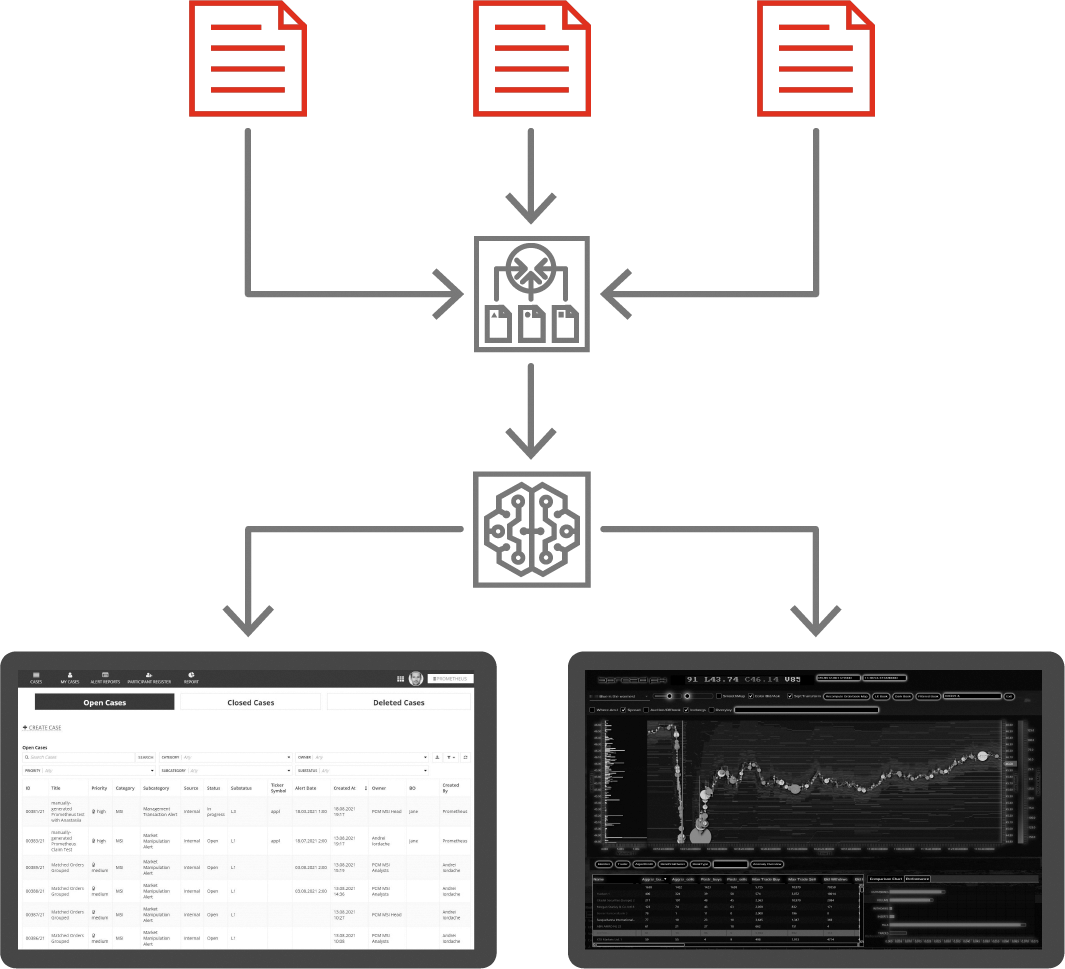

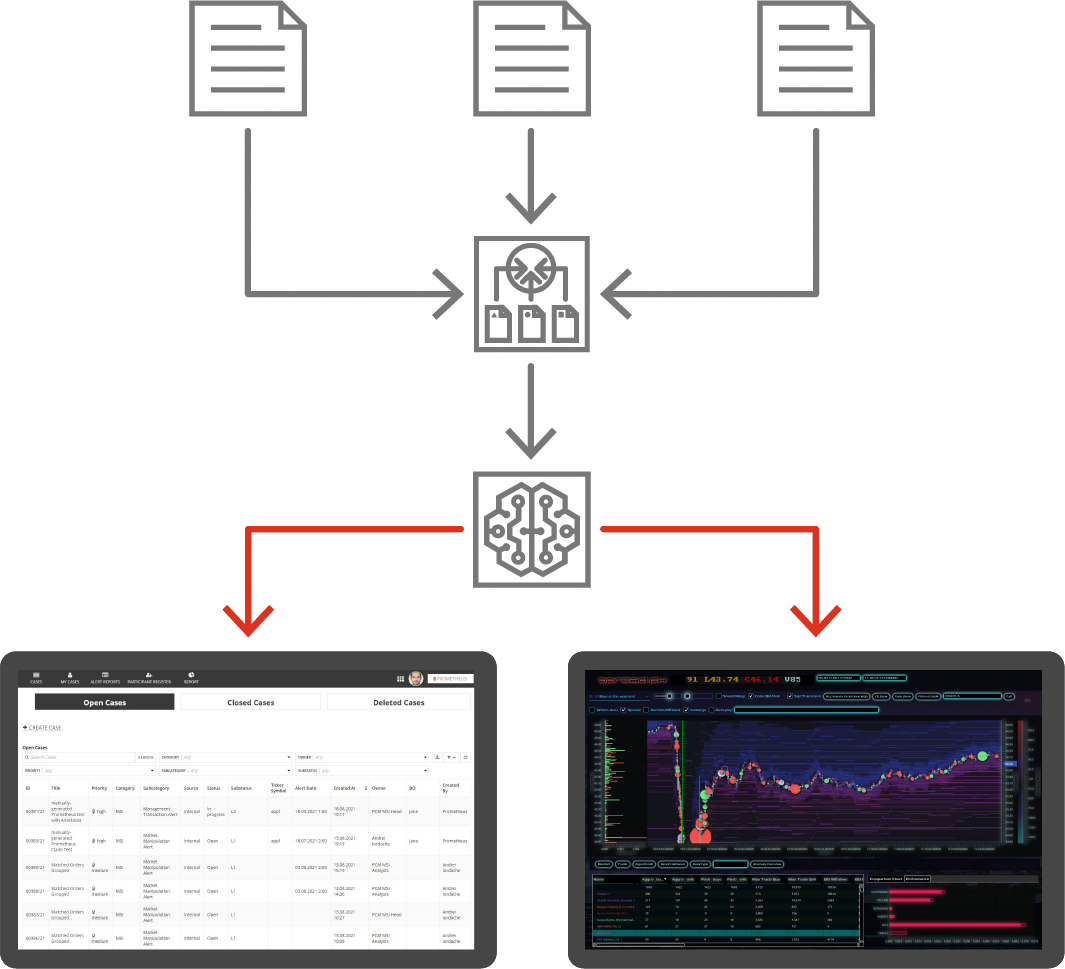

The order book function allows the user to view the order book with Limit, Market, SwissAtMId, EBBO and Plus orders. It is fully interactive, with a variety of filtering, charting and export functions. It generates the order book from the pre-trade raw data of the various modules in Prometheus.

The market playback functionality calculates a persistent order book at runtime to capture every single market event at runtime. It is available for more than 3,000 securities from the past year. From the manipulation alert generated in the system to analysis and playback, it only takes a few mouse clicks to quickly validate each warning. The user can select the exact time frame down to milliseconds and also specify how many price ranks should be displayed.