{{item.title}}

{{item.text}}

{{item.text}}

The International Accounting Standards Board (IASB) has issued IFRS 18 'Presentation and Disclosure in Financial Statements' in April. IFRS 18 will replace IAS 1 and will have a significant impact on the statement of profit or loss. This article provides related insights for financial services companies.

On 9 April 2024, the IASB issued a new standard – IFRS 18, ‘Presentation and Disclosure in Financial Statements’ – in response to investors’ concerns about the comparability and transparency of entities’ performance reporting. Read the related blogpost for an overview of the changes IFRS 18 introduces.

The key changes introduced by IFRS 18 for financial services entities relate to:

This publication provides an overview of the requirements for each of these aspects, alongside focus areas for the financial services industry. It also provides an illustrative statement of profit or loss for (1) an investment and retail bank, (2) an insurer and (3) an investment fund.

Classification categories

IFRS 18 introduces a defined structure for the statement of profit or loss. The goal is to reduce diversity, so as to help investors understand the information and make better comparisons between entities. The structure is composed of categories and required subtotals.

Items in the statement of profit or loss will be classified into one of five categories: operating; investing; financing; income taxes and discontinued operations. IFRS 18 provides guidance for entities to classify the items among these categories. Operating, investing and financing are the three main categories.

IFRS 18 requires entities to assess whether their main business activities include investing in assets and/or providing financing to customers. If so, some specific income and expenses that would otherwise be outside of the operating category are classified in the operating category.

Accordingly, for entities (such as insurers and investment funds) for which investing in assets is a main business activity, we expect that the required categories will generally reflect the following:

Some insurers invest in associates and joint ventures as part of the assets that back their insurance liabilities, so presenting the results from such investments outside the operating category would create a classification mismatch. To address this issue, IFRS 18 provides an option on transition to IFRS 18. Applying that option, if an entity was eligible to account for an associate or joint venture in accordance with IFRS 9 (applying paragraph 18 of IAS 28), but previously elected not to do so, it can change that election on transition to IFRS 18.

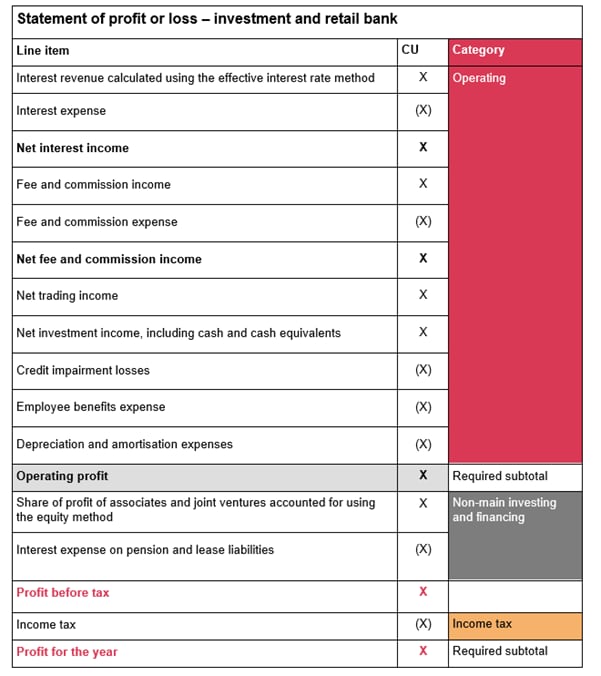

For entities (such as banks) for which investing in assets and providing financing to customers are both main business activities, we expect that the required categories will generally reflect the following:

The assessment of main business activity is performed at the reporting entity level. This means that the conclusion at group level might differ from that at the subsidiary level, resulting in some income and expenses needing to be reclassified on consolidation.

Required subtotals

IFRS 18 requires entities to present specified totals and subtotals. The main change is the mandatory inclusion of ‘Operating profit or loss’, which is defined as the result from the operating category. The other required subtotals are ‘Profit or loss before financing and income taxes’ and ‘Profit or loss’, as shown in the Appendix below. However, the ‘Profit or loss before financing and income taxes’ subtotal is not permitted for an entity that provides financing to customers as a main business activity and chooses to classify income and expenses as operating for all liabilities that involve only the raising of finance, regardless of whether those liabilities relate to providing financing to customers.

Entities should also present additional line items and subtotals if they are necessary for the primary financial statements to provide a useful structured summary. Among other requirements, any subtotals that the entity presents must be consistent from period to period, and they must not be displayed with more prominence than the required totals and subtotals.

As part of the transition to IFRS 18, entities will need to assess the line items and subtotals that they currently present, to determine whether those items meet this IFRS 18 requirement, and whether any changes might be needed.

Management might define its own measures of performance, sometimes referred to as ‘alternative performance measures’ or ‘non-GAAP measures’. IFRS 18 defines a subset of these measures that relate to an entity’s financial performance as ‘management-defined performance measures’ (‘MPMs’). An MPM is a subtotal of income and expenses that:

A financial ratio is not an MPM because it is not a subtotal of income and expenses. However, if a subtotal of income and expenses is the numerator or the denominator of a financial ratio, that subtotal might be an MPM (if the subtotal meets the definition of an MPM on a stand-alone basis). In such situations, the MPM disclosure requirements apply to the numerator or denominator that meets the definition of an MPM, but not to the ratio as a whole.

As compared to most other industries, financial institutions can often have more alternative performance measures based on balance sheet metrics, gross aggregations of income or expenses and regulatory measures, rather than subtotals of income and expenses.

Accordingly, many of the alternative performance measures currently used by financial services entities (for example, the loan-to-deposit ratio for banks, or the solvency capital ratios for insurance entities) will not be within the scope of the new disclosure requirements.

Information related to MPMs should be disclosed in the financial statements in a single note, including a reconciliation between the MPM and the most similar specified subtotal in IFRS Accounting Standards. This will effectively bring a portion of non-GAAP measures into the audited financial statements.

Judgement might be required to determine which measures meet the definition of an MPM. Additionally, the new disclosure requirements might go beyond what is typically disclosed today for an entity’s alternative performance measures. Entities should begin the process of identifying their MPMs now to prepare for any process or internal control changes that might be required to comply with the new requirements.

IFRS 18 provides enhanced guidance on the principles of aggregation and disaggregation that focuses on grouping items based on their shared characteristics. These principles are applied across the financial statements and are used in defining which line items are presented in the primary financial statements and what information is disclosed in the notes.

Totals, subtotals and line items presented in the primary financial statements and items disclosed in the notes need to be described in a way that faithfully represents the characteristics of the item. Entities should provide all necessary descriptions and explanations, including, in some cases, the meaning of terms used and information about how amounts have been aggregated.

IFRS 18 requires foreign exchange differences to be classified in the same category as the income and expenses from the items that resulted in the foreign exchange differences, unless doing so would involve undue cost or effort.

As an example, foreign exchange differences arising on a foreign currency-denominated liability that arises from a transaction that involves only the raising of finance (for an entity that does not provide financing to customers as its main business activity) would be classified in the financing category.

For derivatives used to manage identified risks (which includes economic hedges), gains and losses are classified in the same category as the income and expenses affected by the risks that the derivatives are managing. The same requirement applies to non-derivatives designated as a hedging instrument in accordance with IFRS 9 or IAS 39.

Gains and losses on derivatives that are not used to manage identified risks are typically classified in the operating category. However, there are additional considerations for some transactions that relate to the raising of finance that might result in some gains and losses being classified in the financing category.

All entities that report applying IFRS Accounting Standards will be impacted. The same requirements apply for both public and private entities, including the identification and disclosure of MPMs.

IFRS 18 will be effective for annual reporting periods beginning on or after 1 January 2027, including for interim financial statements. An entity is required to restate comparative information. Early application is permitted.

Appendix – Illustrative examples

(1) Illustrative statement of profit or loss for an investment and retail bank

(2) Illustrative statement of profit or loss for an insurer

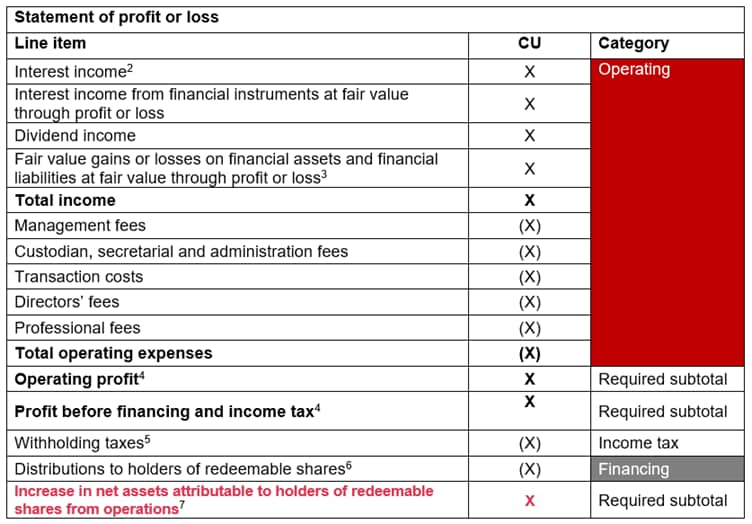

(3) Illustrative statement of profit or loss for an investment fund1

Paragraphs 64(a) and B58(b) of IFRS 18 requires an entity to exclude income and expenses from issued investment contracts with participation features recognised applying IFRS 9 from the financing category, and to classify them in the operating category. However, we do not believe that these paragraphs are applicable for investments funds, this is because:

a. there is no definition of investment contracts with participation features in IFRS 18, so it is unclear whether these paragraphs are applicable to funds, and

b. the intention of these paragraphs, as detailed in paragraph BC194 of IFRS 18, is for entities to reflect their margin appropriately by including income and expenses in the operating category. However, this does not apply to investment funds, since all income and expenses are returned to investors, with no residual profit left in the fund.

The 'Distributions to holders of redeemable shares' are therefore presented in the financing category, maintaining consistency with the presentation in paragraph IE32 in example 7 of IAS 32. The IAS 32 example approach offers a more useful presentation to the investors in the fund, and it aligns with the logic outlined in paragraph BC194 of IFRS 18.

The subtotal 'Increase/(decrease) in net assets attributable to holders of redeemable shares from operations' is shown as the ‘profit or loss’ subtotal in the statement of profit or loss of an investment fund. This aligns with example 7 of IAS 32 and remains unchanged under IFRS 18 as:

a. IFRS 18 did not change the requirement to present a line item for the period's profit or loss (this was already mandated by paragraph 81B of IAS 1);

b. the description established by the practice as exemplified by example 7 of IAS 32 was not amended by IFRS 18; and

c. paragraph 43 of IFRS 18 states, "An entity shall label and describe items presented in the primary financial statements or disclosed in the notes in a way that faithfully represents the characteristics of the item". This confirms that an entity might need to change line item descriptions compared to those in IFRS Accounting Standards.

Although it is not mandatory, the statement of profit or loss above separately presents interest from financial instruments at fair value through profit or loss, and fair value gains or losses on financial assets and financial liabilities at fair value through profit or loss. This presentation complies with paragraph 41 of IFRS 18, providing a useful structured summary and permitted to be disaggregated according to paragraph B5(e) of IFRS 7. These two elements are therefore recognised and measured in accordance with IFRS Accounting Standards, as required by paragraph 24 of IFRS 18 for disaggregation.

If this presentation is adopted, the entity’s accounting policy, including how such amounts are calculated and on which instruments, should be developed in accordance with paragraph 10–12 of IAS 8 and disclosed in accordance with paragraph 27A of IAS 8.

For further details, please refer to FAQ 18.36.1 – Presentation of interest for derivatives and other financial instruments measured at FVTPL.

1 This investment fund invests as a main business activity in financial assets that generate a return individually and largely independently of the fund’s other resources. As a result, all income and expenses related to financial assets are classified in the operating category. The fund also does not have transactions in foreign currencies and so no foreign currency gains or losses are presented.

2 This line item includes interest income on financial assets measured at amortised cost.

3 According to paragraph 55 (b) of IFRS 18, this line shows changes in the fair values of investments, including associates, joint ventures and unconsolidated subsidiaries.

4 This illustration shows two separate lines for ‘operating profit’ and ‘profit before financing and income tax’ in line with paragraph BC152 of IFRS 18.

5 Withholding taxes classified in this line fall within the scope of paragraph 2 of IAS 12. For more information, please refer to FAQ 14.6.1 – When are withholding taxes within the scope of IAS 12?

6 The fund’s shares are classified as financial liabilities under IAS 32. Where shares are classified as liabilities, distributions can be recognised as a finance cost in the statement of profit or loss, or they can instead be recognised within the statement of changes in net assets. Where shares are classified as equity, however, distributions are required to be recognised in the statement of changes in equity.

7 Paragraph 89 of IFRS 18 requires the disclosure of line items for items of ‘other comprehensive income’. Other comprehensive income comprises items of income and expense (including reclassification adjustments) that are not recognised in profit or loss as required or permitted by other IFRS Accounting Standards. This fund does not have other comprehensive income items. All income and expenses have previously been reported in the statement of profit or loss.

{{item.text}}

{{item.text}}