Patrick Akiki

Partner, Financial Services Market Leader, PwC Switzerland

The crypto industry is bracing for major transformation in the EU with what is potentially the most comprehensive regulatory framework in the space. How should Swiss firms prepare for the new crypto era?

Countdown to MiCA

The Markets in Crypto Assets (MiCA) regulation is set to transform the crypto industry. The new framework will support market integrity and consumer protection by regulating the offer of crypto assets and the provision of crypto asset services to the public.

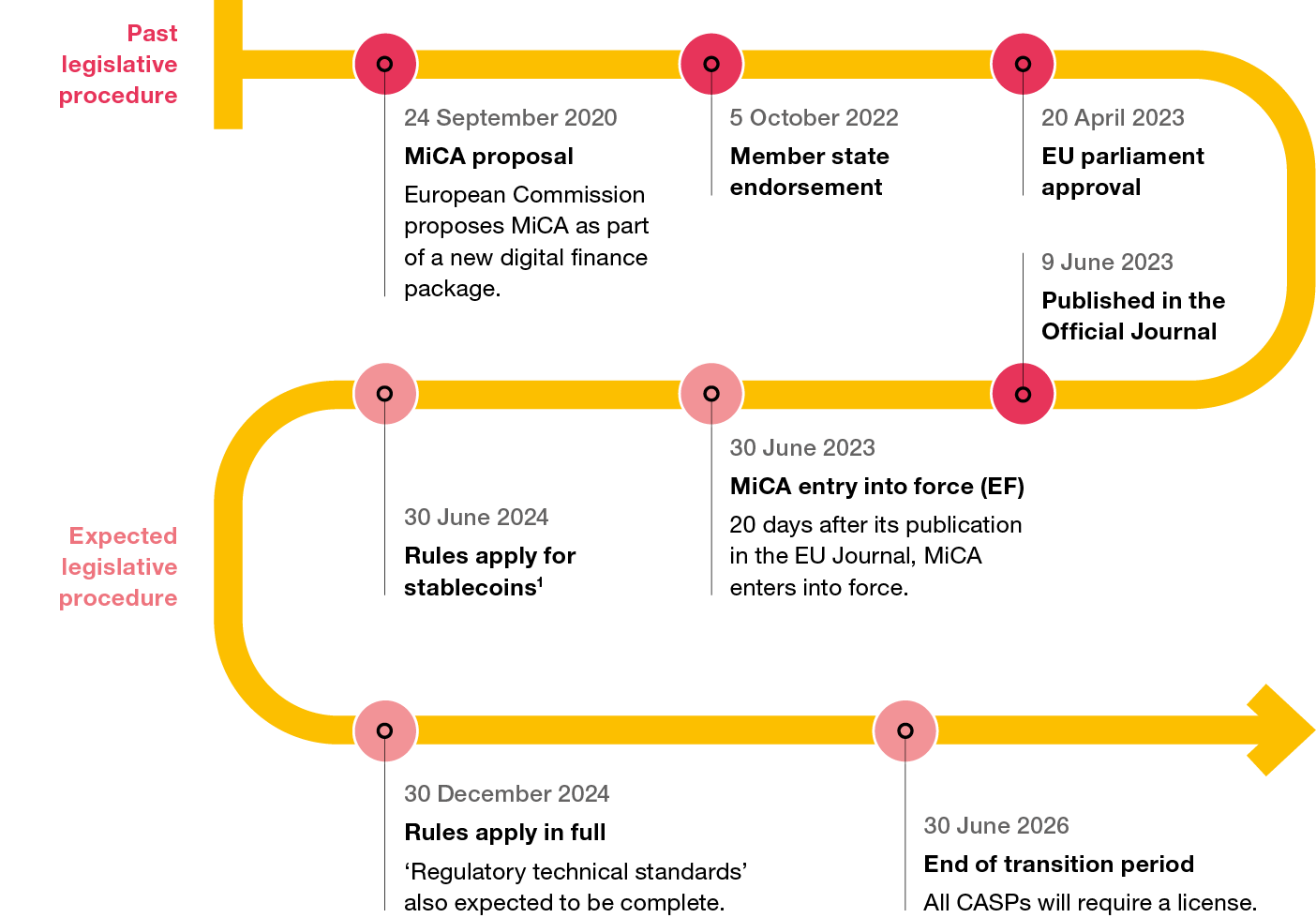

MiCA will enter into the force on 30 June 2023, with its provisions set to be rolled out in stages over the subsequent 18 months:

With the EU's tradition of setting global standards, MiCA is likely to become a benchmark worldwide. As a result, Swiss providers of crypto services need to prepare themselves for the upcoming regulatory changes to ensure they can continue doing business within the EU and to stay ahead of the curve in this fast-moving industry.

Overview of key requirements

The legislation imposes several requirements on crypto asset issuers and service providers, focusing on transparency, disclosure, supervision of transactions and – most importantly – a new authorization regime that promises to provide legal certainty for crypto firms to operate across the EU market.

Requirements for Crypto Asset Issuers:

Requirement for Crypto Asset Service Providers:

MiCA may position the EU as the catalyst for a new ‘crypto spring’ – a period of growth and innovation in the crypto landscape with new institutional participation.

What does this mean for Swiss crypto firms and the wider crypto industry?

MiCA’s emphasis on investor protection and governance is set to have a positive impact on global crypto markets following the recent challenges, which cast a negative light on the industry. Its robust standards closely tied to existing financial regulations will not only attract new institutional participants but also appeal to a broader class of investors reassured by the enhanced protections. Consequently, MiCA may position the EU as the catalyst for a new ‘crypto spring’ – a period of growth and innovation in the crypto landscape with new institutional participation.

Companies operating in both Switzerland and the EU will have to adapt to MiCA's more prescriptive framework, bringing new challenges and requiring strategic adjustments for compliance. Provisions of "reverse solicitation" might not be a sufficient basis for maintaining cross-border business into the EU. With a population of nearly 450 million people and combined GDP of almost EUR 15 trillion, the EU is one of the wealthiest markets and cannot be ignored.

Download our publication to find out what crypto firms should be doing to ensure business continuity with the EU and maximise opportunity in this new regulatory era.

Contact us

Partner, Financial Services Market Leader, PwC Switzerland

Tel: +41 58 792 25 19

Director, AWM Strategy & Transformation, Digital Asset CoE Lead, PwC Switzerland

Tel: +41 79 238 62 78