{{item.title}}

{{item.text}}

{{item.text}}

Blackout periods, sometimes called 'closed' or 'blocking' periods, are essential corporate governance measures designed to prevent insider trading at publicly listed companies. In Switzerland, this topic isn't extensively covered by the regulations of the two Swiss exchanges - SIX Swiss Exchange and BX Swiss. Moreover, Swiss financial market regulations, corporate law, and the Swiss Code of Best Practice don't offer specific guidance.

This blog post provides a practical overview of blackout periods for companies listed on Swiss exchanges, focusing on deadlines, individuals in scope, instruments affected, and exceptions. It's based on publicly available data from the 30 companies in the Swiss Leader Index (SLI).

SIX Swiss Exchange addresses blackout periods in the annex titled 'Subject and extent of the information relating to Corporate Governance' within the 'Directive on Information relating to Corporate Governance'. This annex outlines the information that must be disclosed in annual or corporate governance reports. Under section 10, 'Quiet periods', listed companies must disclose their general blackout rules, including deadlines, individuals involved, scope of financial instruments, and any exceptions.

Furthermore, SIX Swiss Exchange’s Investor Relations Handbook provides a high-level overview of blackout periods, detailing who is typically covered, their duration, and where they are disclosed. BX Swiss regulations and its website don't offer specific details on blackout periods.

We've taken a close look at the 2024 annual reports and publicly available data from the 30 companies in the Swiss Leaders Index (SLI). Our focus was on the criteria set out in the 'Directive on Information relating to Corporate Governance' by SIX Swiss Exchange, covering deadlines, relevant individuals, financial instruments, and exceptions. Here's what we found:

The following deadlines are imposed on publications of annual reports. Some companies use shorter blackout periods when publishing quarterly or half-year reports.

The average and median blackout period is 50 days. The shortest was 17 days in the context of the announcement of preliminary annual results, while the longest was 78 days. Excluding special cases, the minimum is 28 days. SIX Swiss Exchange's Investor Relations Handbook suggests blackout periods of six to eight weeks (28 to 56 days).

Companies use three systems to start the blackout period:

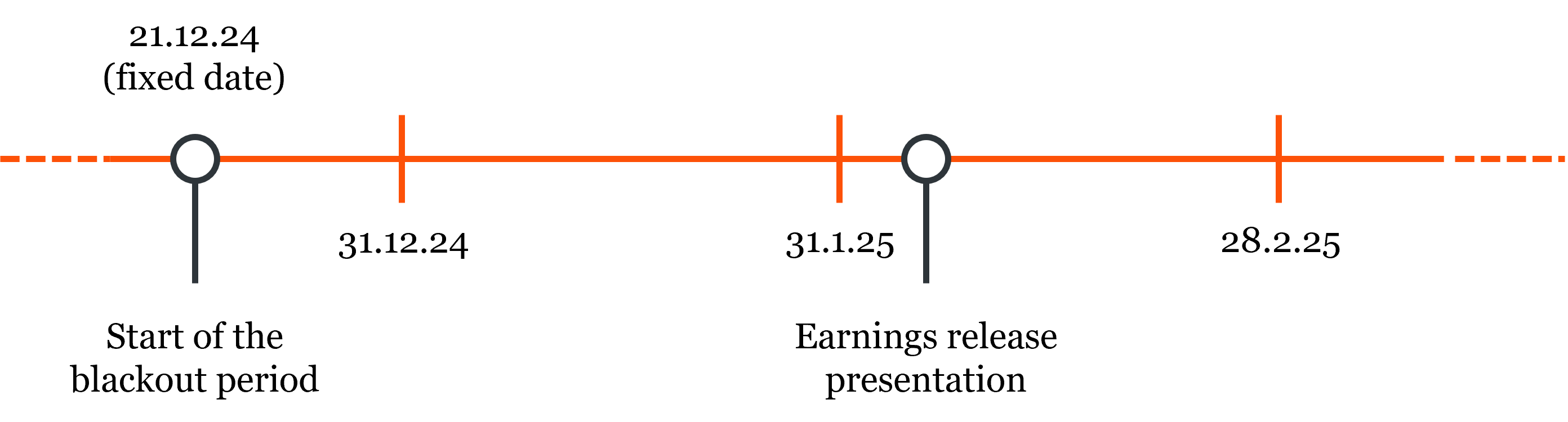

Fixed calendar date: The blackout period starts on a set date (e.g. 21 December 2024). This system is used by about 20% of companies.

2. Date based on the end of a reporting period: The start of the blackout period is based on the end of a quarter, half-year, or year (e.g., 10 days before the end of the reporting period; seventh business day of the final month of the financial quarter). Roughly 60% of the companies used this system.

3. Date based on the earnings release presentation: The blackout period begins by subtracting the blackout duration from the earnings release date (e.g., the blackout starts 45 days before releasing the annual results). Approximately 20% of companies used this system.

Companies end the blackout period in four ways:

End of publication day: Half of the companies end the blackout period after trading hours on the day when financial results are published.

2. Full trading day after publication: One-third end the blackout period a full trading day after publication. If results are published before trading hours, the blackout period ends the same day (see chiff. 1 above for end of publication day). If results are published after trading hours, it ends at the end of the next day. Two companies end the blackout period two full trading days later.

3. End of the day of the next day after publication: About 10% end the blackout period 24 hours after publication or at the end of the next day after publication.

4. End of the day before publication: One company ends the blackout period the evening before results are published.

One company does not define blackout periods. Rather, it sets trading windows during which employees may place trades. This is the inverse of the usual blackout period approach, which specifies when trading is prohibited. Another company ties the beginning of the blackout period to when individuals access insider information. One company doesn't disclose the start date of the blackout period.

Individuals in Scope

Across all companies, board members and executive management face blackout periods. Most companies also include those with access to earnings-related data - typically staff in corporate finance, communications, legal, IT, and management accounting. Seven companies have extended the blackout periods to all employees. Some firms disclose in the documentation assessed to also apply blackout periods to external parties like lawyers and consultants who might access insider information. In one case, persons related to the above individuals are covered too.

When defining who is in scope, we noticed two methods: some companies list these individuals directly in their annual or corporate governance reports, while others refer to an internal insider list. In some cases, employees are informed individually about their inclusion in blackout periods.

These methods rely solely on annual or corporate governance reports. Many companies also create internal insider lists to include additional individuals beyond those mentioned in the reports.

Instruments in Scope

Nearly all companies apply blackout periods to their own shares. Only three companies didn't specify which instruments are included. A third of the companies clarified that financial instruments linked to their shares, such as derivatives and structured products, are also covered. A few companies extend the scope to include bonds issued by the company or its subsidiaries.

Exceptions

About a third of companies reported in their annual reports that they granted no exceptions in the past financial year. Five companies did allow exceptions for share buyback programs, long-term incentive plans, employee share plans, option plans, or pre-approved trades. Other exceptions weren't mentioned in the reports.

Half of the companies didn't provide any information on exceptions in their annual reports.

The Market Abuse Regulation (MAR) outlines that a 30-day blackout period is required before announcing interim or year-end financial reports. This affects persons discharging managerial responsibilities (PDMRs), including the board of directors, c-level executives, and all persons with regular access to unpublished price sensitive information and the power to take managerial decisions affecting the future developments and business prospects. MAR covers company shares, debt instruments, derivatives, and related financial instruments. Exceptions include buyback programs, employee share-, option-, and other long-term incentive plans as well as transactions that do not involve a change in beneficial ownership. Trades may also be pre-approved on case-by-case basis in exceptional circumstances, like severe financial hardships.

Exceptions also exist when the trade doesn’t involve an active investment decision by the PDMR. This is for example the case when a portfolio manager buys or sells the financial instrument without the PDMR being involved in the investment decision. Furthermore, exceptions apply when transactions are results of events outside the circle of influence of the PDMR (like inheritance), as well as transactions made under predetermined, irrevocable terms agreed outside or before the blackout period, including the exercise of derivatives.

Stock exchange rules may add further requirements.

We help businesses by refining internal policies and processes to manage insider lists or grant exceptions, whether related to blackout periods or other governance issues for listed companies. Our experience allows us to provide solutions that are both detailed and efficient.

{{item.text}}

{{item.text}}