Lease term under IFRS 16 - a telecommunications industry perspective

At a glance

Telecommunication companies enter into a wide variety of lease arrangements. These can range from co-location (mast and site sharing) and capacity (network sharing) arrangements to leases of fleet and warehousing solutions.

IFRS 16, ‘Leases’, defines a lease as a contract, or part of a contract, that conveys the right to use an asset (the underlying asset) for a period of time in exchange for consideration. At first sight, the definition looks straightforward. But, in practice, it can be challenging to assess the various parts of this definition. In particular, the determination of the lease term can be a significant judgement in applying IFRS 16. This is because it affects the amount recorded for the entity’s lease obligation and related right-of-use asset – the longer the lease term, the larger the lease liability and related right-of-use asset.

This publication focuses on the practical challenges and considerations in determining the lease term under IFRS 16. For simplicity, the illustrative examples all assume that the arrangements contain a lease.

IFRS 16’s requirements in determining lease term

IFRS 16 defines lease term as the non-cancellable period of a lease, plus periods covered by options to extend that the lessee is reasonably certain to exercise, and options to terminate that the lessee is reasonably certain not to exercise. In principle, where a lessee option exists, the lease term is the shorter period unless the lessee is reasonably certain to use the underlying asset for longer.

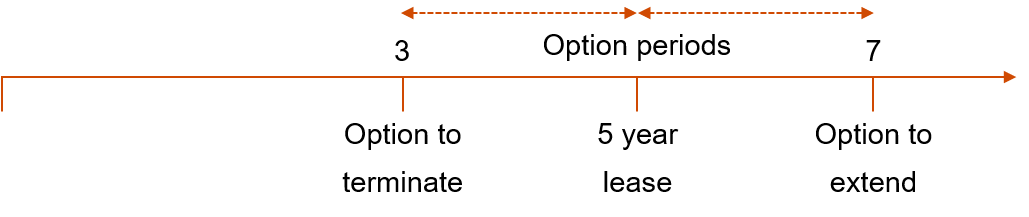

In this example, the lease is for a period of five years, with an option to terminate after three years and an option to extend to seven years. The lease term is:

- Three years if the lessee is not reasonably certain not to exercise the termination option (in other words, the lessee is not reasonably certain to lease the asset for more than three years).

- Five years if the lessee is reasonably certain not to exercise the termination option, but is not reasonably certain to exercise the extension option (in other words, the lessee is reasonably certain to lease the asset for at least five years, but no longer).

- Seven years if the lessee is reasonably certain to exercise the extension option and lease the asset for seven years.

Extension and termination options: the ‘reasonably certain’ test

The previous standard, IAS 17, also applied a ‘reasonably certain’ test. IFRS 16 contains additional guidance in the form of examples of factors that should be considered when determining the lease term:

- Contractual terms and conditions for optional periods compared with market rates: It is more likely that a lessee will not exercise an extension option if lease payments exceed market rates. Other examples of terms that should be taken into account are termination penalties or residual value guarantees.

- Significant leasehold improvements undertaken (or expected to be undertaken): It is more likely that a lessee will exercise an extension option if the lessee has made significant investments to improve the leased asset or to tailor it for its special needs.

- Costs relating to the termination of the lease/signing of a replacement lease: It is more likely that a lessee will exercise an extension option if doing so avoids costs such as negotiation costs, relocation costs, costs of identifying another suitable asset, costs of integrating a new asset, and costs of returning the original asset in a contractually specified condition or to a contractually specified location.

- The importance of the underlying asset to the lessee’s operations: It is more likely that a lessee will exercise an extension option if the underlying asset is specialised or if suitable alternatives are not available.

- If an option is combined with one or more other features (such as a residual value guarantee), with the effect that the cash return for the lessor is substantially the same, whether the option is exercised or not, an entity shall assume that the lessee is reasonably certain to exercise the option to extend the lease, or not to exercise the option to terminate the lease.

Aside from this, a lessee’s past practice regarding the period over which it has typically used particular types of assets, and its economic reasons for doing so, may also provide helpful information.

Example: Determining whether an entity is reasonably certain to exercise a renewal option

Telco A enters into a contract to lease a cell tower from Operator B. The contract includes a noncancellable term of five years and a five-year fixed-price renewal option with future lease payments that are intended to approximate market rates at the time of renewal.

The cell tower is a strategic asset used in Telco A’s operations, and Telco A has historically used such assets for a period of approximately ten years. If it wishes to terminate its contract with Operator B, Telco A will incur significant costs in removing its antenna and radio equipment and relocating to another cell tower site.

Analysis:

At lease inception, the lease term determined by Telco A should be ten years. This is based on the fact that:

- the cell tower is a strategic asset and is significant to Telco A’s operations;

- the future lease payments are expected to approximate market rates;

- Telco A has past practice of using such assets for a period of ten years; and

- Telco A will incur significant costs to relocate to another cell tower site.

Considered together, the factors above indicate that Telco A is reasonably certain to exercise the renewal option.

The enforceable period of a lease

As noted above, the lease term is the non-cancellable period of a lease, plus periods covered by extension or termination options as appropriate. However, the lease term cannot be longer than the period for which the lease is enforceable - ie the period for which enforceable rights and obligations exist between the lessee and lessor. In practice when determining the lease term, significant judgement may be required over both aspects, i.e. both in assessing whether the exercise of an option is reasonably certain and in determining the ‘enforceable period’.

The IFRS Interpretations Committee (‘IC’) was asked how to determine the lease term of a cancellable or renewable lease [IFRIC update November 2019]. A cancellable lease is one that does not specify a particular contractual term but continues indefinitely until either party to the contract gives notice to terminate. A renewable lease specifies an initial period and renews indefinitely at the end of the initial period unless terminated by either of the parties to the contract.

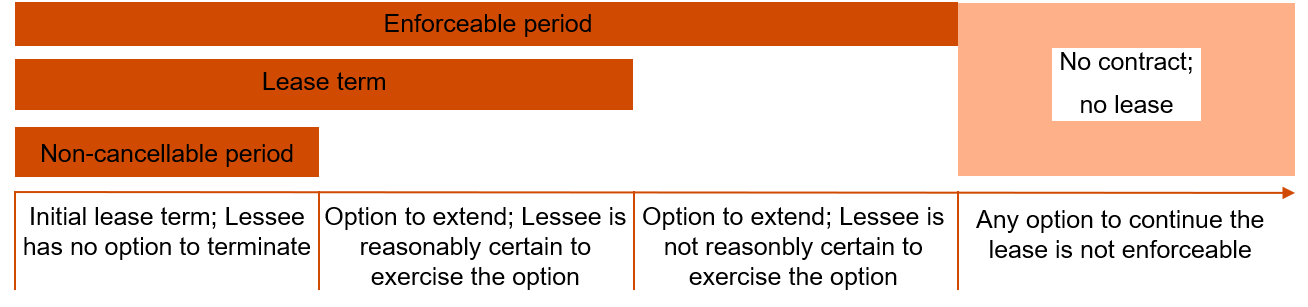

The IASB staff paper included the following diagram, which illustrates the notions of ‘noncancellable period’ and ‘enforceable period’ and how the lease term must lie between these two periods.:

The following concepts should be considered when determining the lease term:

(1.) the non-cancellable period of a lease is any period during which the lessee is unable to terminate the contract (paragraph B35 of IFRS 16). Consequently, any non-cancellable period in effect sets a minimum lease term.

(2.) the enforceable period of a lease is the period for which enforceable rights and obligations exist between the lessee and lessor (as described in paragraph B34 of IFRS 16). To be part of a contract, any optional periods that are included in the lease term must also be enforceable. Consequently, the enforceable period in effect sets a maximum lease term.

(3.) the lease term is the non-cancellable period of a lease, together with any optional periods that the lessee is reasonably certain to use (paragraph 18 of IFRS 16). The lease term cannot extend beyond the end of the enforceable period.

Determining the enforceable period - penalties

IFRS 16 (paragraph B34) states that a lease contract is no longer enforceable when the lessee and lessor each has the right to terminate the lease without permission from the other party “with no more than an insignificant penalty”.

While a literal reading of the word ‘penalty’ might focus attention on penalty payments stipulated in the lease contract, the intention is that ‘penalties’ should be considered in a much broader economic context. This was confirmed by the IC [IFRIC Update November 2019] which concluded that, in applying paragraph B34 and determining the enforceable period of a lease, an entity considers:

- the broader economics of the contract, and not only contractual termination penalty payments. For example, if either party has an economic incentive not to terminate the lease such that it would incur a penalty on termination that is more than insignificant, the contract is enforceable beyond the date on which the contract can be terminated; and

- whether each of the parties has the right to terminate the lease without permission from the other party with no more than an insignificant penalty. Applying paragraph B34, a lease is no longer enforceable only when both parties have such a right. Consequently, if only one party has the right to terminate the lease without permission from the other party with no more than an insignificant penalty, the contract is enforceable beyond the date on which the contract can be terminated by that party.

This is also in accordance with paragraph BC156 of IFRS 16, which sets out the Board’s view that “the lease term should reflect an entity’s reasonable expectation of the period during which the underlying asset will be used because that approach provides the most useful information”.

In practice, issues over determining the enforceable period of a lease most often occur for cancellable or renewable leases as illustrated in the examples below.

Example: Consideration of penalties in determining the lease term

Telco B enters into a lease contract with a lessor on 1 January 20X1 to lease a piece of land. The contract does not specify a particular contractual term but continues indefinitely until either party gives notice to terminate. Telco C constructs a cell tower on the leased land. The land and therefore the cell tower is in a unique location, with exclusive use of the land granted to Telco B. The cell tower has a useful life of twenty years.

Telco B and the lessor each has a right to terminate the contract, without permission from the other party, at the end of each calendar year, with a six-month termination notice (i.e. the earliest right to terminate would be at 31 December 20X1, and the six-month notice period means it would be effective at 30 June 20X2). If Telco B terminates the contract before the end of year ten, it has to pay a termination penalty to the lessor equivalent to two years of lease payments (which is more than an insignificant penalty) and it will also incur significant costs to relocate to another site. If the lessee terminates the lease after that period, no penalty payment is incurred. For the lessor, no termination penalty payment is incurred, regardless of when it terminates the contract.

Analysis:

In this case, the lease term is determined taking into account the following:

- The non-cancellable period is 18 months, because the lessee cannot terminate the lease effective earlier than 30 June 20X2 (considering the notice period)

- As noted above, the enforceable period is the time until the lessee and the lessor each has the right to terminate the lease without permission from the other party with no more than an insignificant penalty. Focusing purely on the contractual termination penalty payments, the lessee would incur a more than insignificant penalty to terminate before ten years. However, within a much broader economic context, Telco B also has a significant economic disincentive to terminate the contract before the end of year twenty (being the useful life of the cell tower). This is because (a) it will incur significant costs to relocate to another site, and (b) leaving this unique location in which the cell tower is now located, combined with the importance of cell towers to a telecommunication company’s operations, could lead to an adverse economic impact on Telco B. The enforceable period is therefore twenty years.

The lease term therefore lies between a minimum of 18 months (the non-cancellable period) and a maximum of twenty years (the enforceable period). In making a judgement regarding the lease term, the following should be considered:

- The guidance for lessee termination options should be applied. As regards Telco B’s termination right within the first ten years of the contract, this affects the lease term if it is not reasonably certain to continue to lease the land during the first ten years (that is, if it is not reasonably certain to not exercise the termination option within that period) [IFRS 16 para B37].

- If Telco B is reasonably certain to continue the lease for the full twenty years (after having taken into account all relevant facts and circumstances creating an economic incentive not to exercise the termination option), the lease term is twenty years. Conversely, if the lessee is not reasonably certain to continue the lease at a certain point in time, despite the termination penalty, the lease term ends at that point in time (taking into account the notice period).

- When evaluating whether the lessee is reasonably certain to not terminate, the termination penalty is one relevant factor. Examples of other factors that should be considered are set out on page 2.

Example: Lease term for month-to-month leases

Tele-C enters into an agreement to lease a cell tower. There is an initial non-cancellable period of three years. The agreement states that, on conclusion of the initial three-year period, the lease is to continue on the same terms on a month-to-month basis until either party notifies the other it is terminating the lease. After the initial three-year period, there is no contractual termination penalty payment.

When considering the operations of the entity, Tele-C’s management looks to a five-year business plan which incorporates its network planning horizon and therefore the length of time for which it expects to use the tower. On the basis of this evidence, it is reasonably certain that the tower will be used for a minimum of five years. Management is not reasonably certain of business decisions that it will take beyond this period.

Analysis:

There is a non-cancellable period of three years in relation to the lease of the cell tower, with the lease continuing thereafter on a month-to-month basis for an indefinite period (that is, a monthly renewal option). This gives rise to the question of whether this month-to-month renewal option should be taken into account in determining the lease term and, if so, the estimate of the monthto-month period which should be included in the lease term.

In this scenario, either Tele-C or the lessor can terminate the agreement and neither party would incur a contractual penalty payment on termination. However in determining the lease term, TeleC should consider the broader economics of the contract including factors such as the strategic importance of the tower, whether alternative suitable cell tower locations are available, the fiveyear business plan incorporating the use of the tower, and that management is not reasonably certain of business decisions that it will take beyond this period. Depending on the specific facts and circumstances the lease term of the cell tower could be aligned to the business plan and forecast period of Tele-C (that is, five years), since management is reasonably certain that Tele-C will use the cell tower for at least this period.

The question arises of how the lease term is affected if, in a later period, there is a change in the business plan of Tele-C that results in a change in the expected period of use of the tower. This is covered in the next section.

Reassessing / revising lease term

The assessment of lease term (that is, whether the exercise of an option is reasonably certain) is made at the commencement date of the lease. A lessee is required to reassess the lease term on the occurrence of a significant event or change of circumstances that:

- is within the control of the lessee; andis within the control of the lessee; and

- affects whether or not it is reasonably certain to exercise an option.

This requirement can be seen as a compromise, clearly set out in the Basis for Conclusions of IFRS 16: on the one hand, the IASB believes that a regular reassessment of the lease term would provide more relevant information to users of the financial statements; on the other hand, the IASB acknowledges that such a requirement could be very costly. Accordingly, the IASB decided to develop an approach whereby a reassessment is only required if there are indicators that it would result in a different outcome.

Examples of significant events or changes in circumstances that could prompt a reassessment of lease term include:

- significant leasehold improvements not anticipated at the lease commencement date;

- a significant modification to, or customisation of, the underlying asset that was not anticipated at the lease commencement date;

- the inception of a sublease of the underlying asset for a period beyond the end of the previously determined lease term; and

- a business decision by the lessee that is directly relevant to exercising, or not exercising, an option.

Example: Reassessment of lease term

Telco D enters into a contract to lease a cell tower from Operator X. Telco B’s subscribers currently use Telco D’s 4G network. The lease is for a period of five years, with an option to renew for a further five years. Telco D’s management is reasonably certain at the lease commencement date that it will exercise the renewal option, and it determines the lease term to be ten years. After using the cell tower for three years, Telco D’s management revises its detailed network plan and makes a business decision to roll out 5G sites with a focus on small cell sites within the next two years, to compete with other telecommunication companies who are in the process of migrating to a 5G network. The cell tower leased from Operator X is included in the scope of the detailed network plan and since the plan contemplates fewer cell towers being needed by Telco D, could be directly impacted.

Analysis:

The revision to Telco D’s network plan, resulting from the business decision by Telco B’s management to roll out 5G sites with a focus on small cell sites, could represent a significant event that is within the control of the lessee (that is, Telco D), and it could affect the entity’s assessment of whether it is still reasonably certain to exercise the extension option. Accordingly, Telco D should consider reassessing the lease term on the occurrence of this event.

Contact us

David Baur

Partner and Leader Corporate Reporting Services, PwC Switzerland

Tel: +41 58 792 26 54