{{item.title}}

{{item.text}}

{{item.text}}

Matthias Leybold

Partner and Data & Analytics Leader

PwC Switzerland

Christian Müller

Head Surveillance & Enforcement

Six Exchange Regulation AG

In collaboration with PwC, the Swiss stock exchange has developed a pioneering software for trade monitoring. Prometheus is AI-based, and reliably identifies patterns suggesting insider trading and market manipulation.

Together with us, SIX Exchange Regulation (SER) has developed and successfully launched the Prometheus trade monitoring application. The artificial intelligence-based software sets new standards worldwide in terms of efficiency, quality and effectiveness. Thanks to the uniquely close and agile collaboration between SER’s specialists and PwC’s experts on transformation, data analysis and IT, the new application was implemented within a very short space of time.

SIX Exchange Regulation (SER) regulates and monitors exchange participants and issuers on the Swiss Exchange and makes all relevant information accessible. Since the FinfraG reporting regime (Financial Infrastructure Act) entered into force, additional information on the beneficiaries of a transaction has been available to SER trade monitoring. SER faced the challenge of integrating and linking personal data with existing trade data in the monitoring system.

The aim was to improve all current processes and the efficiency and effectiveness of trade monitoring. The quality and speed of the system was to be increased by incorporating all available data and using the latest technologies – and the integrity and transparency of the Swiss financial centre was thereby to be maintained at the usual high level.

To implement this complex big data project, SER looked for a partner with the necessary technical background as well as experienced and innovative transformation and data experts. Christian Müller, Head Surveillance & Enforcement at SER, explains: “By using the latest technological approaches such as artificial intelligence and machine learning, we are not reacting to change but driving it ourselves. Prometheus has made us a global leader in trade monitoring and is setting new standards.”

“Not only did we want to develop an innovative and efficient application, we also wanted to do it as quickly as possible. SER was able to draw on an extremely experienced team of experts at PwC Switzerland for the development of Prometheus.”

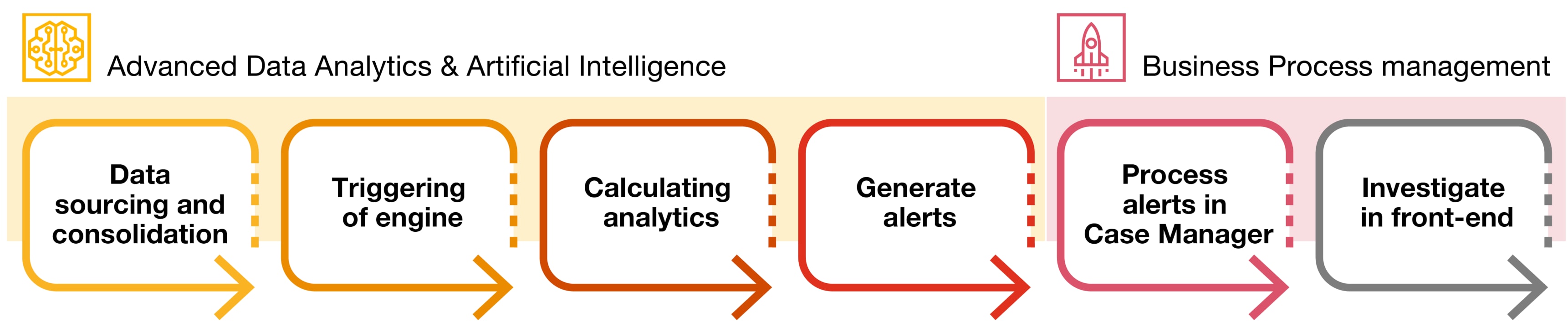

SER consistently pursues a comprehensive monitoring approach with the Prometheus trade monitoring system. With cutting-edge technologies such as artificial intelligence, big data and machine learning, the quality, effectiveness and efficiency of market monitoring is being increased with the aim of achieving a maximum degree of automation. SER developed the system in close cooperation with PwC and defined specific performance targets and processes, taking regulatory requirements into account.

SER’s trade monitoring analysts can identify potential cases of market manipulation, insider trading and other breaches of the law or irregularities more quickly and in greater detail. At the same time, the number of false alarms is reduced and the proportion of correct positive alerts is increased. This is particularly relevant because under the previous monitoring system, SER needed a lot of time to process false alarms (the false alarm rate of commercially available systems is 90%). This enables trade monitoring specialists to examine qualitatively suspicious reports much more deeply and intensively.

Prometheus uses big data transformation and analytics to identify suspicious anomalies and patterns. The software makes use of a large number of specially developed key performance indicators (KPIs) and metrics. The cross-linking of media such as public blogs, social media or public press is also an integral part of the new solution.

“The state-of-the-art Prometheus market monitoring system combines various methods based on artificial intelligence to reliably identify specific patterns of market abuse or insider offences. With Prometheus, SER has one of the best trade monitoring systems in the world from a technical perspective.”

With Prometheus, SER has been able to establish itself as a global leader and technological pioneer in trade monitoring. Besides the efficient analysis and evaluation of alerts, the most important success factors of Prometheus include more efficient processes that take the company’s targets into account in a transparent and comprehensive manner.

#social#

Would you like to learn how Prometheus and a monitoring system based on artificial intelligence and big data can also check your stock exchange or the transactions in your company better and more effectively? Send us your email address so that we can contact you.

https://pages.pwc.ch/core-contact-page?form_id=7014L000000PpmAQAS&embed=true&lang=en