Driving sustainable value and sustained outcomes for your treasury function

Corporate Treasury Management

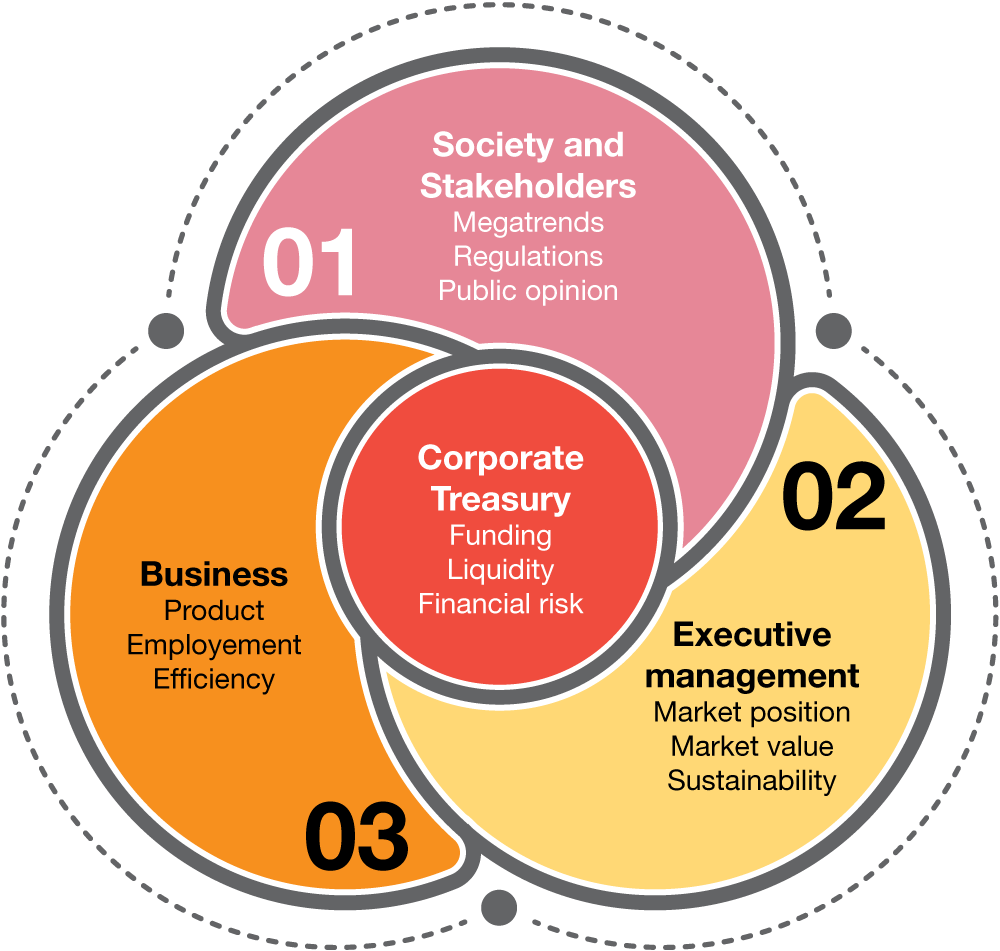

Forces shaping today’s corporate treasuries

Volatile market conditions are constantly altering the risk landscape in which companies operate. This not only poses a challenge to their financial health, but also increases the pressure on both treasurers and CFOs to stay on top of current and emerging issues. These include increased inflationary pressure and rising interest rates, exchange rate volatility, changing regulations or rising commodity prices. Because of its vital role in managing such demanding conditions and its effective response to it, corporate treasury has evolved into a strategic partner both to the business and the CFO.

Seize this opportunity to reposition your team and create sustainable value throughout your company.

Here’s how we can help

Over the past few years, corporate treasuries have started to transform into strategic functions, contributing to a company’s profitability, performance, and value. The agility with which they react to and predict changes in risk and market environments makes them important partners for numerous strategic business decisions. New technologies provide treasury functions with opportunities to increase visibility into key financial data. This allows them to provide critical insights into finance and risk issues, but also to improve cash flow. Moreover, by seizing the potential of tech treasurers can drive the digital transformation of the finance function. The possibilities are manyfold: corporate treasuries can act as an architect of the company-wide payments and collection processes, automate financial risk management and hedging execution or drive cash efficiency across the organisation.

Our team combines the expertise of treasury, financial risk, accounting, and system specialists, which allows us to assist you in navigating this complex and shifting landscape and future-proof your treasury function. We help you not only to achieve your strategic, business, and financial objectives, but support you in generating sustainable outcomes to stay competitive over the long term.

We understand the complexity of treasury and how the different elements combine to add value. Clients come to us because we listen to what they need and have the practical expertise to deliver a solution that not only works for them but that also helps create sustainable value throughout the entire organisation.

Michiel Mannaerts

Partner Treasury and Commodity Management

PwC Switzerland

Explore our Treasury services

- Processes and control

- Financial risk management

- Strategy and organisation

- Treasury technology

- Liquidity and cash management

- Treasury accounting and valuation

- Deals support

Processes and control

Transparency and compliance are mandatory to safeguard the interests of all stakeholders. Core treasury often involves a few specialists dealing with high value and complex transactions. Our team’s experience leading treasury audits can help design and improve your treasury processes by reviewing policies and procedures to close gaps, including cybersecurity, fraud risk, internal controls, and board expectations; and providing internal audit support.

Financial risk management

A traditional objective of treasury is managing foreign exchange and interest rate risk within the risk tolerance levels of the company. However, commodity risk management is increasingly falling under the scope of treasury. Financial risk management requires solid risk management policies and a deep understanding of the underlying exposures from a reliable exposure forecast.

Strategy and organisation

Corporate treasury has touchpoints across the entire organisation. A well-defined treasury strategy is therefore key for guiding efficient and effective day-to-day operational business decisions. To stay ahead of the curve, our team provides you with comparative insights on how you measure up against other companies. By benchmarking your current operations against best market practices, we focus on finding the right treasury target operation model (TOM) to prepare your function for both current and future challenges – all while furthering business objectives.

Treasury technology

Technology is a powerful tool to drive efficiency and effectiveness of processes when team members are collaborating from different locations. Moreover, when dealing with complex and high-value transactions, secure workflow control, for example, becomes indispensable.

Proper tool selection – may they be offered by a bank or by a third-party provider – is one of the key steps to achieve digital transformation.

Liquidity and cash management

Liquidity and cash management are at the heart of corporate treasury management and more than ever before, the focus is on internal processes including payment/receivables factories, in-house banking solutions and trade finance.Given the dynamic marketplace of banking and technology vendors, new solutions surface frequently. We assist in evaluating new processes to help improve visibility, control, cost and predictability.

Treasury accounting and valuation

Accounting frameworks define accounting for financial instruments and hedging of exposures while valuation has become a separate specialisation in its own right. We can help you manage accounting and regulatory change, achieve compliance and mitigate risk in relation to your Treasury or Commodity risk exposures and transactions.

Deals support

Treasury is a vital component in supporting successful M&A activity of a company. We help organisations navigate the full transaction lifecycle from pre-close diligence and support through post-deal day-to-day operations, treasury optimisation and value enhancement. We partner closely with other PwC deals, tax and accounting teams to provide full global support across the deal life cycle.

Talk to our experts

PwC's 2023 Global Treasury Survey: Treasury's role in driving sustainable value

PwC’s 2023 Global Treasury Survey report reflects the views of 375 treasury department respondents contacted by the PwC global network from January through April 2023. The respondents are based in over 32 countries, across 23 industries and in companies with median annual revenue of USD 3.9 billion. The report also relies on insights from our global team of treasury function specialists.

Contact us

Chair of the global governance board (“Global Board”) of PricewaterhouseCoopers International Limited (PwCIL), Geneva, PwC Switzerland

+41 58 792 96 03

Michiel Mannaerts

Aniket Kulkarni