Non-financial reporting describes the way you deal with key themes that can have an impact on your organisation – including a financial impact. It involves a complex process of becoming aware and making aware. Becoming conscious of the consequences of your value creation, and explaining them to your stakeholders, is part and parcel of assuring long-term value and taking corporate responsibility.

Non-financial reporting is defined as disclosing information that isn’t based on the usual financial figures but which nevertheless gives your stakeholders an understanding of the essential areas of value creation in your business that goes way beyond your financial statements. Some intangible assets, for example, have their origins in a whole variety of non-financial performance indicators.

Vital for large organisations

Under the current interpretation, non-financial reporting is more relevant for large multinational companies than for small and medium-size enterprises (SMEs), although SMEs may be affected if they’re part of an area for disclosure because they’re involved in the supply chain of a global export or import company. On a global level the necessity of disclosing this kind of information depends primarily on the main cultural and economic considerations arising from the business that have to be covered in reporting.

Chequered past

Like so many global developments, the origins of non-financial reporting go back to unfortunate circumstances, in this case occurrences with an impact on the environment. Already decades ago events like Chernobyl and Schweizerhalle (1986) prompted tighter environmental legislation. Added to this, organisations have been under increasingly critical scrutiny from various quarters in relation to areas such as health and safety, compensation and the treatment of employees.

Shortly before the end of the millennium the Global Reporting Initiative (GRI) published its first sustainable reporting standard. Individual industries have created their own frameworks in parallel with this. The Verein für Umweltmanagement und Nachhaltigkeit in Finanzinstituten (VfU), for example, has set down environmental management and sustainability guidelines for banks, the European Chemical Industry Council (Cefic) has created a framework for chemicals, and the Cement Sustainability Initiative (CSI) launched by the World Business Council for Sustainable Development (WBCSD) has standards governing the cement industry. In Switzerland there have been repeated political and public initiatives to enshrine non-financial reporting in law, so far without success. The Swiss Federal Council’s ‘green economy’ proposal is currently being debated. The following institutions and guidelines play a significant role today:

- UN Global Compact:

The ten principles of the UN Global Compact are derived from international frameworks in various areas including human rights, labour law, the Rio resolutions and the UN Convention against Corruption. The principles of the Compact are designed to provide organisations with a basis for acting with integrity. - UN Sustainable Development Goals:

The Division für Sustainable Development (DSD) promotes and implements the United Nations’ sustainability goals. Many organisations see these goals as a norm for taking account of societal dimensions in their sustainable development. - GRI-G4:

On the European level the fourth release of the GRI (May 2013) is regarded as the ultimate benchmark. GRI-G4 constitutes an indicative framework rather than binding legislation. At the core of the latest release is the principle of materiality (see Figure 1). - Integrated Reporting (IR):

On 9 December 2013 the International Integrated Reporting Council (IIRC) published a framework for integrated reporting, the IR-Framework. This integral approach is designed to provide a holistic picture of the performance of an organisation and its various businesses. - EU directive [1] on the disclosure of non-financial and diversity information: These rules were given the rubber stamp by the EU Commission in April 2014 for adoption by member states in their domestic legislation. The directive is a principles-based standard for multinational companies with more than 500 employees, and gives users certain leeway. It applies to around 6,000 large undertakings and groups in the EU.

[1] Directive 2014/95/EU on disclosure of non-financial and diversity information by certain large undertakings and groups.

- Sustainability Accounting Standards Board (SASB)

A counterpart to the Financial Accounting Standards Board (FASB), the Sustainability Accounting Standards Board (SASB) in the United States has set down standards requiring listed

US companies to use Form 10-K, and non-US companies to use Form 20-F, for disclosure in standard filings to the SEC. - Principles for Responsible Investments (PRI):

The six UN principles provide guidance to enable the financial industry to ensure environmentally and socially compatible management. They centre around so-called ESG issues (Environmental, Social, and Corporate Governance). - Other principles for the financial industry: Principles such as the Green Bond Principles, the Equator Principles or the Principles for Sustainable Insurance are used in the financial industry, particularly in connection with transactions or as a framework for setting investment objectives.

Sustainability Accounting Standards Board (SASB)

Form 10-K, the standardised format specified by the Securities Exchange Commission (SEC) for annual reports, has to be submitted by companies with assets of more than USD 10 million. Form 20-F applies to all foreign issuers of securities that have shares listed on US exchanges.

Principle of materiality

GRI-G4 places special emphasis on the principle of materiality in an attempt to prevent reporting from degenerating into a collection of data without any focus. Analysing materiality enables companies to first identify the key themes from the perspective of all their stakeholders, including authorities, local residents, suppliers and employees. Then they can define the areas where their business has a material economic, environmental or social impact. The approach covers the entire value chain, which means, for example, that because of its connections with certain suppliers a company might have to treat child labour as a material aspect even though the issue isn’t relevant in the company itself.

Figure 1 shows how companies have to define materiality and communicate with the respective audience under the main frameworks and standards.

Figure 1: Comparison of materiality under the main frameworks and standards

| <IR> (global) |

IFRS (global) |

GRI (global) |

SASB (US) |

|

| Audience | Providers of financial capital with a perspective on short, medium and long term |

All existing/potential investors, lenders and other creditors |

All stakeholders |

Investors of those companies that engage in public offerings of securities registered under the Securities Act |

| Subject matter / report purpose |

Value creation over time |

Financial performance and position |

Sustainability impact (economic, environmental, social, and governance) |

Sustainability impact environment, social capital, human capital, business model and innovation, leadership and governance) |

| Nature of definition |

Multistep process:

|

Information is material if omitting it or misstating it could influence decisions that users make based on financial information about a specific reporting entity. Relevance based on the nature or magnitude, or both, of the items to which the information relates in the context of an individual entity’s financial report. |

Organisation-driven materiality The report should cover aspects that:

|

SASB is identifying a minimum set of sustainability topics that have a significant impact on most, if not all, companies in an industry and which – depending on the specific operating context – are likely to be material to a company within that industry; guided by the materiality definition adopted by U.S. Securities laws and case law |

| Disclosure form |

Integrated report |

Financial statements |

Sustainability (GRI) report |

For use in reports filed with the SEC |

A question of responsibility

Companies face a highly complex key question when it comes to non-financial reporting: how can you communicate the

non-financial assets that express your corporate responsibility? The answer is to be found in the organisation’s value chain. First of all you have to get absolute clarity on your productive activities and their implications for all your stakeholders. You have to understand what input (e.g. a raw material) results in what output (products or services) and ultimately what outcome (e.g. customer utility), who is affected by this and how. On the basis of this kind of matrix you can define the main fields of responsibility.

Non-financial reporting is a framework that enables you to mirror your key issues and initiate dialogue with your stakeholders – ideally regularly and systematically. So rather than simply being the result of the organisation’s own, internal ethical aspirations, responsibility reflects the impact of the organisation’s activities in terms of people and issues.

Ambitious goals

Transparency and communication are often named as goals of non-financial reporting. This is only partly true. Transparency is more of a result; it neither adds value nor safeguards against risks. And communication is a matter of getting the message across and choosing the right channel or format. The processes underlying and preceding non-financial reporting itself hone an organisation’s awareness of how long-term value can be created and the existence of the business can be assured. In concrete terms this means keeping an eye on risks and dependencies, making sure resources are available, maintaining the supply chain, and gaining and maintaining the trust of core audiences.

An organisation has to understand itself, be aware of its responsibility in all its complexity, and last, but not least, be understood by its stakeholders (see Integrated reporting). A business managed from this perspective is a business managed with far-sightedness and a focus on value.

No guarantee

Disclosing non-financial information is no guarantee you’ll be able to eliminate risks or errors. There are always risks over which an organisation has no control, or whose impact it underestimates. You can’t completely eliminate the risk of individual misconduct either. And of course there’s also the risk of errors in disclosure. Non-financial reporting isn’t an area where you can afford to think in terms of black and white. When preparing and interpreting non-financial information, organisations, auditors and readers have to consider the context and the way the various influencing factors are linked. For this reason it’s seldom possible to compare different companies’ non-financial reporting one to one.

More clarity, more value

You might ask what benefits your organisation stands to gain from all this. That’s a valid question. Using non-financial reporting as a pure communications or marketing offensive is probably the least profitable approach. You’ll gain the most value if your

non-financial reporting not only represents your business accurately and meets your own need for information and clarity, but meets the needs of your owners, the public, the media and your employees as well. You can also use non-financial reporting as a means of differentiating yourself from the competition. Whatever the case, it depends directly on your corporate culture and the philosophy of your board and management.

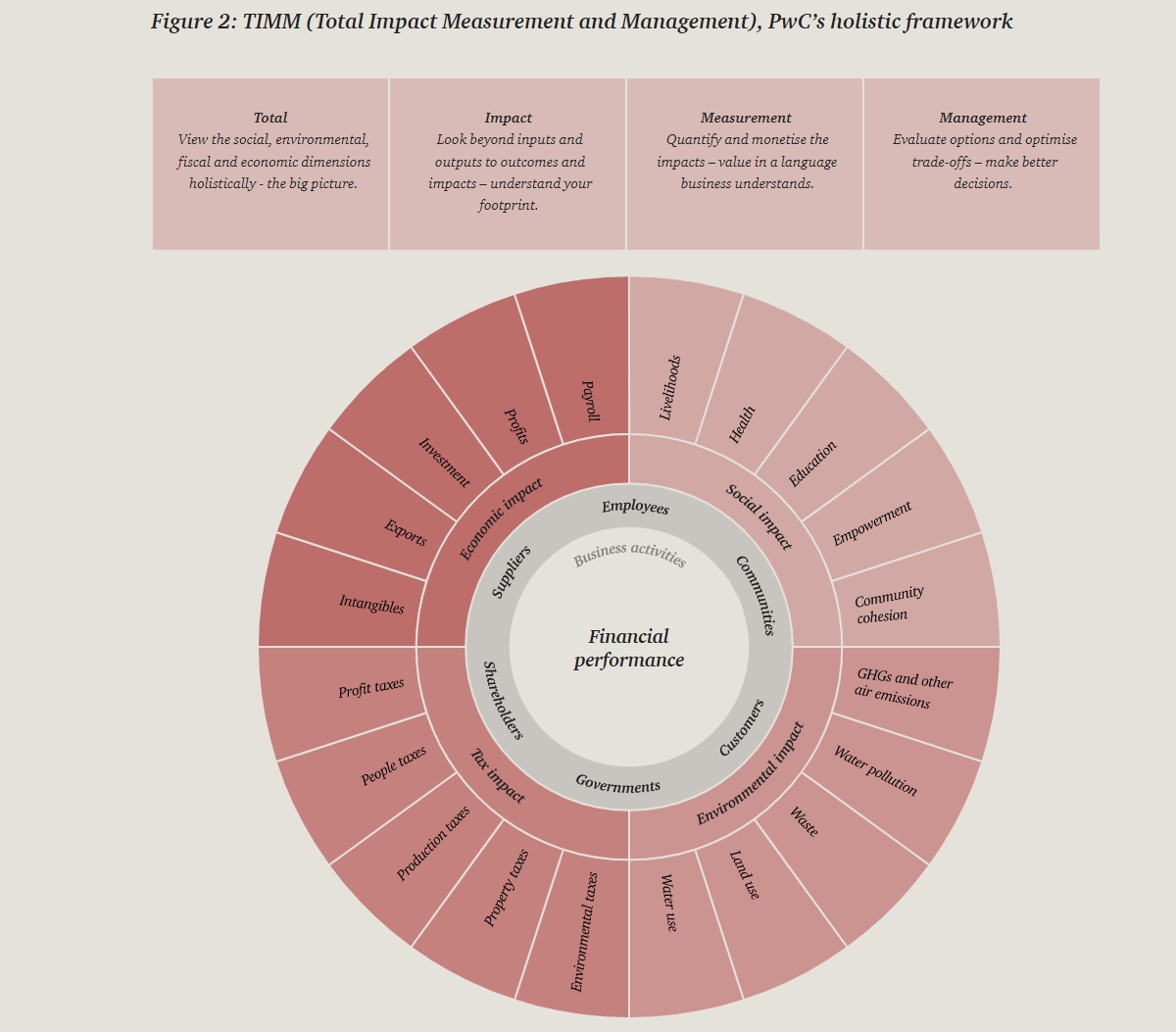

TIMM: measuring and managing impact

To translate non-financial information into financial impact we have developed a model called TIMM (Total Impact Measurement and Management) (see Figure 2). For the first time organisations can use various core indicators to assess the consequences of their actions in environmental, social, tax and economic terms. TIMM is a useful decision-making tool for managers. It helps you look at things from the perspective of materiality and broaden your understanding of your own products and services, which in turn feeds into risk management.