Private Banking in Switzerland and in Liechtenstein

The private banking sectors in Switzerland and Liechtenstein have undergone sweeping change in recent years. In the aftermath of the financial crisis, the regulatory environment has tightened markedly as the Swiss and Liechtenstein financial centres came under increasing pressure from abroad, especially from the USA and the EU. The automatic exchange of information (AEOI) was introduced in Switzerland on 1 January 2017, effectively eroding banking secrecy. Dependency on other countries increased. The digitisation trend has not spared private banking and is changing customer requirements. Banks specialising in wealth management were forced to react to the upheavals in the offshore business and adapt their business models.

The price level observed for transactions in the Swiss and Liechtenstein private banking sectors appears to be high. Financial investors may therefore find it difficult to meet their return targets. The creeping consolidation is therefore increasingly being driven by strategic investors.

Thesis: M&A activity in private banking has accelerated in recent years.

Switzerland

There has been no marked acceleration in M&A activity in the Swiss private banking sector in recent years. Quite the contrary; the number of transactions in private banking has been declining since the tax dispute was settled. We reached this conclusion by comparing the average number of transactions between 2002 and today (around eight per year) with the number of takeovers since 2016. Only during the financial crisis (2007/2008) and shortly before the peak of the euro crisis (2012) were the transaction figures lower than the historical average.

Liechtenstein

The number of banks in Liechtenstein has changed very little in recent years. In fact, only the sale of Centrum Bank to VP Bank in 2014 and of Vontobel Liechtenstein to Privatbank Kaiser Partner in 2017 has reduced the total from 16 to 14 banks, 13 of which focus on private banking. Only six are controlled by an owner from Liechtenstein. So, to speak of a consolidation in Liechtenstein’s banking sector would be somewhat of an exaggeration.

Thesis: Ongoing pressure to consolidate has caused transaction prices in the private banking sector to decline.

Liechtenstein

In Liechtenstein, a similar picture emerges in terms of the transaction prices paid. During the tax dispute, goodwill multiples were at approximately 0.8%, which is significantly lower than before the tax dispute. After the tax dispute was over, the goodwill multiples actually paid rose markedly, to around 1.5%. Due to the low number of transactions, however, the results for Liechtenstein are somewhat less meaningful than those for Switzerland.

Private banking had been written off. But the consolidation in the sector is strengthening the surviving banks and ensuring that banks in Switzerland and Liechtenstein will continue to play an important role in the wealth management business.

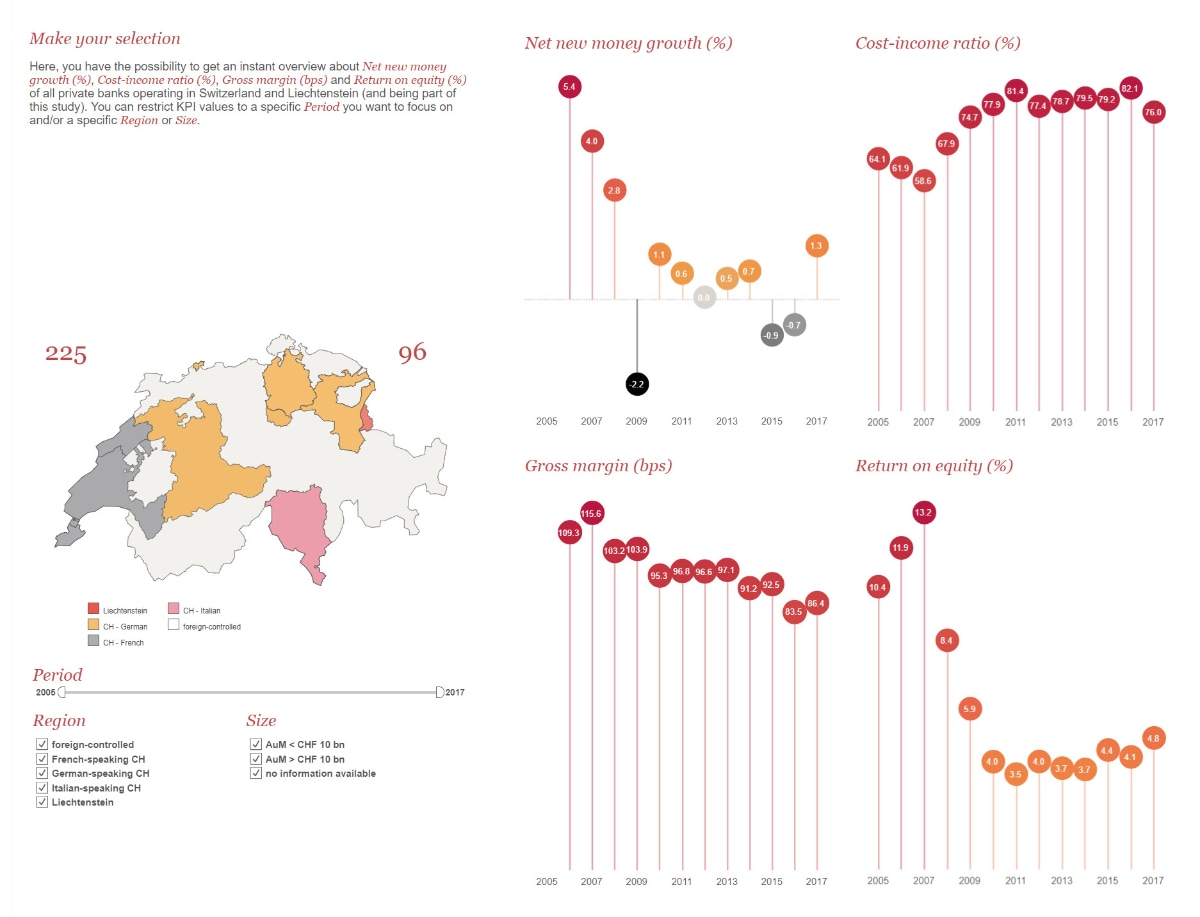

Demo of the Private Banking Tool

This presentation provides you with a sample of the functionalities of our Private Banking Benchmarking Tool, such as the overview of the market development and the benchmarking between pre-defined target groups.