{{item.title}}

{{item.text}}

{{item.text}}

Evolving regulations and investor expectations are pushing for sustainability reporting to be on a par with financial reporting, as seen with new legislation and standards like the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy. The CSRD, for example, is aimed at changing behaviours through reporting. Hence, sticking to a pure compliance approach will probably be a losing strategy in the long run. Opting for shortcuts might ensure compliance in the short term but doesn’t fully harness the potential competitive advantage of sustainability steering, as companies will be expected to take action to move indicators in the right direction at the right pace. Incorporating sustainability reporting and steering into an organisation is a delicate balancing act between meeting immediate compliance obligations and seizing opportunities in the longer run. Sustainability solutions are one element that can facilitate this balancing act. While technology is rapidly evolving to meet companies’ sustainability requirements, they aren’t mature enough yet. As a result, companies often encounter challenges along their sustainability reporting journey.

This article sheds light on the following three main technology-related challenges that clients face when trying to establish sustainability reporting and steering, and highlights best practices to overcome them:

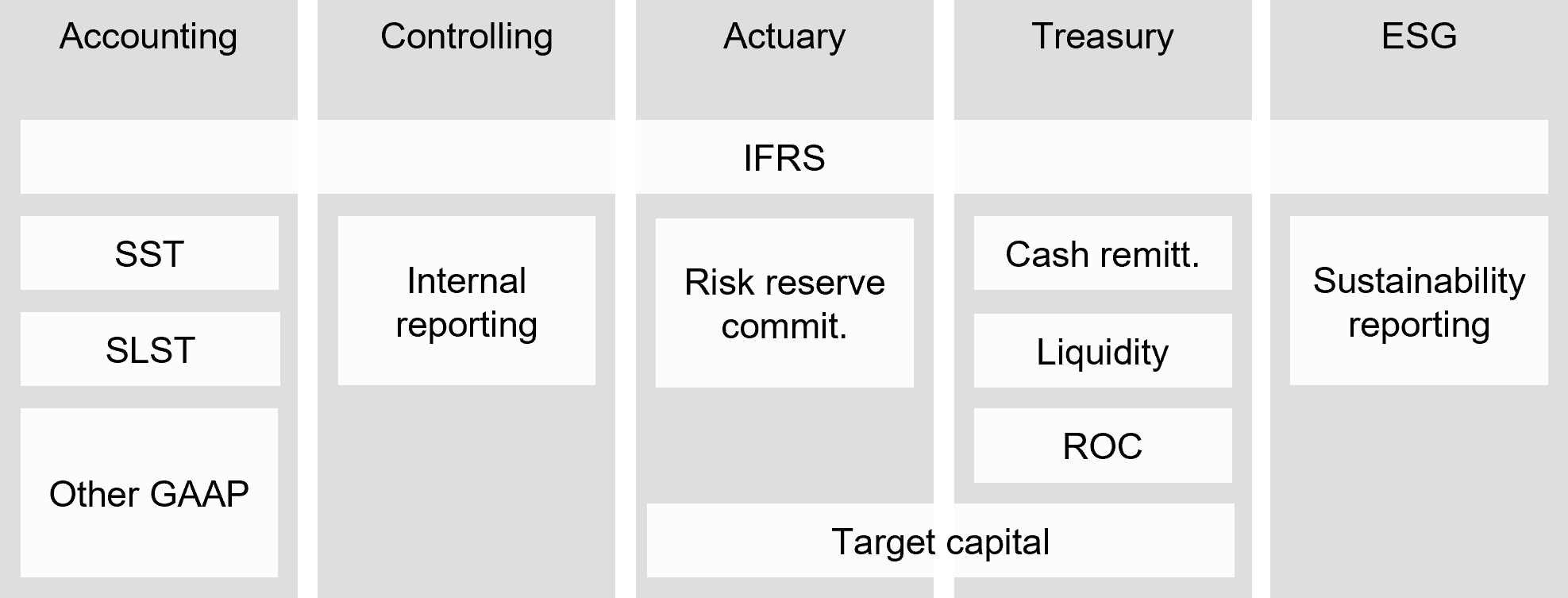

Gathering, preparing, organising and analysing sustainability data from diverse sources to enable effective sustainability reporting and steering is a major challenge in all industries. The lack of a standardised governance framework in combination with multiple data sources leads to inconsistencies in data collection, reconciliation, consolidation and reporting.

One best practice is to redefine the system infrastructure by establishing a unified data model (UDM), enabling the transition to a streamlined and centralised data source for reporting and steering. A UDM aligns data definitions and granularities across functions, simplifying and harmonising information company-wide, which in turn accelerates the digital transformation journey effectively.

In essence, a single UDM serves as a powerful solution to solve inconsistencies, thereby streamlining operations and unlocking numerous advantages, such as:

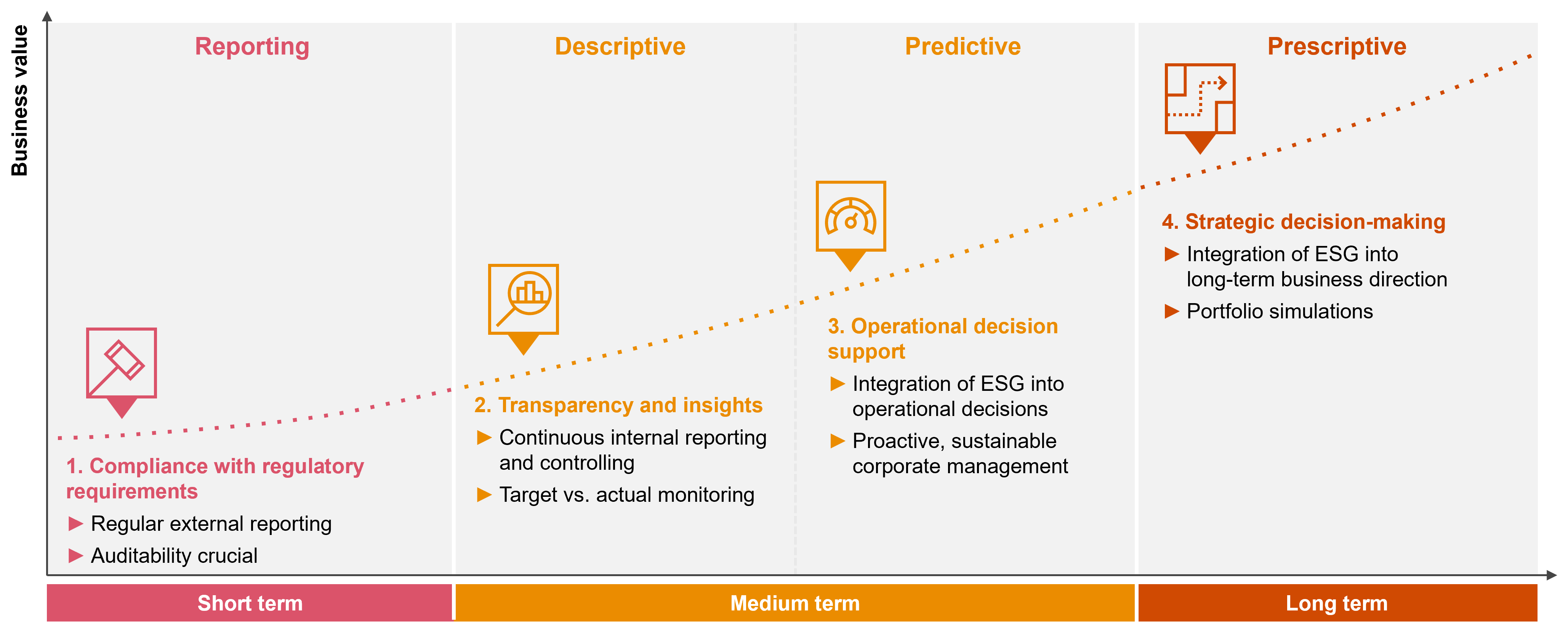

Adapting to evolving sustainability reporting standards within a tight timeframe poses a significant challenge, impacting a company’s ability for effective decision-making in the long run. Striking the right balance between aligning solutions with the company’s sustainability goals, system infrastructure and operational needs, while ensuring its feasibility for implementation, can be difficult.

What we are currently seeing among clients that are successfully implementing sustainability reporting and steering is the embedding of ESG factors at the core of both short- and long-term business objectives. By doing so, sustainability becomes more than a distant vision; it becomes an essential factor influencing all current and future business-related decisions.

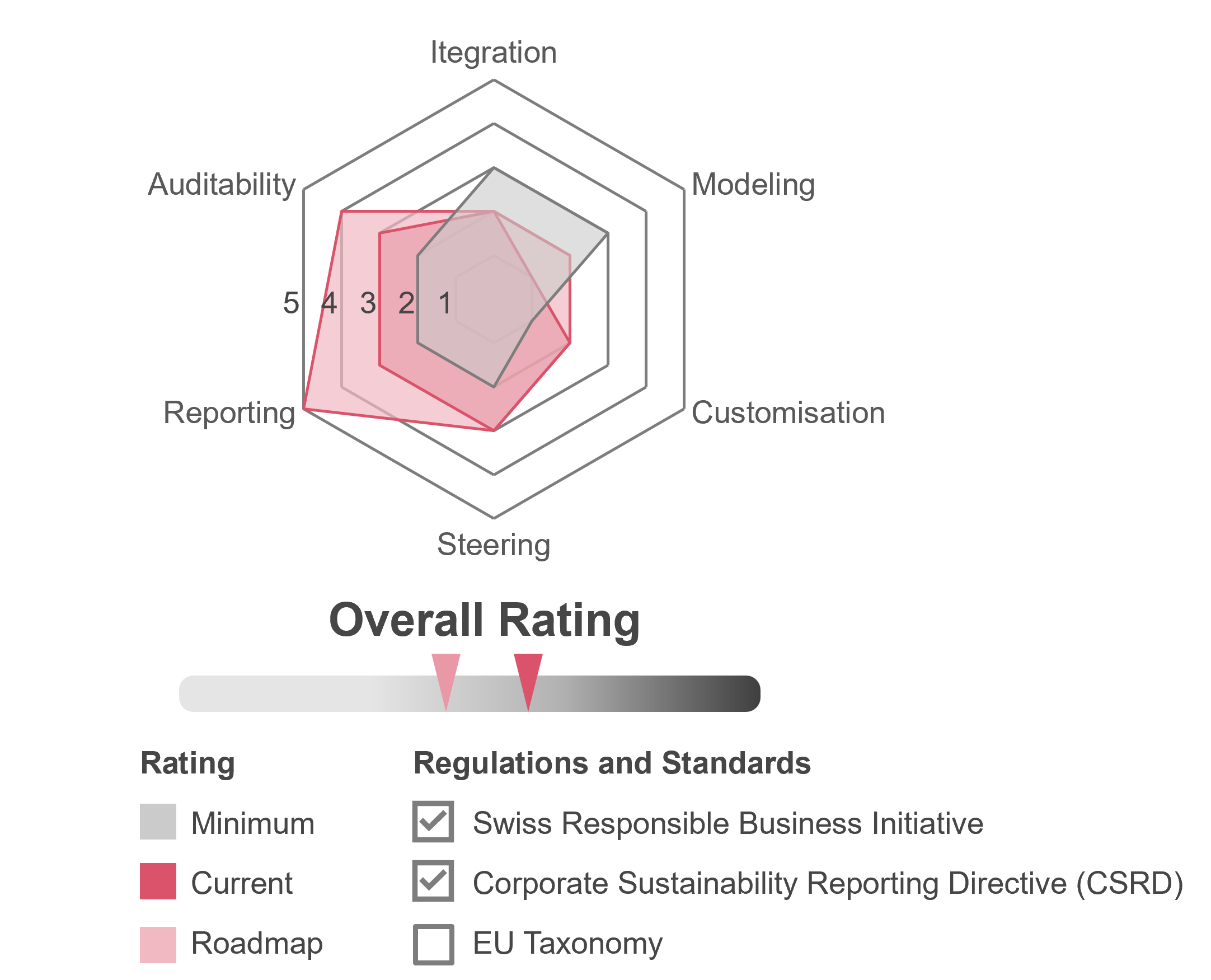

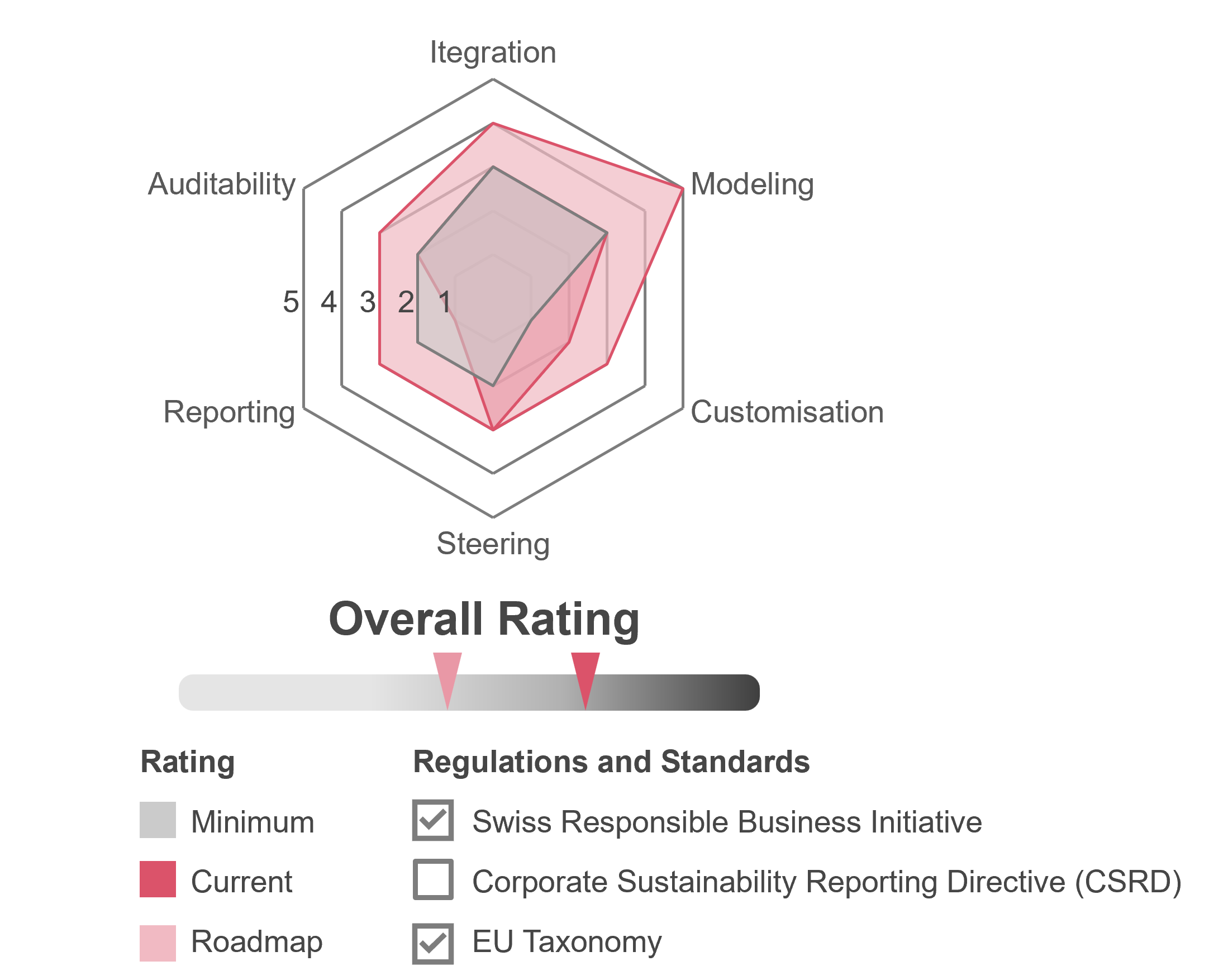

Aligning a technology solution with a company’s sustainability objectives, system infrastructure and operational requirements while assessing its feasibility for implementation can be complex. Historically, most vendors focused on specific capabilities like disclosure management, limiting functionalities such as data modelling, calculation, visualisation and steering. This also holds true for sustainability software providers; thus, it’s highly unlikely that any solution meets all client requirements. The plug-and-play assumption therefore doesn’t work. What’s more, companies often overlook their unique circumstances, individual needs and vision when selecting a tool to support their specific sustainability requirements. One best practice involves conducting a market analysis and assessing company-specific factors like functional specifications, solution roadmap and ESG objectives. We help our clients in performing this in-depth analysis using accelerators to expedite and facilitate their sustainability steering and reporting journey.

* Fictional sustainability software solution for illustration purposes

Wherever you are on your sustainability journey, choosing the right partner is pivotal to achieving success. Benefit from our extensive alliance partnerships and the global PwC network. Explore solutions like the CSRD Manager, which enhances SAP’s Sustainability Control Tower (SCT) with additional content and ready insights, unlocking comprehensive CSRD reporting capabilities. Discover how our services and solutions can empower your growth and help you establish a future-proof system. For further details, visit our website:

{{item.text}}

{{item.text}}

Partner, Finance Transformation Platform Leader and Sustainability Platform Leader, Zurich, PwC Switzerland

+41 58 792 25 37

Jean-Pierre Manfredi