PwC continues to track sentiment and priorities about the COVID-19 outbreak among finance leaders. This time we surveyed 867 CFOs from 24 countries or territories, including Switzerland, during the week of 4 May. This survey is our fourth look across the globe; we continue to add territories and companies to offer a robust view of how the crisis is affecting people and businesses worldwide.

However, now that the acute phase of the COVID-19 response is over and the economy has entered a period of stabilisation, we’ll be ramping down our survey slightly. We’ll still be keeping our finger on the pulse of how CFOs view developments, including those in Switzerland, but it will no longer be on a bi-weekly basis.

What’s striking in Switzerland?

Let’s first take a brief look at a couple of thought-provoking findings for Switzerland. All in all the sentiment and expectations of CFOs in Switzerland broadly matched their counterparts across the globe during the latest period surveyed. There are, however, some interesting differences that are worth noting.

Is Switzerland more vulnerable in terms of supply chains?

First off there’s Swiss CFOs’ responses to the question of planned changes in supply chain strategy post-COVID-19. Nearly three-quarters of Swiss respondents said that their company was planning to develop additional, alternate sourcing options, compared with only half of CFOs globally.

Related to this is the question of whether companies plan to extend visibility into their suppliers’ networks: the proportion of Swiss respondents saying they would be doing so (around half) was considerably higher than those globally (fewer than one third). This discrepancy could reflect Switzerland’s vulnerability as a small country reliant on global supply chains for everything from food to parts or software. It might also conceivably have to do with the fact that many Swiss businesses are integrated in complex global supply chains.

Whatever the case, the survey also indicates that a sizeable proportion of Swiss companies (a considerably larger share than in the global sample) are planning to diversify product assembly and/or service delivery locations. Could this, too, indicate increased awareness of the vulnerability of supply chains in the wake of COVID-19?

Remote working the new normal?

Another interesting area of comparison between Switzerland and the global sample relates to expectations around workplace presence versus remote working in the wake of COVID-19. Firstly, the response of Swiss CFOs suggests that Swiss companies are better equipped to maintain productivity with their people working remotely: fewer than 20% of Swiss respondents expect an imminent loss of productivity owing to a lack of remote working capability, compared with one third of global respondents.

The next question in the survey also reveals a difference in how companies expect working arrangements to change once the transition back to on-site work starts: Less than half of the global sample say their company is going to make remote work a permanent option for roles that allow, versus more than two-thirds of Swiss CFOs.

Taking these two responses together raises an interesting question: given that Swiss business is apparently already coping well with the challenges of remote working, is this country at the vanguard of a longer-term transition to increased virtual offices?

Business as usual?

What about the question of how quickly businesses will recover? The latest round of the survey shows that CFOs are maintaining their confidence in their businesses’ ability to bounce back: around half of respondents estimate a return to normal within less than three months if COVID-19 were to end today, the same figure as in the last wave two weeks ago.

Now that we’ve looked at some of the more striking findings from Switzerland, let’s turn to the global sample.

Previous survey results

Finance leaders respond to the latest developments of COVID-19

The stabilisation wave of companies’ novel coronavirus response, during which leaders focus on the tactical moves that will help them manage through the new normal, is likely to be long. Even as restrictions slowly continue to lift in some countries and territories, the economic fallout of the crisis is still widespread. The European Commission recently projected that the EU economy will decrease by 7.5% this year; it shrank by 4.5% in the recession in 2009. The US economy lost 20.5m jobs in April, and the unemployment rate reached 14.7%. In Asia, purchasing managers’ indices (PMIs) continue to creep down, in some cases to record lows. And the sudden drop-off in tourism could plunge the Caribbean into its deepest recession in more than half a century.

Both because of and despite these challenges, governments realise that their economies must reopen. They will do so at a varied pace, with some territories providing a blueprint for success and others serving as cautionary tales. But it’s clear in every corner of the world that navigating the way forwards will increasingly fall on companies. It is companies that will ultimately need to determine when to bring their people back to worksites and how to keep them safe; it is companies that will need to develop innovative solutions to ensure this safety can be sustained throughout the crisis and recovery.

As they manage this process, business leaders — including the CFOs we’ve surveyed here — will be faced with a series of decisions that will have a wide-reaching impact: on their own financial future; on the well-being of their employees, customers and other stakeholders; and on society at large.

Top findings

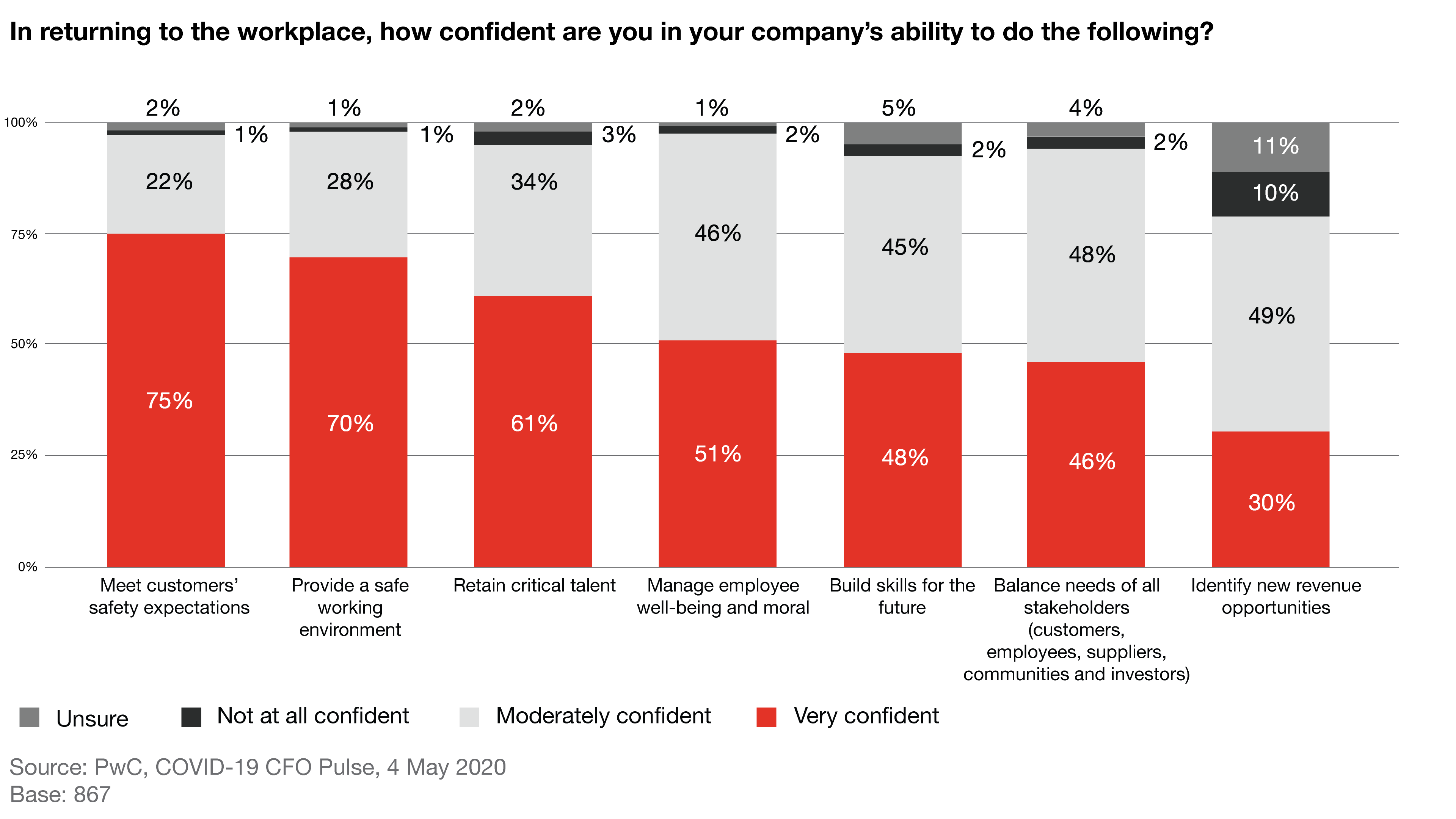

- As worksites reopen, 75% of CFOs feel very confident they can meet customers’ safety expectations, and 70% are very confident they can provide a safe working environment for employees.

- 85% of CFOs expect some decrease in revenues and/or profits this year as a result of COVID-19, with just more than half (51%) reporting the decline will be up to 25%.

- Capex investments are CFOs’ most likely source of deferrals or cuts (83%), compared to just 18% who are planning cuts to R&D and 16% who expect to scale back their investment in digital transformation.

CFOs are confident about their ability to keep customers and employees safe

Our survey reveals optimism among CFOs as businesses around the world bring employees back to physical worksites or plan to reopen. A majority (75%) report feeling very confident about meeting customers’ safety expectations, and 70% say they are very confident about the ability to provide a safe working environment. Confidence about workplace safety runs particularly high in Denmark (90%) and Germany (85%), both of which have either reopened or are planning to reopen their schools, restaurants and stores soon. Meanwhile, 78% of Central and Southern Africa CFOs are very confident they can retain critical talent. This comes as South Africa, which initially enacted one of the strictest lockdowns, began easing restrictions on 1 May. Looking at industries, energy, utilities and resources CFOs report high levels of confidence about customer safety (92%), and health industries CFOs are confident about talent retention (72%).

Of course, CFOs’ confidence will be tested as reopenings progress. In the US and Europe, government agencies are acting quickly to issue new safety guidelines for the workplace, and in some cases, establish information hotlines for employees or customers to report non-compliance. Anecdotally, reports of calls to these hotlines concerning issues related to safety, retaliation and more are running high. Moreover, although governments are issuing broad guidance, businesses will need to design their own return-to-work strategies. It remains to be seen how plans will roll out in practice, and how they will need to evolve to meet unexpected challenges.

Organisations will also need to consider how they will support employees dealing with unprecedented working conditions, whether that means adjusting to different configurations on the shop floor or conducting work at home in the presence of children, elderly parents or extended family. Only about half (51%) of CFOs say they are very confident about their company’s ability to manage their employees’ well-being and morale, yet these are factors that may significantly affect productivity and possibly decelerate the pace of future economic recovery. For example, only 30% of CFOs are very confident they can identify new revenue opportunities at this juncture. This is a metric that can be influenced by focussing on people — those who will plan and execute these new opportunities — and it will be interesting to track over time.

Seventy percent of CFOs believe they can provide a safe environment for returning employees.

The workplace, reimagined for a new normal

The majority of CFOs are making plans focussed on tactical measures to protect staff, followed by strategic measures around remote work and automation. For example, 76% of CFOs are considering workplace safety measures and requirements such as masks and testing, and 65% say they’ll reconfigure work sites to promote physical distancing.

Given the need to limit the number of people in close contact, about half (49%) of CFOs are considering making remote work a permanent option where feasible, which corresponds to another finding: 72% of CFOs say that the work flexibility they have created in response to the crisis will benefit their company in the long run. Of course, the success of remote work will be driven by the opportunities that businesses create for employees to interact, learn and be part of a community. CFOs in Denmark (72%), Germany (67%) and Mexico (69%) are most likely to consider making virtual working arrangements a permanent option. Meanwhile, 48% of CFOs are looking at accelerating automation and other new ways of working — among Germany CFOs, this jumps to 76%.

Changing safety measures is also a top choice across industries, led by CFOs in the industrial manufacturing and automotive industry and the technology, media and telecommunications industry (81%). Health industries CFOs are most likely to plan to reconfigure worksites (72%) and consider automation (60%). Although measures involving benefits to employees rank last among potential workplace adaptations in general, finance leaders in health industries are most likely to consider targeted benefits such as childcare and private transportation (21%) and hazard pay (13%).

More than three-quarters of companies will change workplace safety measures; nearly half plan to accelerate automation.

Which of the following is your company planning to implement once you start to transition back to on-site work? Please select all that apply.

Base: 867

CFOs will also need to prepare for a rise in demand for employee protections

As employees return to work sites, many CFOs expect a higher demand for protections (43%). Paid sick leave, discrimination safeguards, and other policies and benefits will be a critical part of ensuring workplace safety: employees who are expected to report back will be thinking, for example, about what to do if they or a loved one falls ill. CFOs in Portugal (54%), the US (52%) and Malaysia (52%) are most likely to expect greater demand for more employee protections.

More than one-third (37%) of CFOs also expect changes in staffing — temporary leaves or furloughs — due to low or slow demand, and another third anticipate productivity loss to occur over the next month due to lack of remote work capabilities. In Denmark, where the unemployment rate recently reached its highest point since December 2017, finance leaders are more likely than average to anticipate changes in staffing (51%). In the Middle East, which has also been heavily affected by oil price volatility, CFOs are more likely to expect changes in staffing (43%) and layoffs (40%).

Industrial manufacturing and automotive CFOs are more likely than average to expect changes in staffing (46%) and layoffs (39%) in the coming month. Meanwhile, health industries CFOs are more likely to expect higher demand for employee protections (58%) and insufficient staffing for critical work (36%). These findings correspond with recent data from the PwC COVID-19 Navigator (an assessment of crisis preparedness that had roughly 3,000 global responses as of April 30). Of its health industries respondents, 82% note that human interaction is required to deliver products and services, and 49% will not be able to effectively work remotely — which may contribute to the expected issues identified in the CFO Pulse findings.

CFOs will focus in the near term on employee protections such as sick leave and other benefits.

As a result of COVID-19, which of the following does your company expect to occur in the next month? Please select all that apply.

Base: 867

Stabilise the supply chain with new sourcing options and better information

CFOs’ approach to supply chains further illustrates their overall acceptance that the stabilisation phase will be long and difficult to maintain. Operationalising the new normal will come with challenges that result from the crisis, as well as from pre-crisis factors. For example, even prior to the novel coronavirus, PwC’s Connected and autonomous supply chain ecosystems 2025 found that only 28% of all companies surveyed said they had implemented solutions to increase supply chain transparency to achieve visibility across the entire supply chain, from materials to customers and back.

Overall, more than half (51%) of CFOs surveyed in the CFO Pulse cite the development of alternate sourcing options as the most pressing area, led by Central and Southern Africa (64%) and Turkey (63%). In Germany (55%) and the US (52%), CFOs are most likely to prioritise understanding the health of their suppliers, and CFOs in the Caribbean (61%), the Middle East (57%) and Central and Southern Africa (56%) say they are focussed on changing contractual terms. The use of automation and other tools skews slightly lower among supply chain approaches overall, which may also reflect the fact that many businesses are still stabilising, rather than looking for ways to upgrade or increase efficiencies.

Energy, utilities and resources CFOs are most likely (61%) to consider alternative sourcing options and work to understand the health of their suppliers (59%). These data points correspond to insight from the PwC COVID-19 Navigator, which finds that 47% of respondents from this industry rely on outsourced supply chains and/or operations, and 71% have operations that are geographically distributed to some degree. In the health industries, in which supply issues have been severe, 45% of CFOs say they expect to extend visibility into their suppliers’ networks. Financial services CFOs are more likely than average to use automation (49%) to improve decision-making capabilities.

CFOs plan to develop additional sourcing options for their supply chains.

As a result of COVID-19, in which of the following areas are you planning changes to your supply chain strategy? Please select the three most pressing areas.

Base: 867

Revenue decline is the reality for many businesses, in most industries

The negative impact of the novel coronavirus on revenue and/or profits is largely a given, with most CFOs (85%) expecting a reduction this year. But a difference lies in how significant companies think this impact will be. Overall, more than half (51%) of CFOs expect a decrease of up to 25% as a result of the current crisis. CFOs in Denmark and Germany — countries that have made notable progress in reopening — are the most optimistic regarding revenues, with 31% and 27% respectively expecting a decrease of less than 10%. Looking at industries, those most severely affected by lockdown restrictions, such as consumer markets, are most likely to expect a revenue decrease of more than 50% (in the case of consumer markets, 16% of CFOs). Health industries CFOs are more likely to expect revenues to increase (19%) or be unaffected (9%).

Expectations about decreased revenues — and growing acceptance about the likely impact of the coronavirus — are also reflected in CFOs’ view of recovery. Although 42% of CFOs believe their company could return to ‘business as usual’ within three months if COVID-19 were to end today, there is a growing sentiment in many territories that recovery may take much longer. Overall, 8% of CFOs would expect it to take more than a year, led by those in consumer markets (10%) and industrial manufacturing and automotive (9%). In Malaysia, 23% of CFOs say returning to business as usual could take more than a year. Twenty-six percent of Mexico CFOs and 33% of Central and Southern Africa CFOs believe it will take six to 12 months. And 40% of technology, media and telecommunications CFOs see a timeline of between three and six months.

In terms of financial disclosures, 48% of CFOs say they will include COVID-19 in their risk assessment or risk profile, and 47% will include it in their macroeconomic or industry factors. These figures seem low, but they could be attributed to timing. Many companies have already made COVID-19 disclosures and may not feel that it will be as much of an issue when it comes time for the next round. We’ll see how these data points evolve over time.

Half of CFOs expect a decrease of up to 25% in revenue as a result of COVID-19.

What impact do you expect on your company's revenue and/or profits this year as a result of COVID-19?

Base: 867

Cost containment is mostly focussed on capex investments

As they settle into stabilisation, CFOs favor a strategy of cost containment, with 81% saying they will consider it in response to the crisis. Sixty percent of finance leaders say they will defer or cancel planned investments, with facilities and general capex (83%), operations (53%) and workforce (49%) topping the list of potential cuts. With an eye perhaps towards what measures will be necessary for success in the post-crisis world, only 16% of CFOs are considering deferring or cancelling investments in digital transformation. Even fewer are likely to cut investments in customer experience (11%) and cybersecurity or privacy (3%).

CFOs in Mexico (95%) and the Middle East (91%), who are less optimistic in terms of the impact of the coronavirus on revenues, are most likely to consider deferring or cancelling capex investments. Capex investments are also the most likely investments to be deferred or cancelled across industries, led by energy, utilities and resources CFOs (91%).

Along with decisions about cutting investments, CFOs are evaluating the other changes they’ve made to help manage the crisis. Many CFOs cite work flexibility (72%), better resiliency and agility (65%), and technology investments (52%) as crisis-driven developments that will improve their companies in the long run. We discussed the former above, in the section on the reimagined workplace; the latter two are also important findings to reflect on. The pandemic has underscored the need for new skills, including empathetic leadership, resilience and agility, collaboration and digital skills, and technical and trade skills such as design, manufacturing, and cyber and supply chain management. Yet in PwC’s 23rd Annual Global CEO Survey (conducted before the coronavirus crisis, in September and October 2019), only 35% of CEOs from companies who self-identified as having more advanced upskilling organisations felt their programmes were very effective at reducing skills gaps and mismatches. Leaders may need to ramp up efforts in this area when possible, to ensure that their technology investments continue to benefit the company and that the resilience they created is built to last.

Many CFOs will cut or defer capex investments, but significantly fewer plan to cancel digital spending.

You mentioned your company is considering deferring or cancelling planned investments as a result of COVID-19. Which of the following investment types are being considered in that regard? Please select all that apply.

Base: 867

Monitoring finance leaders’ evolving response

It’s clear that global finance leaders are shifting their focus to a more prolonged recovery period. Ensuring a safe workplace is taking precedence as economies reopen, and stabilising the supply chain remains critical to ongoing business continuity. As new recovery milestones are reached, we’ll continue to monitor how CFOs react and respond.

About the survey

To help identify the business and economic impact of COVID-19, PwC is conducting a global, biweekly survey of finance leaders. Of the 867 surveyed for the global report during the week of 4 May 2020, respondents were from 24 countries or territories: Central and Southern Africa*, Brazil, the Caribbean**, China/Hong Kong, Cyprus, the Czech Republic, Denmark, France, Germany, Greece, Kazakhstan, Malaysia, Malta, Mexico, the Middle East***, Netherlands, Portugal, Singapore, Slovakia, Sweden, Switzerland, Turkey, the US and Vietnam. The next set of results will be released in early June.

*Representatives from Ghana, Kenya, Mauritius, Namibia, Nigeria, South Africa, Togo, Uganda

**Representatives from the Bahamas, Bermuda and Jamaica

***Representatives from Bahrain, Egypt, Jordan, KSA, Kuwait, Lebanon, Oman, Qatar and UAE

Contact us

Julie Fitzgerald Wieland

Partner and Leader Finance Transformation and Growth & Markets, PwC Switzerland

Tel: +41 58 792 26 80

Norbert Kühnis

Partner and Leader Family Business & SMEs, PwC Switzerland

Tel: +41 58 792 63 63