions consulting. From risk assessment to internal compliance programs and training, we provide comprehensive solutions tailored to your business needs.

- Risk assessment: Stay ahead of risks with detailed assessments, identifying vulnerabilities to export controls and sanctions to safeguard against legal complications and reputational damage.

- Dual use classification support: Obtain expert assistance in product/dual use classification, ensuring compliance with Swiss and international export control lists while streamlining export processes.

- Internal compliance programs: Design tailored compliance programs to fit your business needs, encompassing policy development, procedure implementation and ongoing management practices.

- Training and awareness: Empower your team with comprehensive training programs, fostering a culture of trade compliance throughout your organisation.

Trade Data Analytics services

Transform your international trade challenges into opportunities with Trade Activator. Unlock significant savings and streamline operations for a competitive edge in the global market. Embrace efficiency with PwC's innovative solution.

- Efficiency enhancement: Embrace Trade Activator to transform international trade challenges into growth opportunities. Unlock significant savings and streamline operations for a competitive edge in the global market.

- Comprehensive solution: Benefit from a solution designed to address your specific trade needs, offering efficiency, cost-effectiveness, and strategic advantages.

- Customisation: Tailor Trade Activator to your business requirements, ensuring seamless integration and maximising your benefits.

- Expert support: Access PwC's expertise and support throughout the implementation and utilisation of Trade Activator for optimal results.

Contact us

Talk to the experts behind your customs and trade success.

https://pages.pwc.ch/view-form?id=7014I0000006qixQAA&embed=true&lang=en

Simeon Probst