On 20 March 2019, the Federal Supreme Court announced an important decision regarding the Swiss transfer stamp tax. The court decision deals with two issues concerning the duties of securities dealers. On the one hand, it refers to the handling of the blue securities dealer’s cards and on the other hand to the proof of a direct representative relationship by the securities dealer. In this newsletter, we discuss the court decision and explain the implications for Swiss securities dealers.

General remarks on the transfer stamp tax

The transfer of ownership of taxable securities against consideration is subject to transfer stamp tax if a Swiss securities dealer is involved in the transaction, either as a contracting party or as an intermediary, and there are no exceptions.

Securities dealers for the purposes of the transfer stamp tax are generally banks domiciled in Switzerland, but also natural and legal persons who, as professional traders, trade taxable securities for third parties or mediate the purchase and sale of taxable securities (e.g. investment advisors, asset managers). Furthermore, companies and occupational pension funds, which hold taxable securities with a book value of more than CHF 10m (according to their latest balance sheet) qualify as securities dealer. The Stamp Duty Act defines taxable securities mainly as bonds, shares and units in collective investment schemes.

1. Decision on the blue securities dealer’s card

A core element of the transfer stamp tax is the principle of self-assessment. Securities dealers must determine their duty themselves and settle it on time. The full responsibility for correct taxation lies in the hands of the taxpayers.

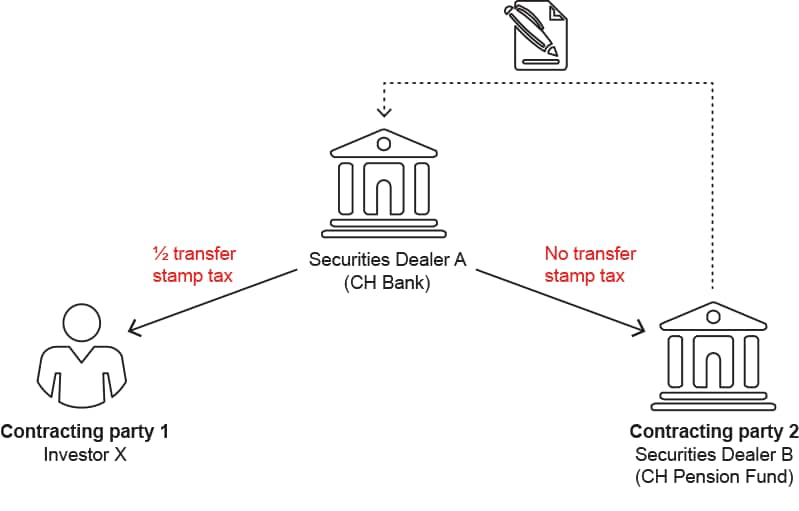

A securities dealer (hereinafter “SD A”) acting as an intermediary shall declare and pay half of the transfer stamp tax for each contractual party that is not exempted. Based on the aforementioned self-assessment principle, the securities dealer is responsible for the identification and qualification of the contracting parties for transfer stamp tax purposes. For a contracting party that also qualifies as a securities dealer (hereinafter “SD B”), SD A does not have to pay transfer stamp tax. Banks, the Swiss National Bank and central counterparties are treated as registered securities dealers without special identification. In contrast, other securities dealers (e.g. investment advisors, asset managers and companies with taxable securities of more than CHF 10m) must prove their status by submitting a blue card to SD A. The Stamp Duty Ordinance stipulates that SD B must physically hand over the blue securities dealer card to SD A in order to identify himself as a securities dealer. By submitting the blue securities dealer card, SD B formally informs that he declares and pays the transfer stamp tax itself. Consequently, SD A does not have to pay half of the tax for SD B. From SD A’s perspective, possessing a blue securities dealer card relieves it from paying half of the transfer stamp tax for SD B. This procedure is graphically illustrated in Figure 1.

The Federal Supreme Court has now ruled on the question whether a securities dealer (SD A) must pay transfer stamp tax if the contracting party is also a securities dealer (SD B, i.e. a pension fund and an insurance company), but has failed to physically hand over (on time) the blue securities dealer card to SD A.

The Federal Supreme Court has ruled as follows:

- In case a contracting party is a securities dealer (SD B), but it has failed to hand over the blue card to SD A, SD A must pay the transfer stamp tax. The fact that the contracting party is a securities dealer is not sufficient in itself to avoid payment of the transfer stamp tax. The submission of the blue card is mandatory.

- Blue cards must generally have been handed over no later than at the time the transaction is concluded. However, the court still permits the handover of the securities dealer card within three days after the conclusion of the transaction. According to the Stamp Duty Ordinance, during this period a transaction must be entered in the transfer stamp tax register. A later handover of the blue card will not be acknowledged.

2. Decision on direct representation

According to the Stamp Duty Ordinance, every person subject to transfer stamp tax must keep a transfer stamp tax register. This is required by the Federal Tax Administration to understand, with no special efforts, transactions relevant for the tax assessment.

If a person acts as a direct representative of a third party, the represented person shall be considered the contracting party for transfer stamp tax purposes. This is particularly relevant for the assessment of whether one of the contracting parties is exempted or not. In the case judged by the Federal Supreme Court, the contact person of the securities dealer SD A was an asset manager representing a foreign fund. The asset manager is a securities dealer (SD B), but had not disclosed its status towards SD A. The contracting party (i.e. the foreign fund) is an exempted party. Thus, SD A would not have to pay half the transfer stamp tax for the fund.

However, SD A has not clearly declared the direct representative relationship in the transfer stamp tax register. In the register, SD A has recorded a column named “Counterparty Name”, where he has registered the asset manager, and an additional column named “CPTY Name 2”, where he has (in certain cases) registered the foreign fund. The Court found that, in those cases where an entry was made in both columns, the Swiss Federal Tax Administration (SFTA) would have been obliged, by virtue of the principle of inquiry, to carry out inquiries and to remove the ambiguities. It would have been obliged to investigate who the contracting party was in each case. On the other hand, in those cases where the taxpayer declared only the asset manager in the transfer stamp tax register, the taxpayer is liable for this information for the purposes of the transfer stamp tax. The representative relationship is graphically illustrated in Figure 2.

Recommendation

The Federal Court decision demonstrates that the transfer stamp tax is a very formal tax and that this is also reflected in the procedural obligations. We recommend that Swiss securities dealers check the following:

- Check whether you have a blue securities dealer card from all contracting parties that you treat as securities dealers in your register and for which you accordingly do not pay transfer stamp tax. (This does not apply to the following contracting parties, which are recognised as securities dealers even without the blue card: banks, the Swiss National Bank and central counterparties).

- Check how you treat direct representation relationships (e.g. fund manager as representative for a fund) in your transfer stamp tax register. It is recommended that the contracting party can be unambiguously identified and that you have appropriate documentation available to substantiate the contractual relationship.