{{item.title}}

{{item.text}}

{{item.text}}

Among organizations that are implementing, or have implemented, a customer transformation initiative, there are statistically significant differences between market winners, laggards, and those in between. The key differences relate to how market winners perceive challenges, how they craft business cases to implement customer transformation, how they use technologies like AI, and how they address people and organization challenges. Perhaps most importantly, these differences include better performance on delivering business outcomes related to customer transformation.

Currently, many companies worldwide are struggling to sustain growth, explore new markets, and discover new revenue sources in an environment where consumer confidence is low and there are mixed economic signals. Implementing a customer transformation is a logical response, but PwC’s research shows that when comparing market winners to other cohorts, the best performing businesses show differences in how they perceive challenges, make their business cases, approach technology and their people, and in what outcomes are achieved.

The resulting boom in productivity can be so significant that it can boost short-term profits while enabling new business models.

Alexander Schultz-Wirth, Partner, PwC Switzerland

Customer Transformation Leader

History: In early 2022, PwC undertook Market Winners’ Survey 2.0, which built on our inaugural research on customer centricity to include the elements of ESG and cybersecurity, as we looked to derive more insights around these three foundational pillars of any successful business.

In mid-2023, PwC commissioned IDC to undertake Market Winners’ Survey 3.0 to expand on the foundations already developed. In addition, this year’s research measured the impact of Artificial Intelligence, including Generative AI, on customer transformation as well as the people and organizational changes required.

| Business Case: Which reasons were most important as to why your organization initially chose to implement its customer-centric business transformation? | AI: In which areas are investments in AI being prioritized in your organization’s customer-centric business transformation? To what extent do you believe Generative AI (i.e., ChatGPT or Copilot) will disrupt your business or operating models in the next five years? | Outcomes: Which were the three most important business outcomes your organization was trying to achieve from customer-centric business transformation initiatives in the past 12 months? |

What were the key findings? Among organizations that are implementing, or have implemented, a customer transformation initiative, there are statistically significant differences between market winners, laggards, and those in between. The key differences relate to how market winners perceive challenges, how they craft business cases to implement customer transformation, how they use technologies like AI, and how they address people and organization challenges. Perhaps most importantly, these differences include better performance on delivering business outcomes related to customer transformation.

These current findings reinforce those of other recent PwC research, including the report, Experience is everything, which highlighted that good customer experience leaves people feeling heard and appreciated, in addition to minimizing friction, maximizing efficiency, and maintaining a human element. Likewise, the PwC report, Customer experience is critical to loyalty, which highlighted that many executives miss the mark when trying to understand consumer behavior. More than ever, winning in every market is complicated, given the uncertain economic environment coupled with the rapid acceleration of digital technologies. But as we noted last year, digital transformations that take a customer-led, digital-first approach to all aspects of a business (i.e., business models, delivery of experiences, business processes and operations) will change customer expectations. This change happens through every interaction, every experience, and every relationship by building trust. And it is as much a cultural change as a technological one. PwC’s current research highlights what market winners do differently, offering clues either to change, or to reinforce, your strategy and tactics

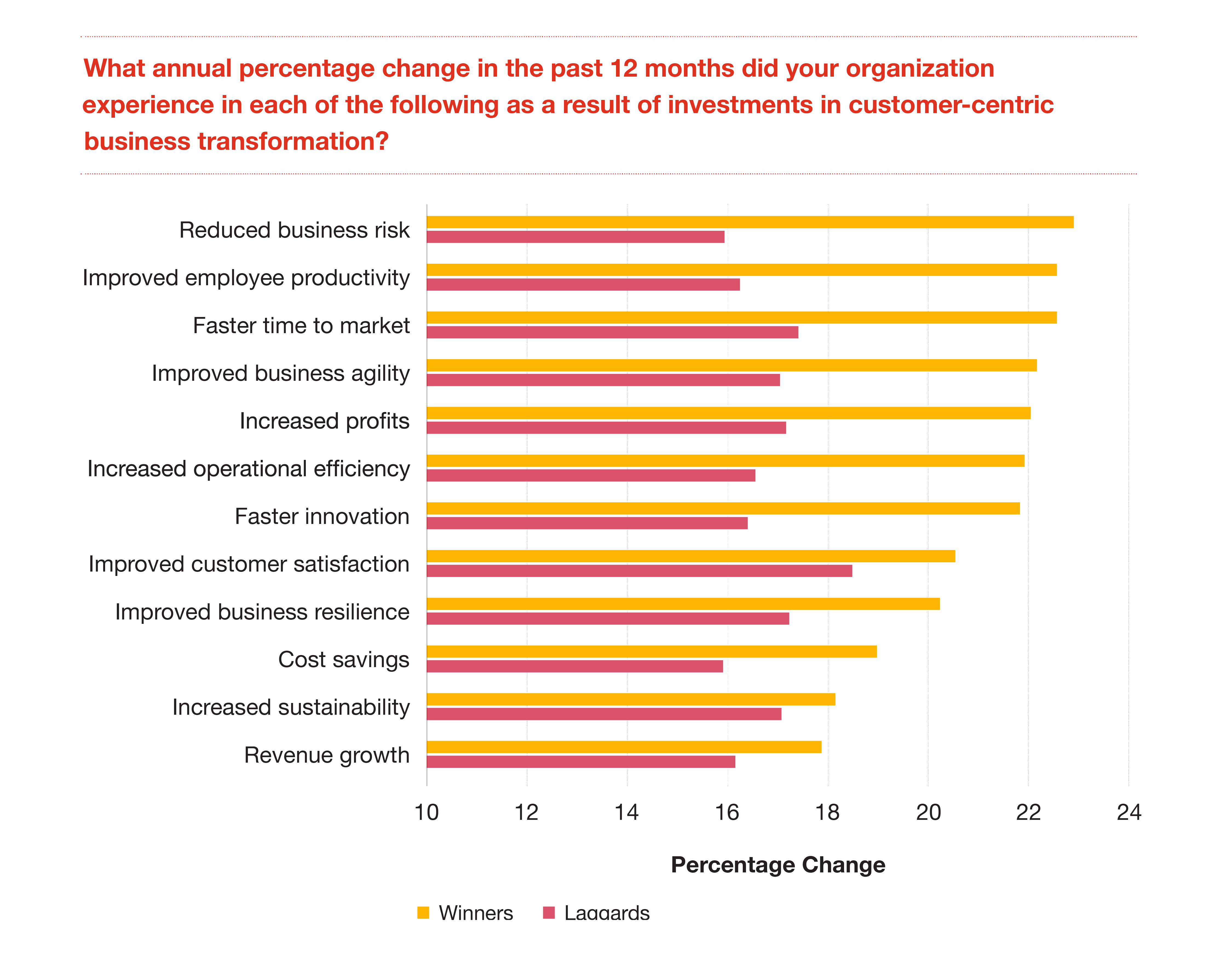

The top line finding this year is an expanded benefit for market winners in their implementation of Customer Transformation (CT) compared with prior research. This year, across all organizations, the most frequent top three goals at the start of customercentric business transformation, across all three cohorts (market winners, laggards, and those in between) were improved customer experience, increased sustainability, and increased profits. But when comparing market winners to the other cohorts, their investments in customer-centric business transformation over past 12 months yielded significantly higher improvements on outcomes including reduced business risk, improved employee productivity, faster time to market, and improved business agility.

PwC’s 2022 research found those businesses that had already implemented, or had started implementing, customer centric transformation in response to changing market and customer behaviors were more likely to have experienced revenue growth. This 2023 research update shows market winners implementing CT are achieving an expanded set of business outcomes beyond revenue growth (i.e., reduced business risk, faster time to market, improved employee productivity and improved business agility) all of which point to an increasing quality of results.

Source: PwC's Market Winners Survey 2023

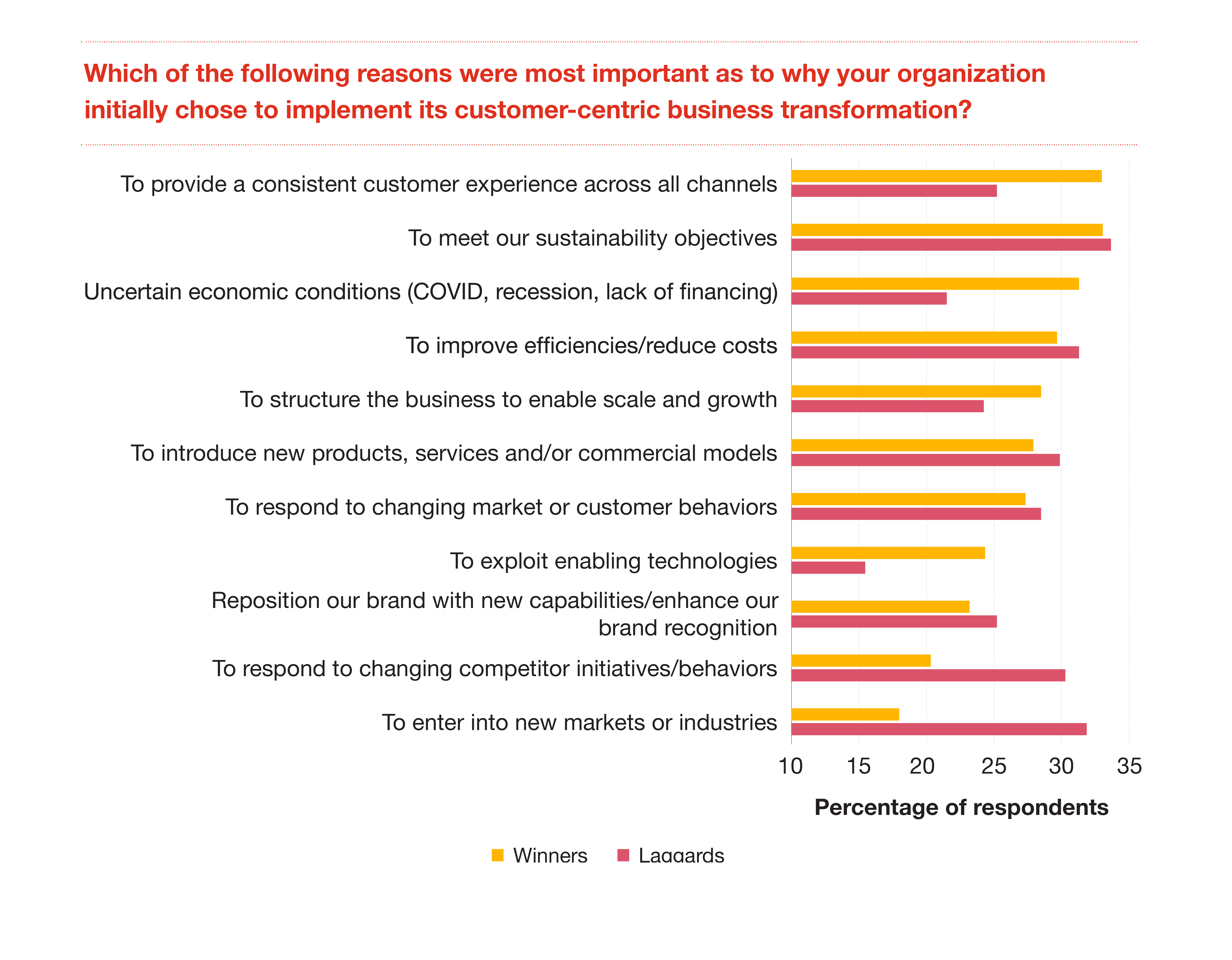

Considering the business case for implementing CT, market winners emphasized two reasons more than others, and likewise de-emphasized two other reasons. Top emphasis was given to providing a consistent customer experience across all channels. Next was meeting sustainability objectives, where laggards mentioned it slightly more than market winners. The second significant difference between market winners and the other two cohorts related to the uncertainty of economic conditions, especially for respondents from EMEA. Across regions, there are a lot of mixed economic signals today, which makes decision-making even more fraught, but instead of using that uncertainty to take a pause, market winners appear to being using economic uncertainty itself as part of the business case to drive their CT initiatives forward.

Conversely, responding to competitors and entering new markets or industries were de-emphasized by market winners.

Not surprisingly, across all respondents, improving efficiency or reducing cost was the top choice, but market winners are emphasizing a couple of things in their business cases for customer transformation ahead of cost take out.

The difference in business case emphasis topics between market winners and laggards points to other possible, and less intuitive, disadvantages of being a laggard. First, that laggards are more likely to chase the potential of new markets or industries rather than focusing on improving their existing business. And second, that laggards are more likely to focus on responding to their competition rather than to the needs of their customers.

Source: PwC's Market Winners Survey 2023

All organizations face challenges when trying to implement CT, with technology issues and workforce/cultural issues topping the list. But market winners emphasized the need to upgrade or improve existing infrastructure significantly more than others, and likewise de-emphasized cybersecurity concerns. When viewed in combination, it appears that market winners are not disproportionally worse off with their infrastructure, but rather that they are describing a larger emphasis on additional infrastructure needed to implement CT since basic needs, like security concerns, have already been addressed. Interestingly, market winners also emphasized significantly more than others that they don’t have enough insight and understanding about customer needs; perhaps another sign of maturity in acknowledging what they don’t know, or what they want to know more about.

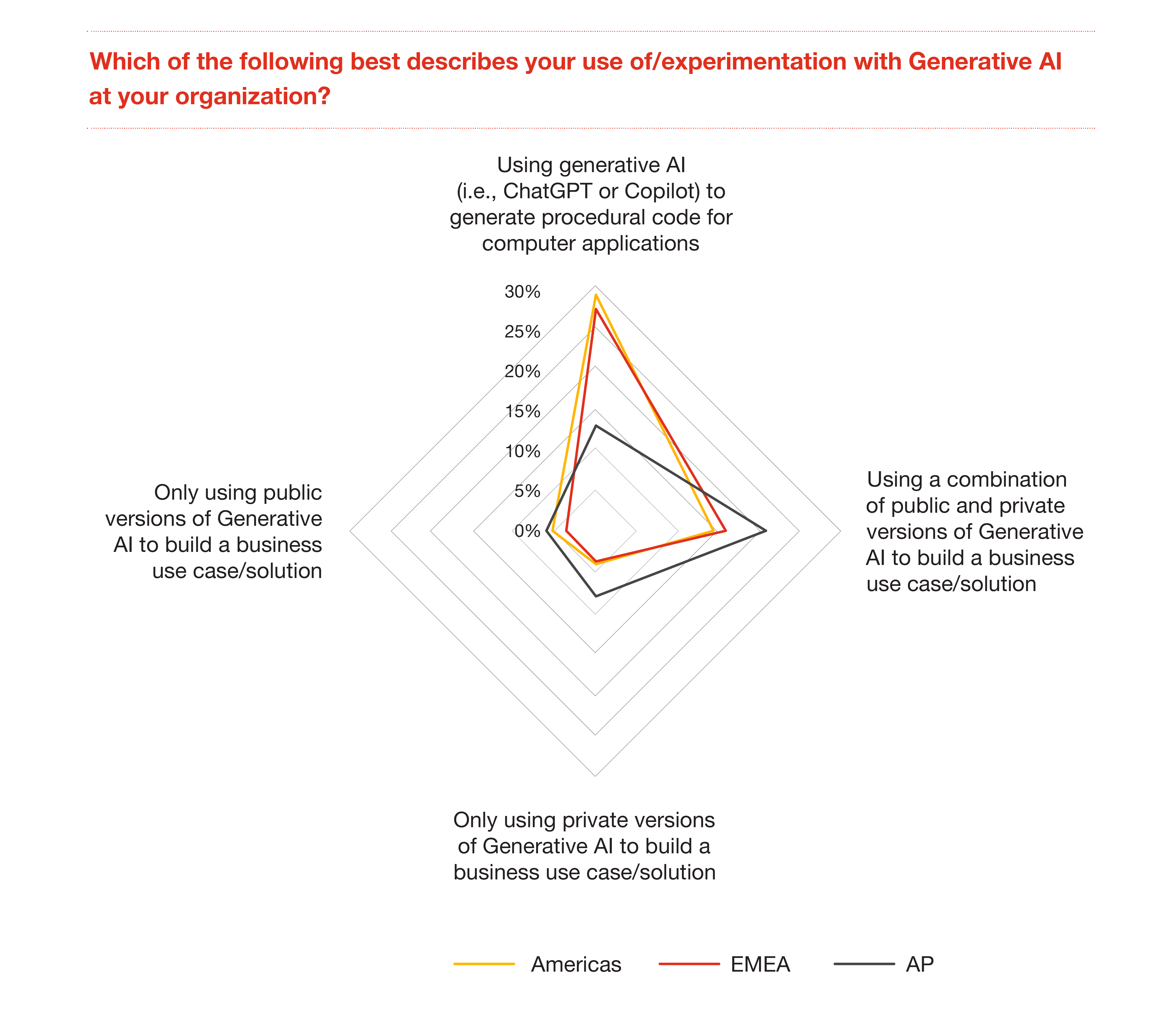

Generative AI’s impact on CT is already being felt, with 52% of all respondents indicating they are already using it. When considered as mutually exclusive options, just over half of the 52% of respondents indicated Generative AI’s best use was to generate procedural code for computer applications, with the balance indicating they were using it to build a specific use case or solution. For those building use cases or solutions, the predominant approach was to use a mix of both public and private versions of Generative AI models, rather than just public or just private. Private models can help prevent proprietary information being shared inadvertently, and the dominance of this hybrid approach will require increased skills in model integration between the public and private data realms.

Market winners are significantly more likely than their other two cohorts to believe that Generative AI will significantly disrupt their CT-related business or operating models in the next five years. Conversely, market laggards were significantly more likely than their other two cohorts to believe that Generative AI will not significantly disrupt them. What might disruption look like? In this research, respondents were asked to consider whether their customers would rather interact with a Generative AI model instead of their current customer facing employees. Regardless of current usage level for Generative AI, 82% of respondents indicated their customers would somewhat or significantly prefer interacting with a Generative AI model. Market winners were more likely to believe their customers would significantly prefer to interact with these models. However, from a regional perspective, respondents from EMEA were significantly less likely to believe that customers would significantly prefer to interact with these models, while the reverse was true from respondents from the Americas.

GenAI not only offers a performance uptick wherever it’s deployed, but it’s so scalable that you can implement it throughout your organization relatively quickly.

Source: PwC's Market Winners Survey 2023

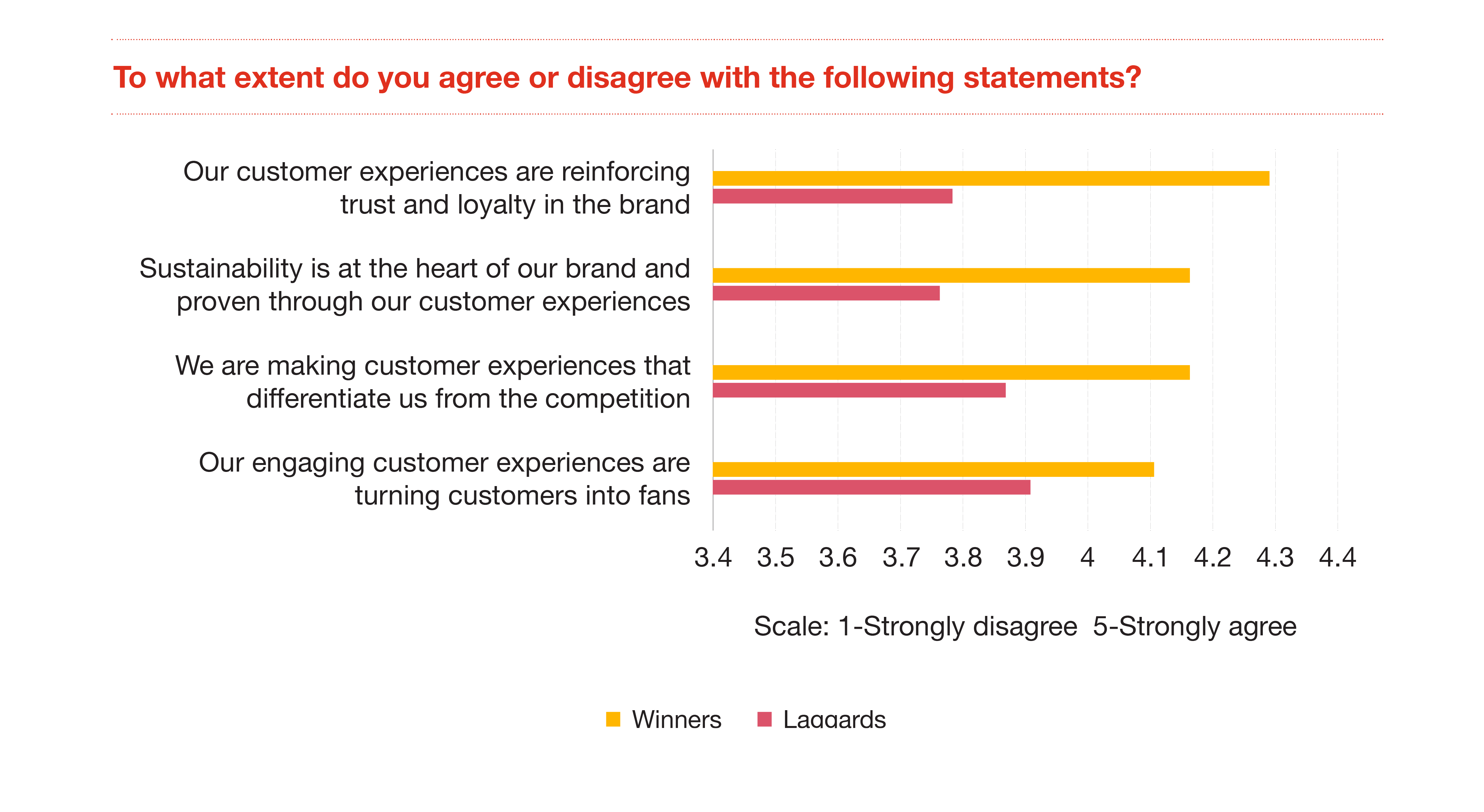

Focusing on customer experience helps all organizations turn customers into fans, but market winners agree significantly more than others about three related factors. First, that customer experiences reinforce trust and loyalty in the brand. Second, that sustainability is proven through customer experiences. And finally, that market winners are making customer experiences that differentiate them from their competition. Interestingly, respondents from the Americas are significantly more likely, and respondents from EMEA are significantly less likely to have strongly agreed with the statement about customer experiences reinforce trust and loyalty in the brand.

Source: PwC's Market Winners Survey 2023

While the steps to drive organizational change are well known, market winners emphasized almost all of them significantly more than others. The largest difference in emphasis was related to creating a clear and compelling need for change. Other large differences were noted for providing training to prepare for change, and for communicating the change message. Interestingly, the only two areas where there was not a significant difference in responses were for the leadership team communicating the value of change and people having the necessary skills to adapt. In other words, these two steps are necessary, but not sufficient, factors required to implement organizational change, and that market winners are focusing more on the other factors that make change stick.

This research is highly relevant for the future because the rate of technological change is likely to continue accelerating. And organizations will need people motivated to remain at the forefront of pushing the boundaries of what technologies like AI can do to improve areas like customer relationship management. Implementing CT is hard not only because organizations must make the right decisions on technologies like CRM and AI, but also because the people in those organizations must truly understand the need to do so.

To identify our market winners and laggards, we constructed a scale across key customer transformation metrics identified in the survey. The metrics included questions around respondents’ initial state of processes and systems for customer transformation, their extent of progress, challenges faced, organizational culture, and technology investments (including a special focus on AI). Winners were identified as the top 17%, and laggards as the bottom 21% of the survey population across these questions.

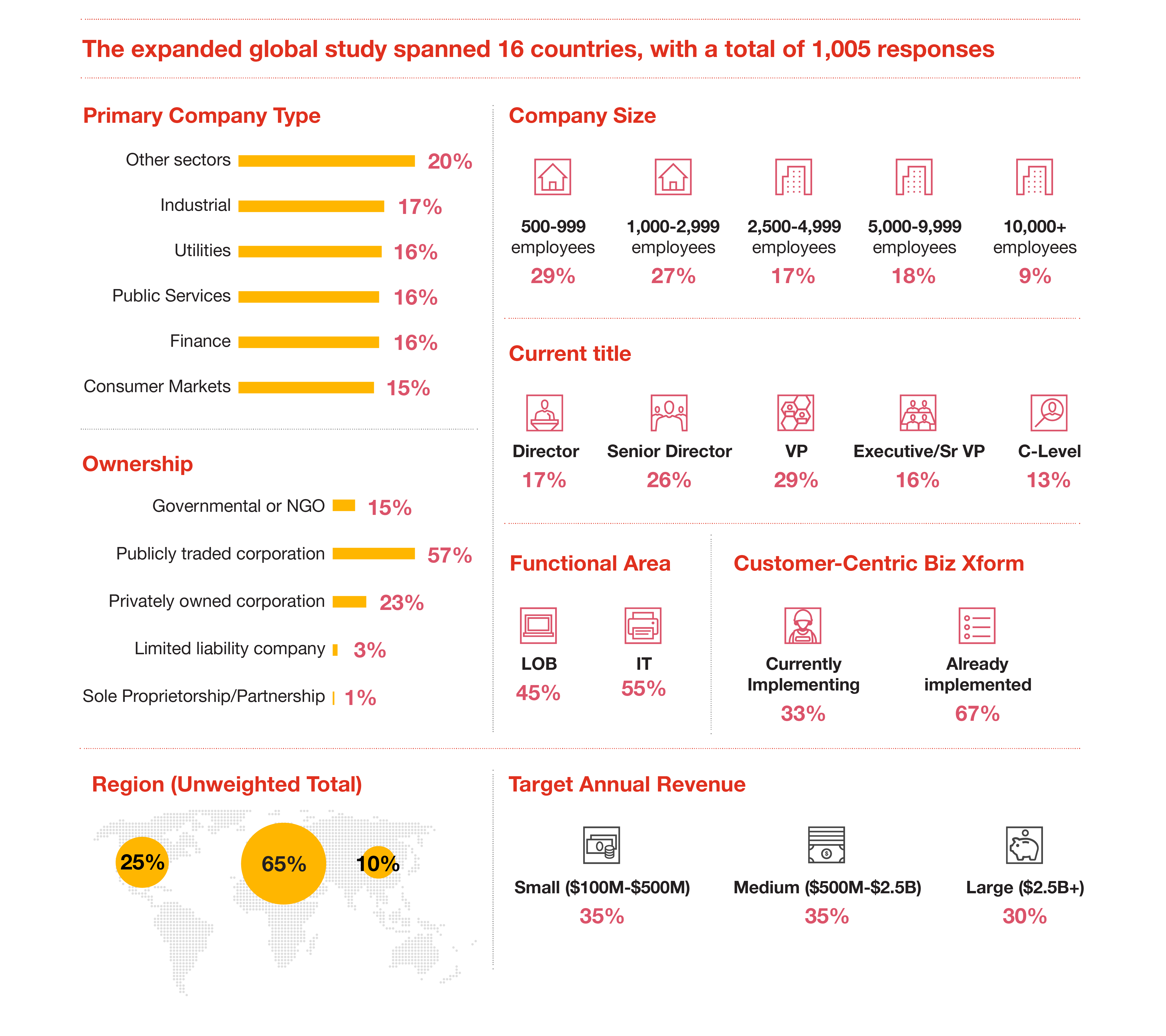

A multi-market online survey of C-Suite and Senior Executive professionals was conducted. The survey was available for respondents to complete in Arabic, English, French, German, Italian and Spanish in June 2023, achieving a total of 1,005 responses. The survey findings in this report are explored at an industry and country level where the number of respondents in each is sufficient. Revenue size is reported as small (less than 500 million), medium (500 million to 2.5 billion) and large (2.5 billion plus). Note, only organizations which had completed, were currently implementing or planned to implement customer transformation qualified to answer the survey questions. With the exception of the US, UK and Germany, country bases range from 25-50, so care should be taken when interpreting results as they are indicative only. Throughout the report, any statistically significant results have been called out, otherwise key variations of interest have been cited. Please note, given the change to both how the maturity scale was constructed and continued improvements in customer transformation maturity in the market, the group of Winners identified in 2023 are not directly comparable to the group identified in the 2022 published report.

Source: PwC's Market Winners Survey 2023

At PwC, we partner closely with our clients to help transform and revitalize their business, ignite growth, and foster stronger customer loyalty. If you’d like to accelerate your business growth, request a FREE customer transformation assessment based on and using our powerful Customer Transformation Assessment Tool (CTAT) today.

{{item.text}}

{{item.text}}

Fabian Hürlimann

Guru Ramachandran