Legal Frameworks and regulation for ICOs

ICO regulation and compliance

What are ICOs?

Initial coin offerings (ICOs) are a means of raising capital using the blockchain technology. On the side of the issuer, the collected funds are typically used to finance a project (e.g. the building of a software).

In exchange for the financing, the investor receives a token which may be connected with the right to receive, e.g. a dividend, a voting right, a license, a property right or a right to participate in the future performance of the issuer.

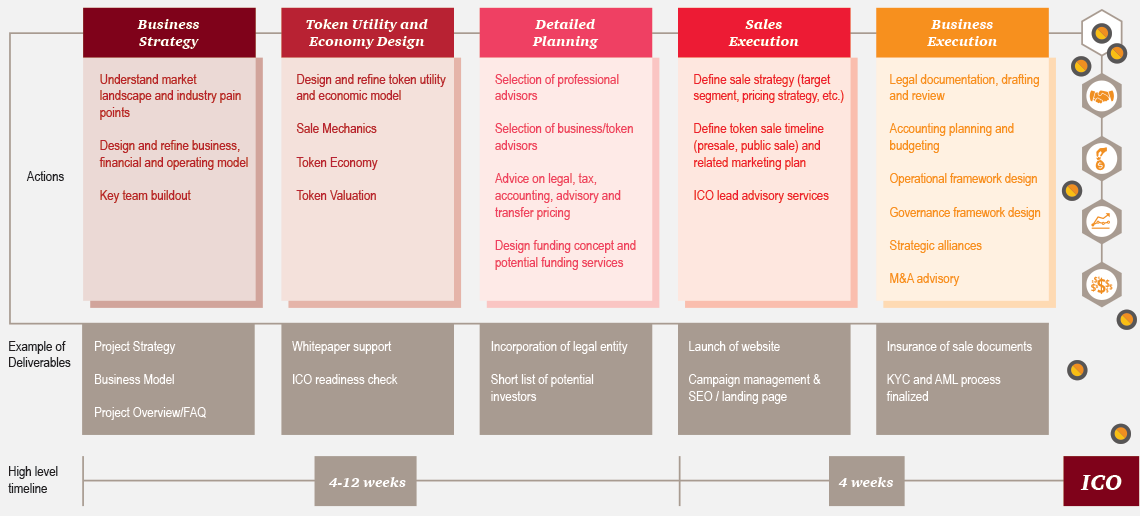

How are ICOs usually structured?

What is the timeline of an ICO?

PwC Global ICO Compass

Treatment of ICOs worldwide

Contact us today about ICOs

How PwC can support

- Legal

- Advisory Corporate Finance

- Assurance

- Strategy&

- Digital Services

- Tax

Legal

- Regulatory strategy and advise for all relevant regulations

- Compliance, KYC and AML support, incl. turnkey-solutions for digital client on-boarding or industry utilities

- Facilitation & support on interactions with regulators (Switzerland and all international jurisdictions)

- End-to-end services in obtaining written approval on regulatory treatment from regulators (e.g. no action letter, licences)

Advisory Corporate Finance

- Presale and public sale strategy, incl. ICO marketing advisory

- Pricing of ICO, valuation of token utility and business model

- Sale characteristics

- Fundraising with institutional investors

Assurance

- Risk management and assurance services and solutions for all relevant risk categories

- Cybersecurity strategy and services, incl. Forensics in fraud or malicious attacks

- Finance advise and audit/assurance services (incl. full/ partial audits based on legal requirements)

Strategy&

- Design of overall ICO strategy, incl. coordination of different teams (project management)

- Design and review of token economics, detailed analysis of usage and functionality

- Design and review of token economics, detailed analysis of usage and functionality

- Timing of ICO, detailed analysis of the market situation

Digital Services

- Web Agency services (end-to-end), incl. UX design, coding, services, maintenance

- Data & analytics services, incl. AI/ML, Quant, Algorithms

- Technical support, coding Blockchain-as-a-Service, integrated technology solutions

Tax

- Business registry and set-up, incl. complex legal entity structures, trusts, cross-border business

- Corporate governance & corporate actions, incl. contracts, by-laws and statutory requirements

- Support and counsel in litigations and intermediation of disputes

- Tax structuring and advise (cantonal, federal, international) for all relevant tax categories

Contact us

Markus Anderrüthi

Jessica Merola