{{item.title}}

Welcome to our study on the strategic evolution and digital transformation of procurement in the face of economic, geopolitical, environmental, and regulatory challenges. Procurement’s role in ensuring supply chain resilience and innovation has never been more important.

Our research shows that procurement departments are increasingly focused on sustainable risk management, including data analytics, supplier risk management, and monitoring of CO2 emissions. Digitalisation is being driven not only by the traditional strive for process optimisation and cost reduction, but also by an emerging need for transparency and compliance. Key findings reveal a notable focus on corporate social responsibility (CSR), a widespread adoption of source-to-pay (S2P) solutions, and a preference for business criteria over technical aspects in the implementation of digital solutions.

Discover how these changes are shaping the future of procurement across industries.

Procurement is more strategic than ever - with sustainable risk management and analytics commitment.

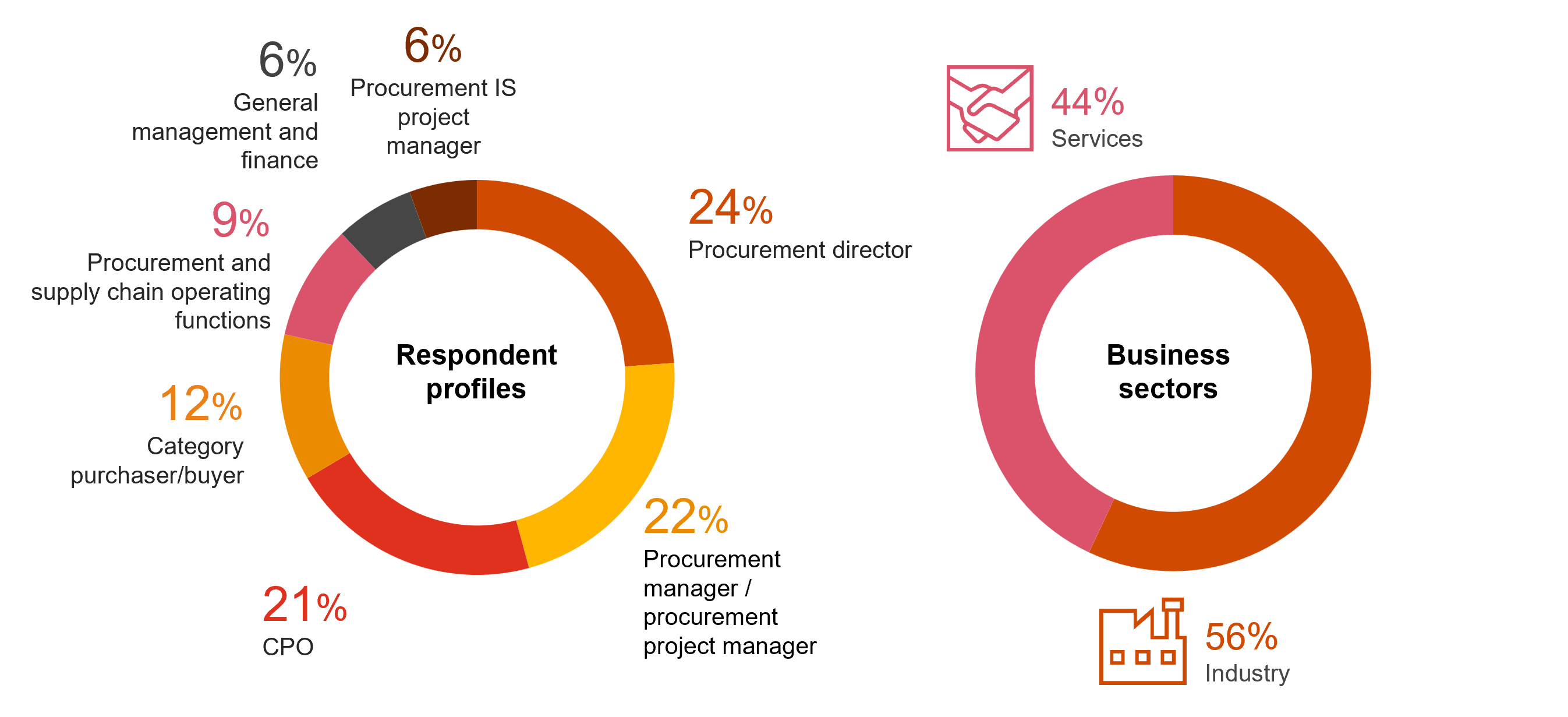

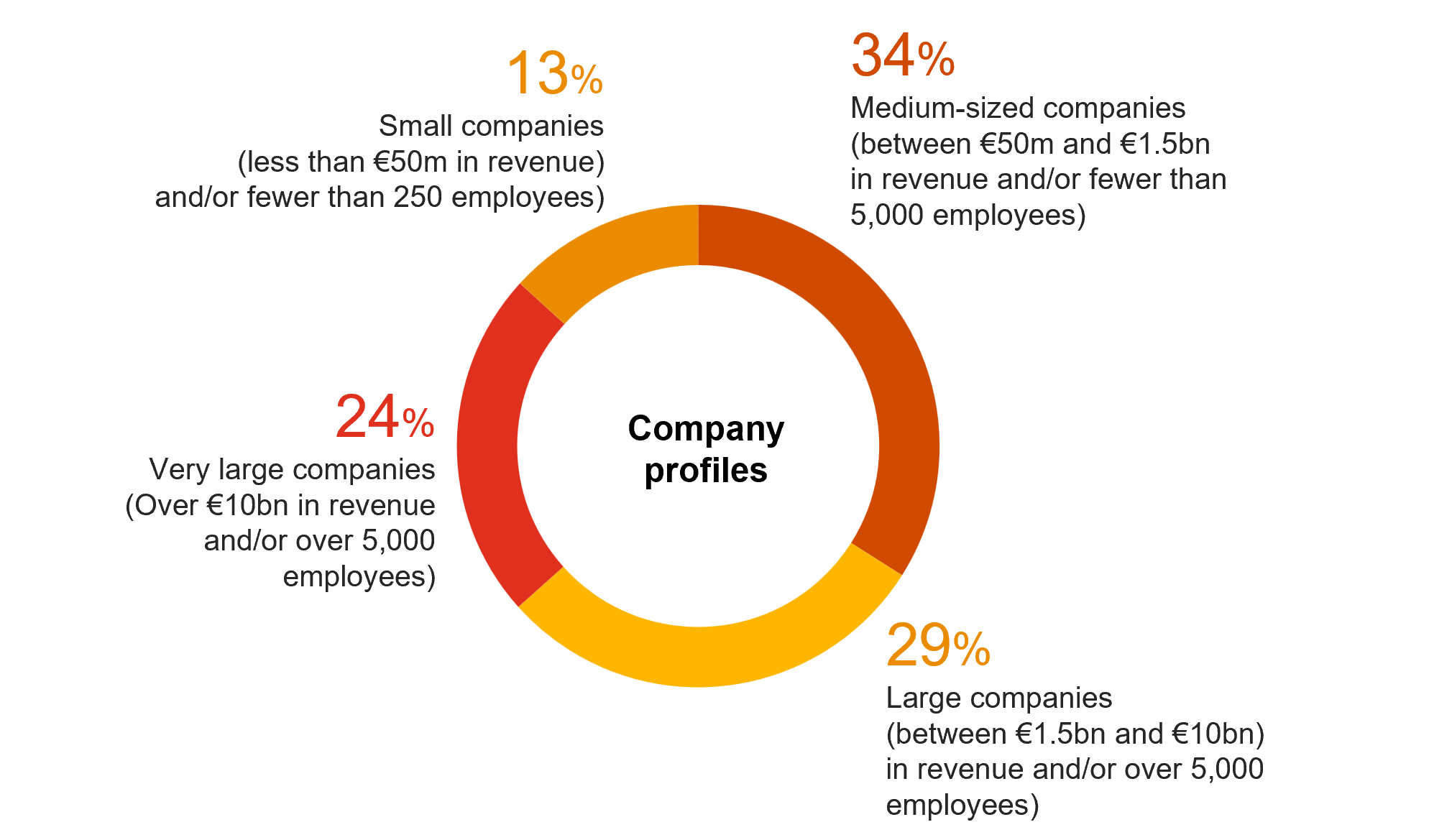

With 1000 participating companies from 58 countries on five continents, the 5th edition of the PwC Global Digital Procurement Survey provides new and detailed insights into the digital transformation of procurement. The survey was conducted between October and November 2023 with an email questionnaire.

In a post-COVID-19 environment marked by elevated interest rates and rising geopolitical tensions and conflicts, strategic priorities increasingly focus on procurement performance. 65 percent of procurement departments name cost control as their primary concern. This is followed by digital transformation, ranked as the second key priority by 46 percent of respondents. Corporate social responsibility (CSR) and sourcing come in third place, each being a priority for 35 percent of the departments. Expanding further, procurement departments are now also increasingly prioritising regulatory compliance (e.g. CSRD), marking it as a new and significant area of focus.

Digital transformation in procurement is mainly driven by efficiency gains, as reported by 70 percent of companies. The results, however, are mixed. While 62 percent achieved the expected benefits in terms of efficiency gains, the impact on procurement performance was less than anticipated. Two in five companies cite process transparency, traceability, and fairness as key digitalisation drivers, with 55 percent seeing benefits there. Increasing regulatory demands are also fuelling digital transformation, with a growing focus on improving user experience. Source-to-pay (S2P) solutions are critical to the digitalisation of procurement, and companies are prioritising business criteria over technical aspects when implementing these digital solutions.

Despite a stabilisation in the digitalisation rate of procurement departments following the pandemic, their ambitions for 2027 remain high, with an average target of 70 percent digitalisation. However, the actual rate didn’t change between 2022 and 2024, likely due to crises that slowed investment and to evolving digitalisation needs. There is optimism for significant growth in digitalisation by 2027, driven by expected improved investment conditions and factors such as ERP changes and regulatory constraints. In addition, risk management and monitoring of CO2 emissions are becoming increasingly important in these digitalisation efforts.

Not only on a global level, but also in Switzerland we observed a distinct increase in responses from the 2022 edition of the study (2022: 17; 2024: 46), which enables us to share a Switzerland-specific perspective for the first time.

Swiss firms emphasise financial performance and stability more than the global average, with over half prioritising it as their top procurement goal. Sourcing ranks second, while digital transformation and supplier management tie for third, reflecting a strategic response to geopolitical and inflationary challenges.

In digital solutions, Swiss companies favour established leaders for source-to-contract (S2C) and procure-to-pay (P2P) implementations, with SAP being the preferred choice. While following global trends in S2P adoption, Switzerland shows a higher preference for standalone P2P solutions. Larger Swiss firms are set to outpace the global average in digital transformation investments by 2027, with a strong focus on monitoring CO2 emissions and risk management in their procurement strategies.

https://pages.pwc.ch/core-asset-page?asset_id=7014L000000IJdDQAW&embed=true

Dinesh Purushothaman

Director, Technology Consulting, Supply Chain Management, Basel, PwC Switzerland

+41 58 792 55 02