We help you realise substantial value from cloud investments and navigate risks on your cloud journey. Reach out to learn more about our standardised assessments on cloud maturity and readiness, cloud strategy and operating model, as well as modernisation and migration.

Cloud in Swiss financial services

The cloud is much more than just a buzzword. Over the past decade, it has ascended to a position of well-deserved prominence, as one of the most effective ways to drive value creation and to enable the entire organization. While cloud in Swiss financial services was historically driven by an IT business case, today this would simply be the wrong approach. Business leaders need to be engaged in cloud strategy and recognise it as platform for growth and innovation. Clients have numerous value propositions for cloud adoption; to name a few:

- cloud native capabilities and innovative technologies

- scalability and self-service provisioning

- faster and flexible product development

- modernisation of applications

According to an IDC study on the Swiss cloud market that was carried out in September 2022, Swiss companies tend to focus on the following criteria when choosing a strategic cloud provider:

- value for money: low price points for compute, storage and/or network services

- digital trust and security capabilities: privacy, IAM, threat detection etc.

- customer experience: ease of use, support and SLAs

- digital resilience: business continuity, disaster recovery etc.

- sustainability: transparent overview of installed infrastructure’s carbon footprint

Cloud market trends in Swiss financial services

In Swiss financial services the move to the public cloud is more attractive today than ever before. The three major hyperscalers – Azure, AWS and GCP – have made significant investments in Swiss regions and data centers, enabling data residency within Swiss national borders and reduced latency. Moreover, digital trust and security capabilities are among the top reasons for choosing a strategic public cloud provider, as the major hyperscalers have invested heavily in cloud security.

The public cloud market in Switzerland is growing at a CAGR of 22.5% and expected to surpass USD 11 billion by 2026. In the last 12 months, Microsoft has communicated a multi-billion-dollar deal with a large Swiss bank and AWS announced a major deal with a large Swiss insurer.

However, we see that certain Swiss companies prefer to run things on premise and to use the public cloud only when they have to. There are concerns about potential data breaches and about the US Cloud Act, which could theoretically enable US law enforcement agencies to access data stored by US cloud providers in Switzerland. This is only one of the reasons for the popularity of Swiss cloud providers, with Swisscom in the lead.

When considering the impact of macroeconomic factors on the hyperscaler market, we see that rising inflation and energy prices have led to slower new migration activity and longer sales cycles.This is partly reflected in recent pricing trends of hyperscalers. While hyperscalers have historically continuously decreased prices, in 2022 GCP and Azure abruptly increased prices for the first time: Google has introduced significant price increases across various cloud core services around infrastructure and storage and Microsoft has increased prices for MS365.

Cloud value generation and how to avoid pitfalls

At PwC we believe that value creation through cloud should be at the centre of every cloud journey. If generating long-term value is not focused on, major inefficiencies may be the result, as well as costs that far surpass initial estimates.

We have witnessed at some clients that promises of cost savings made by hyperscalers at the beginning of cloud transformations did not materialise in the foreseen time. This applies especially to clients who followed a mass migration approach and realised too late that certain apps should have better remained on premise, e.g. due to not properly scaling after migration.

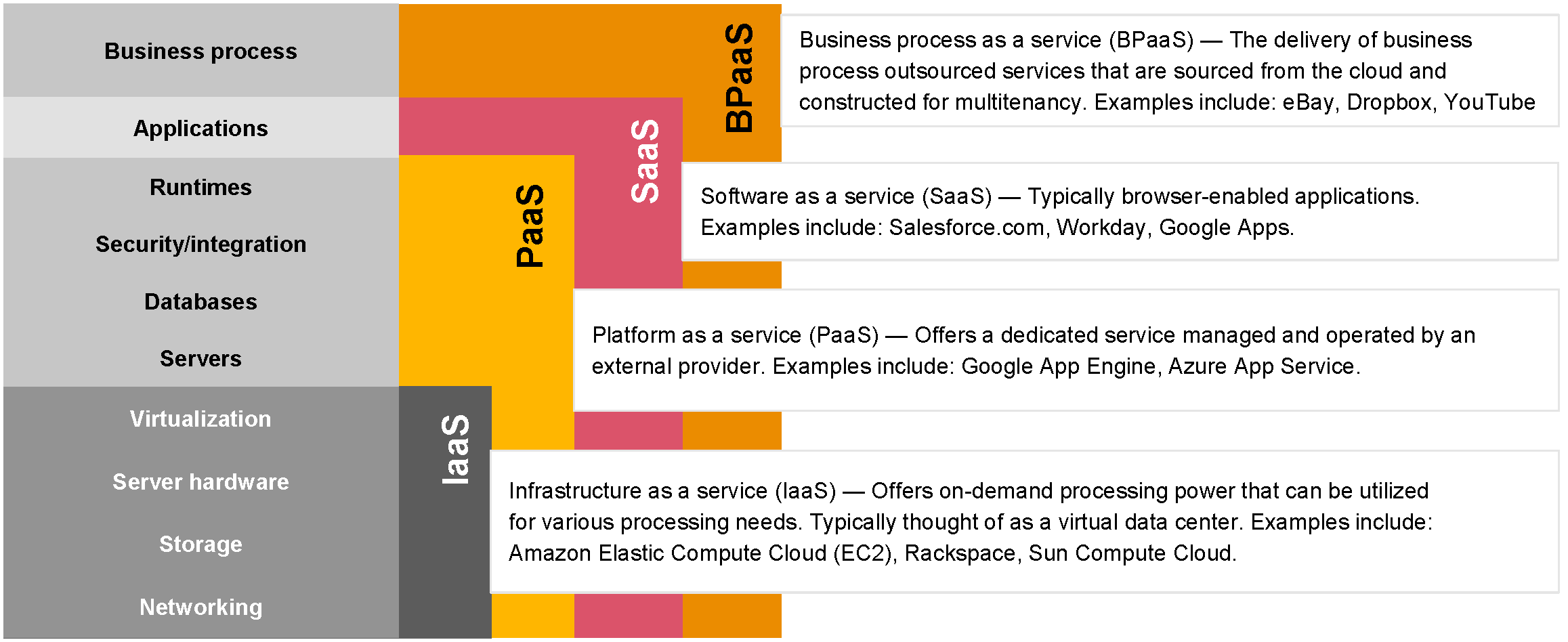

This can be prevented by making sure migrated or transformed applications have a proper business case. Moreover, by prioritising value generation, there should be a focus on PaaS and SaaS services that leverage innovation. Such services offer specific added value, e.g. Microsoft Office 365.

On the other hand, PaaS and SaaS services create ‘lock-in’ risk, due to the specific investment and contract with one certain cloud provider. Lock-in risks can partially be mitigated by e.g. choosing to rely on more than one strategic hyperscaler.

Moreover, we have witnessed at multiple clients that costly mistakes were made when initially moving to the public cloud, especially due to a lack of cloud knowledge and skills, resulting e.g. in the wrong provisioning of resources.

As a result, some clients have carried out initiatives to actively identify inefficiencies and to quickly cut cloud cost, especially at the beginning of their public cloud journey. Other clients have carried out cloud cost-cutting initiatives mainly due to difficult economic circumstances. In both cases we are convinced that it is of high importance to find a sweet spot between cost cutting and preserving the actual business case, so that long-term value creation is not undermined.

To avoid cloud pitfalls, we recommend our readers to set a focus on:

- a clearly defined business case on an application level when moving to the public cloud

- education and skills for dealing with the cloud

- a cloud centre of excellence and clearly defined responsibilities between business and IT

- transparency on the quality and price of cloud services and products provided.

#social#

Contact our Cloud and Data experts

We would be keen to understand how we can help you get value from your data and support you on your cloud transformation journey, and are very much looking forward to hearing from you.

https://pages.pwc.ch/core-contact-page?form_id=7014L000000PwipQAC&embed=true

Contact us

Partner Technology Strategy & Transformation and Technology & Data FS Leader, PwC Switzerland

Tel: +41 58 792 18 72