ESMA’s call for harmonisation

Performance fee models

Since the launch of the UCITS framework, there has never been any real harmonisation of the application and disclosure of performance-based investment management fee models.

- Performance fee models were not dealt with in the EU regulations, nor was any self-regulation issued by any of the European investment management industry associations.

- Unsurprisingly, ESMA’s analysis of current practices in various EU Member States regarding performance fees found a lack of harmonisation among EU jurisdictions, thus initiating further convergence work. A consultation paper on the proposed 'Guidelines on performance fees in UCITS' was published in July 2019.

- The final ESMA 'Guidelines on performance fees in UCITS and certain types of AIFs' were released on 3 April 2020.

- The Guidelines apply to managers of UCITS and of AIFs marketed to retail investors in the EU and the European Economic Area (with some exceptions such as for closed-ended AIFs and for open-ended AIFs that are EuVECAs or EuSEFs).

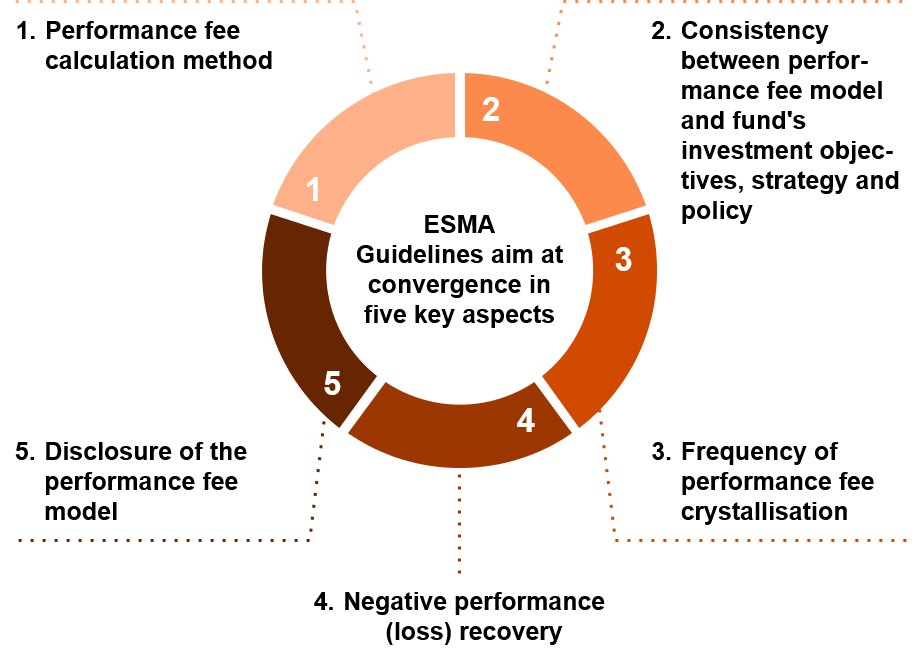

The five key aspects of the ESMA Guidelines

The calculation of a performance fee should be verifiable and designed to ensure proportionality between performance fee and the actual investment performance of the fund.

- Performance fee calculation method should include, at least, the following elements:

- A reference indicator;

- Crystallisation frequency;

- Performance reference period;

- Performance fee rate; and

- Performance fee methodology.

- Computation frequency

- Performance fee calculation method should be designed to ensure that performance fees are always proportionate to the actual investment performance of the fund.

- Performance fee model should constitute a reasonable incentive for the manager and be aligned with investors’ interests.

- Performance fee model should be symmetrical in terms of accrual and its reversal.

- Performance fees may be calculated on a single investor basis.

The Manager must implement and maintain a process in order to demonstrate and periodically review that the performance fee model is consistent with the fund’s investment objectives, strategy and policy.

- Performance fee model should be consistent with the fund’s investment objectives, strategy and policy. For example, a HWM- or hurdle-based model is more appropriate for absolute return funds, than reference to an index.

- If benchmark is used, it should be appropriate for the fund’s investment strategy and adequately represent its risk-return profile (in general, the benchmark index used for the performance fee model should be the same as the benchmark against which the fund is managed).

- For actively managed funds not tracking an index, the benchmark used for performance fee model may be different, but should be consistent with the fund’s benchmark in terms of risk-return profile.

- Excess performance should be calculated net of all costs (e.g. management fees) but could be calculated without deducting the performance fee itself as long as this is in the investor’s best interest

- Reference benchmark changes should be properly reflected in the calculation

The frequency for the crystallisation should be defined in such a way as to ensure alignment of interests between the portfolio manager and the shareholders, and fair treatment among investors.

- Crystallisation frequency should be fairly aligned with the interests of the fund manager and investors, and should not be more than once a year, unless:

- The performance reference period is equal to the whole life of the fund and cannot be reset

- Fulcrum fee model and other models which provide for a symmetrical fee structure (negative performance fees) are applied.

- Crystallisation date should be the same for all share classes of a fund.

- Generally, the crystallisation date should coincide with 31 December or with the financial year-end of the fund.

- Crystallisation of performance fee in case of fund’s closure or merger should not be contrary to investors’ best interests.

The Guidelines reaffirm that a performance fee should only be payable in circumstances where positive performance has been accrued during the performance reference period.

- Performance fee should only be payable where positive performance has been accrued during the performance reference period. Underperformance or loss previously incurred should be recovered before a performance fee becomes payable.

- Performance fee could also be payable in case the fund has overperformed the benchmark but had a negative absolute performance, as long as a prominent warning to the investor is provided.

- Performance fee model should be designed to ensure that the manager is not incentivised to take excessive risks.

- Any underperformance against the benchmark should be compensated before performance fee becomes payable -> length of the performance reference period should be set to at least 5 years (except for fulcrum and symmetrical fee models).

- For a HWM model, a performance fee should be payable only where, during the performance reference period, the new HWM exceeds the last HWM. Performance reference period should be -> set to at least 5 years on a rolling basis -> performance fee may only be claimed if the outperformance exceeds any underperformance during the previous 5 years and performance fees should not crystallise more than once a year (except for fulcrum and symmetrical fee models).

The Guidelines require adequate information about the existence of performance fees and their potential impact on the investment return and therefore oblige fund managers to ensure this is the case.

- Prospectus and any information/marketing material should clearly set out all information to enable investors to understand the performance fee model and the calculation methodology. Such documents should include a description of the performance fee calculation method, with specific reference to parameters. The prospectus should include examples of how the performance fee is calculated, especially where the performance fee model allows for performance fees to be charged even in the event of negative performance.

- If a fund provides for a performance fee to be paid even in the event of negative performance (e.g., the fund has overperformed its benchmark but has a negative absolute performance), a prominent warning to investors should be included in the KIID.

- If a fund managed in reference to a benchmark calculates performance fees based on a different but consistent benchmark, the manager should be able to explain the choice of benchmark in the prospectus.

- KIID should clearly set out all information necessary to explain the existence of the performance fee, the basis on which the fee is charged and when the fee applies. Where performance fees are calculated based on a benchmark, the KIID and the prospectus should display the name of the benchmark and show past performance against it.

- Annual and semi-annual reports and any other ex-post information should indicate the impact of the performance fees for each relevant share class by clearly displaying: (i) the actual amount of performance fees charged and (ii) the percentage of the fees based on the NAV of the share class.

Get the full information deck here

Performance fee models – ESMA’s call for harmonisation

Effective date and applicability

Effective date and transitional provisions

- Applicable from June 2020

- Existing UCITS with performance fees have to comply by the beginning of the financial year following 6 months from the application date of the Guidelines (basically, from January 2021).

- UCITS with a performance fee established after the application date of the Guidelines have to comply immediately.

Applicability

The Guidelines apply to UCITS and AIFs marketed to retail investors, except for closed-ended AIFs and venture capital, private equity and real estate AIFs.