Partnering with clients to advance their parametric insurance ambitions and in the process making the world more resilient

Parametric insurance advisory

Understanding parametrics

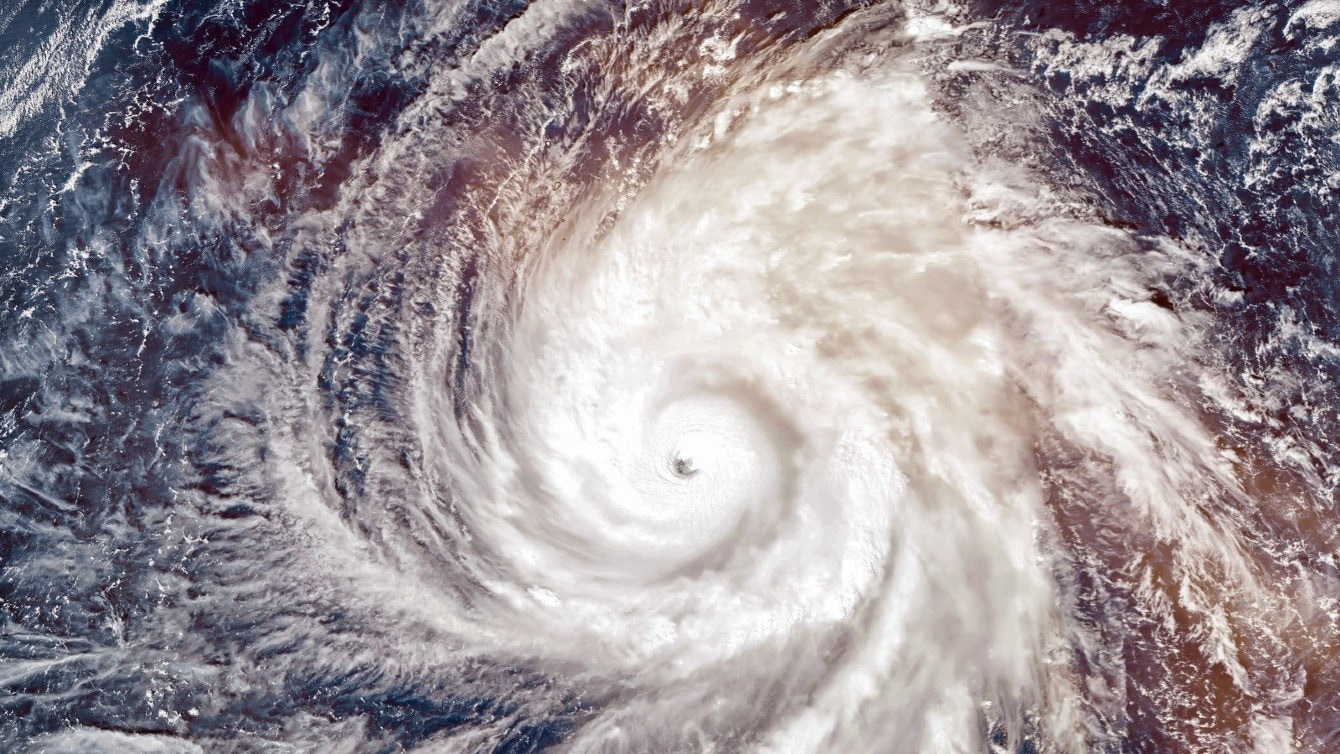

Parametric insurance is quickly becoming a popular alternative to traditional insurance policies. Unlike traditional policies that require detailed assessments of losses, parametric insurance works by using predetermined, objective markers to determine payouts in the event of a specific triggering event, such as a natural disaster or other defined risk.

Parametric insurance can provide quick, transparent and customisable coverage for specific risks and exposures, allowing businesses and organisations to better manage their financial risk and protect their assets. It can cover previously difficult-to-insure risks and/or new risks that are currently uninsurable. In this process, it can fulfil its wide-ranging potential and, alongside traditional insurance and other novel forms of risk transfer, play a key part in closing the protection gap and make society more resilient.

Our parametric advisory offering

Our client discussions with a diverse range of carriers across the (re)insurance market provide multiple examples of how clients are looking to enter the parametric insurance market or enhance their existing capabilities.

PwC is uniquely positioned to provide access to parametric product experts as well as teams with climate resilience and deep industry sector insights – both from a (re)insurance perspective as well as cross sector expertise sourced from the broader PwC network (e.g. energy, agriculture, retail).

PwC offers the below listed end-to-end parametrics proposition depending on whether you are a corporate/captive or (re)insurer.

Our services

- Risk Consultancy

A comprehensive assessment of your business risks and identification of which risks would be best suited for a parametric solution. - Calculation of basis risk

Comparison of cost of risk transfer options, including estimation of payout and cost deltas between the parametric solution and expected loss. - Tax advisory

Offering tax advisory support with regard to the treatment of parametric products. - Accounting advisory

Technical accounting advice on the impact of insurance policy on financial statements.

- Structuring the risk transfer options

Structuring parametric solutions, including selection of effective indices, and exposure analysis to effectively transfer the risk. - Support in selecting appropriate risk transfer partner

Support in identifying an appropriate parametric solution partner to take on risk and advise during the e2e risk transfer process. - Legal advisory

Specialist review and input on policy wordings to ensure contracted coverage meets risk transfer criteria.

- Market assessment and strategy

Providing market insights and collateral to support expansion activities, including go-to-market and product launch initiatives. In the context of parametrics, this can include assessing the types of risk. - Design and structuring products

Analysis of historical data and public indices to develop robust parametric triggers, including defining the appropriate pricing, limits, terms, etc for the specific risk to be covered. - Tax, risk, legal, regulatory and accounting services

Offering tax, risk, legal, regulatory and accounting advice in the design of a parametric policy. - Operating model design and delivery

Advising on how to set up the parametric insurance programme from an operational perspective (underwriting, claims, reserving).

- Data modelling

Modeling different risk events to measure historical and projected losses, thus forming the basis on which to design and structure a parametric product. - Reserving and portfolio analysis

Identifying an appropriate reserving policy that addresses the risks covered. - Sector-specific insights

End-to-end advisory expertise across a diverse range of industry verticals.

Your benefits

Speedy payment of claims

As parametric solutions are based on an index rather than physical loss, claims are processed without any need for a lengthy claims investigation. This allows for claims to be paid very quickly (5–30 days on average). This also makes them particularly useful to manage earnings volatility.

Claims certainty and transparency

When disaster strikes, the insured needs liquidity; a parametric solution removes all subjectivity as the claims pay-out is set on the pre-agreed index measurement being reached, rather than a loss. This means that no claims investigation or loss adjustment is needed, just confirmation that the index or trigger occurred and the payout is then made.

Bespoke solutions

Policy exclusions, limits and sub-limits can leave losses or assets uncovered. With parametrics, a structured, tailor-made solution can be put in place that will accurately reflect an insured company’s exposure. This would include customising the trigger or index, the locations, the payout amount and the timeframe, which can span multiple years.

Offers immediate payout for emergency cash relief.

Acts as a complement to traditional insurance, not as a substitute.

Makes sense when traditional insurance is not accessible or affordable.

Frequently asked questions or client cases

Contact us

https://pages.pwc.ch/core-contact-page?form_id=7014L000000cpYtQAI&embed=true&lang=en