{{item.title}}

{{item.text}}

{{item.text}}

(PDF, 10.4mb)

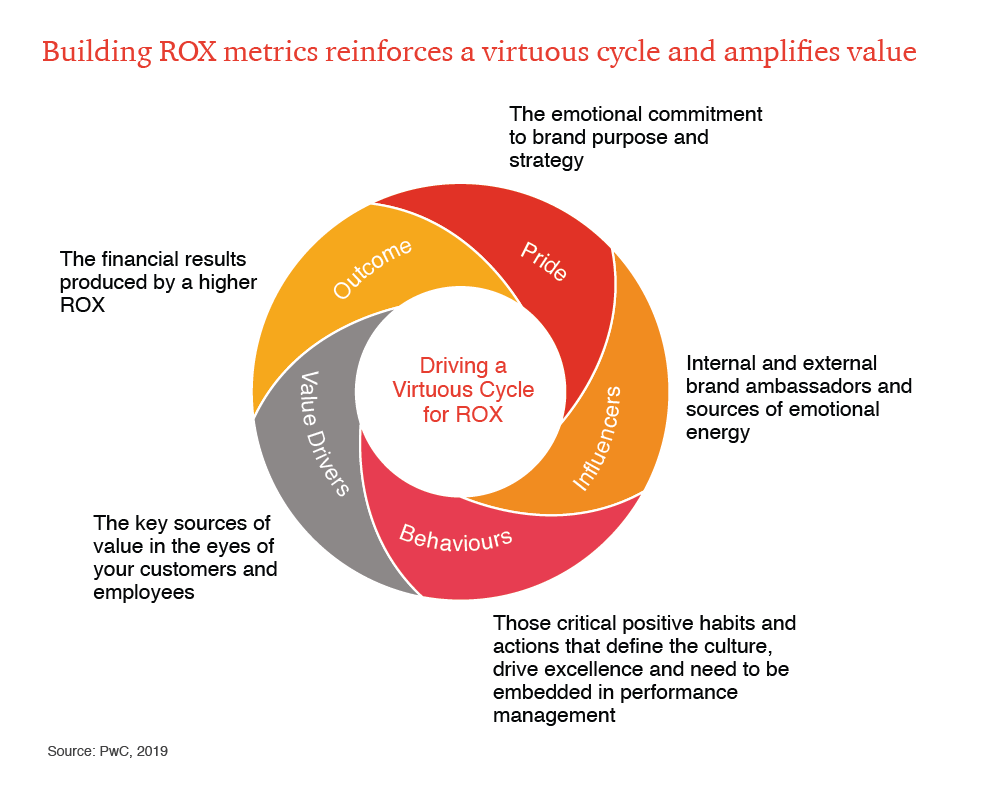

Consumers are not only on the lookout for products or services anymore, but also on the experiences that they go through when purchasing them. That’s why companies should measure their return on experience, or ROX, to help them understand the return on investments that they made into the parts of the organisation which directly impact customer experience (CX) with the brand.

The Fourth Industrial Revolution is already having a massive impact on business and society, and it’s an area where business can make a real difference. Equipping people with the skills they’ll need and preparing future generations for the changing world of work is crucial, and it’s also a theme that resonated strongly with the CEOs that took part in our 22nd annual survey of business attitudes.

Customer experience (CX) is inherently related to employee experience (EX). Using the ROX framework, you will be able to understand the relationships between the company culture, behaviours and business outcomes, and identify your EX’s impact on customer experience (CX).

PwC’s 2019 Global Consumer Insights Survey shows that shoppers exhibit the same behaviours and attitudes across different industries. If you understand the various behavioural types, you can engage more meaningfully with shoppers.

Find the values your employees and consumers have in common, and use the right tools to communicate them with both internal and external audiences. This can help create more meaningful engagement and successful ROX.

People have become increasingly aware of what firms have been doing with their personal data, and our research shows that they’re ready to take their business elsewhere if they don’t trust that a company is treating their data with respect.

Maintaining customer loyalty isn’t easy to achieve in the age of ever-expanding digital options. Customer loyalty to the brand, and not only the products or services, should be earned and can only be built over time.

Fusing the CX and EX is a lot easier when both groups are highly motivated to be associated with a particular brand or organisation. Find the values your employees and consumers have in common, and use the right tools to communicate them with both internal and external audiences. This can help create more meaningful engagement and successful ROX.

PwC's Global Consumer Insights survey found shared behavioural and attitudinal attributes among consumers across different industries. Integrating these characteristics with demographical data can help in creating a rich, detailed consumer profile.

Interested in shopping exclusively online across all product categories, mainly books, music, movies and video games.

Influenced by digital forms of advertising. Such as interactive social media.

Seek technology (VR/AR) and customisation to enrich in-store shopping experience.

Tend to be cashless consumers. Most are currently performing financial activities online and are more likely to trust an online financial adviser.

Early adopters. More likely to own smart home devices. Enthusiastic about future trends such as driverless cars.

Most likely shop exclusively online. More comfortable accessing healthcare using non-traditional channels.

Almost a third have carried out over four digital financial activities online.

Believe technology and virtual experience with products/services can enhance physical shopping experience.

Tend to be cashless consumers; half have made mobile payments. Open to investing in digital currencies.

Tend to track energy usage. Half are planning on purchasing smart home energy meter.

Don't use technology to shop. Favour traditional shopping and human contact in retail.

Over half don't shop exclusively online, prefer shopping for groceries in-store.

Not interested in smart technology: few own smart home devices and are not planning on purchasing them.

Value conventional touch-points with knowledgeable sales associates.

Less inclined to show interest in sustainability.

Will do their shopping exclusively online. Willing to access healthcare from non-traditional providers.

Likely to go grocery shopping in daily microtrips. Influenced by interactive forms of advertisements.

Pursue exclusive services and individualised offers in-store and technology to enhance their shopping experience.

Make shopping decisions guided by sustainability. Purchase brands that support sustainable practices.

A hybrid path to purchase; shopping online but paying in advance via mobile and placing personalised orders.

Expect ordering and payment to be quick and easy; more likely to be influenced by advertising while on the move.

Consume on-the-go- using smart wearableables or smartphones as shopping channels.

Expect convenient navigation in-store and quick and easy payment methods.

Own and use smart devices as a way of life.

Undertake digital financial activities regularly.

Either own or plan to own the latest smart devices and usually shop using this technology.

Mostly shop online for retail and entertainment products and services. More likely to invest in bitcoin currencies.

Usually take sustainability into consideration when making a purchase.

{{item.text}}

{{item.text}}