{{item.title}}

{{item.text}}

{{item.text}}

Maribel Flores

Manager, PwC Switzerland

Increases in corporate bond yields over the year will lead to a reduction in pension obligations. However, falling asset values mean that many companies reporting under IFRS and US GAAP at 31 March 2023 may see small improvements on their pension balance sheets over the year.

Despite the challenges in the banking sector, there were modest gains in Swiss equity values during the first quarter of 2023. The Swiss National Bank also raised interest rates by 50 basis point in March 2023 to 1.5%. Long-term Swiss Corporate bond yields ended the quarter at 2.0% p.a. marginally lower than they were at the end of 2022. Typical pension funds saw positive asset returns of around 3% over the quarter.

| Assumption | Observed market practice at 31 March 2023 |

Observed market practice at 31 March 2022 |

||

| Optimistic |

Prudent | Optimistic | Prudent | |

| Discount rate | 2.35% |

1.95% |

1.35% |

1.05% |

| Inflation | 0.50% | 1.50% | 0.50% | 1.00% |

These ranges cover schemes of all commonly observed durations and do not represent PwC’s internal acceptable ranges.

For companies reporting on their Swiss pension funds as at 31 March 2023, this means higher discount rates of around 1.0% compared to one year earlier. Discount rates are a key assumption for the measurement of Swiss pension plans reporting under IFRS or US GAAP. A higher discount rate leads to a drop in the value of the plans obligations on the balance sheet. At the same time, most companies would be expected to increase their interest credit rate assumptions to reflect higher expected asset returns in the future.

Higher inflation has a significant impact on pensions in other countries such as the UK, but it does not have an impact on most Swiss pension plans as benefits are typically not directly linked to inflation but do influence salary growth expectations.

We expect obligations at the end of March 2023 under IFRS and US GAAP to reduce depending on the specifics of the plan. A typical plan would see a reduction of obligations of around 10% compared to one year earlier.

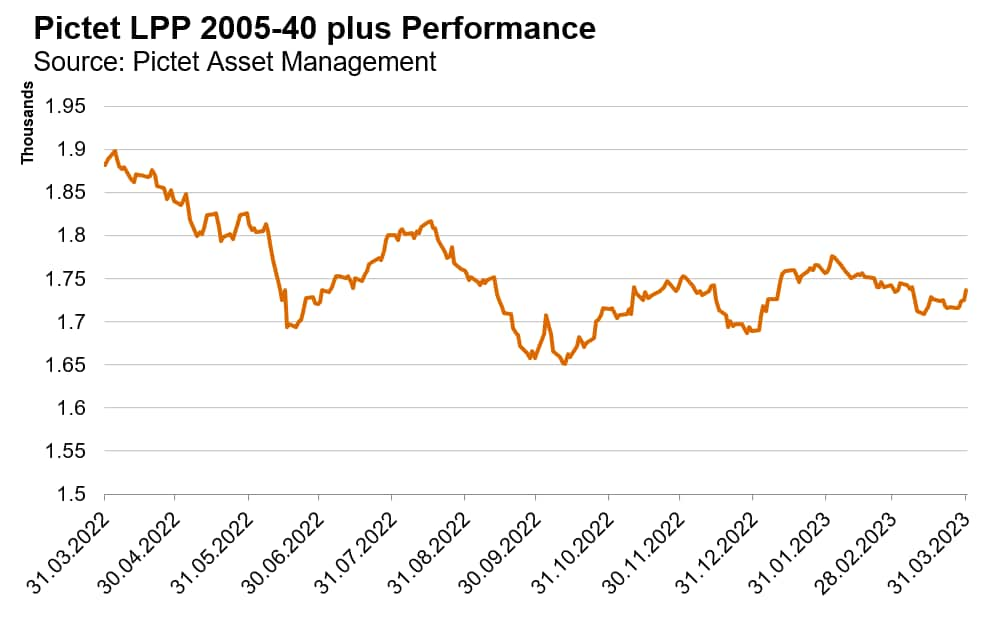

The performance of different pension plans can differ widely depending on how the assets are invested, but we would expect most pension plan asset values to have fallen in the year to 31 March 2023 with a reduction of 8% typical.

This fall was mainly driven by volatility in the global financial markets during 2022. The first quarter of 2023 saw modest positive asset returns of around 3% despite the challenges in the banking sector.

Negative asset returns over the year has impacted the IFRS or US GAAP net liabilities in different ways depending on how plan assets are determined and how companies finance their pension plans, e.g. through a multi-employer foundation, an autonomous pension fund or a fully insured collective foundation.

The asset values of autonomous pension plans and multi-employer plans with segregated assets are driven by the underlying market values of assets. These plans asset returns are likely to have fallen over the year to 31 March 2023 which would partially offset the reduction in liabilities. Other pension plans where assets are linked to the underlying members accounts may even experience a positive return under IFRS or US GAAP as a result of interest granted to members savings accounts during the year.

Overall, we expect the net pension balance sheet of companies reporting under IFRS or US GAAP at 31 March 2023 to remain broadly comparable or to have slightly improved compared to one year earlier, depending on the specifics of the plan.

Learn more. Interested to know more about the latest global financial reporting trends? We summarised for you in a comprehensive document the key market movements from the last quarter.

#social#