On 8 November 2018 the Joint Consultation Paper concerning amendments to the PRIIPs KID was published by the ESA outlining their suggestions for amendments to the PRIIP regulation.The focus of the Working paper lays on the enhancement of the user-friendliness of the KID by including new visualization and simplifications of the performance scenarios. In addition, new calculation methodologies for performance scenarios, market risk measures, and the holding period are suggested.

Beside these major suggestions the Joint Consultation Paper (JCP) addresses how to proceed with the temporary exemption for management and investment companies and persons advising on, or selling, Undertakings for Collective Investments in Transferable Securities (UCITS) from providing Packaged Retail and Insurance-based Investment Products (PRIIP) Key Information Document (KID). The temporary exemption ends 31 December 2019 with no clear guidance on the time thereafter.

Furthermore, the JCP addresses a proposed change to the current methodology and visualization approach for performance scenarios; proposes changes to the methodology of MRM calculation for Category 2 and 3 PRIIPs; further details on the recommended holding period (RHP) of auto-callable products; and the summary risk indicators (SRI).

Finally, the JCP also addresses potential alignments with Undertakings for Collective Investments in Transferable Securities (herein “UCITS”) in light of the potential end to the current exemption from producing a KID. In the absence of legislative changes, from 1 January 2020, UCITS and relevant non-UCITS funds will be required to draw up and publish both a PRIIPs KID and UCITS KIID.

All in the JCP recommended changes are subject to the ongoing public consultation. At this time the ESA have opted only to address the most pressing issues to ensure the changes can be implemented seamlessly before the end of 2019. This JCP is to be viewed independently of other co-legislators currently discussing potential legislative changes.

Next steps

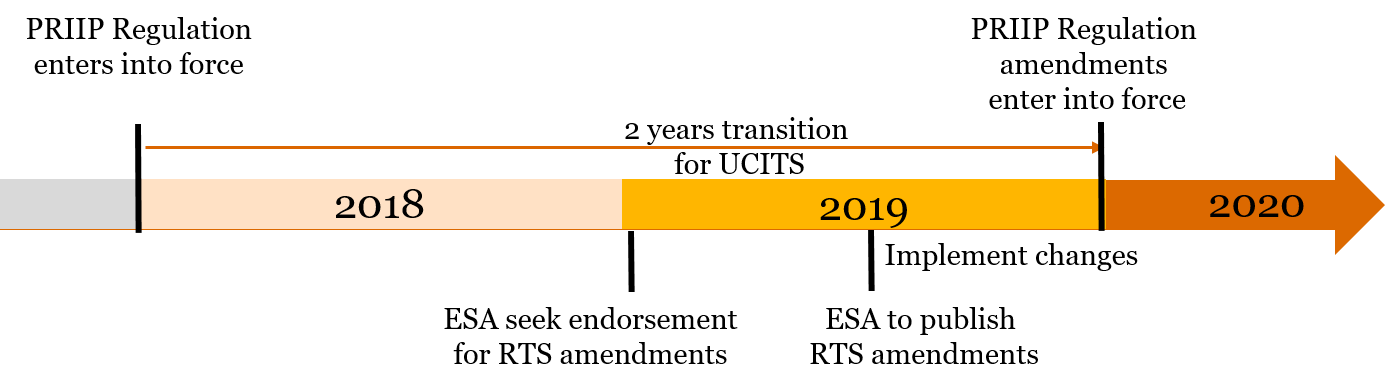

Once the public consultation is completed, ESA will consider the feedback received. In January 2019 ESA intends to submit the RTS and cost benefit analysis to the European Commission for endorsement, as well as publish a final report on the feedback.

The amendments would apply from 1 January 2020, with the finalization of the RTS including the corresponding feedback round by the European Commission and Parliament to be concluded by the second quarter of 2019. Such provides PRIIP manufacturers and persons selling PRIIPs with a minimum of six months to implement any necessary changes.

Background

Regulation (EU) No 1286/2014 on PRIIP is applicable since 1 January 2018. This regulation requires PRIIP manufacturers to produce and maintain a KID, which provides the retail investors with the key points, risks and costs of the product allowing the comparison of similar products by various manufacturers. The KID is required to be a three pages document in simple language and in a standardized format.

However, first results from the usage of PRIIPs KID showed a non-harmonized approach across various manufacturers and a multitude of shortfalls regarding the consumer friendliness of the presentation of the information. As such, a review of the PRIIP Regulation is ongoing. Due to the deferral of the original application of the Regulation by one year, the time period for the scheduled review was shortened, which has direct implications on the review process.

The proposals made in the JCP are limited to address the most urgent issues and facilitate the possible use of the KID by UCITS and the relevant non-UCITS funds.

End of the UCITS exemption

The JCP considers whether changes are required to the PRIIP Delegated Regulation (RTS) in light of the end of the UCITS exemption.

Several provisions in the PRIIPs Delegated Regulation concerning PRIIPs offering a range of options for investment are directly linked to the exemption for UCITS and relevant non-UCITS funds. Therefore, the expiry of that exemption would necessitate the deletion of these provisions in Articles 12, 13 and 14 of the PRIIPs Delegated Regulation.

Changes to the Performance Scenarios

The PRIIP Regulation requires PRIIP manufacturers to include assumptions regarding potential performance scenarios in the KID. The current methodology requires an illustration of four different scenarios: stress, unfavourable, moderate and favourable, which generally are derived based on the returns or price, and fluctuations therein, over the previous five years.

Particularly, as the past five years have shown positive performance of many asset classes, PRIIP manufacturers and sellers, as well as associations representing retail investors have raised concerns that these performance scenarios provide inappropriate expectations.

Methodology Amendments

Basing the calculation for future performance on historic real market data, enables to illustrate the actual behavior of a product in real market environment and can help investors to assess the volatility of the product. The varying performance scenarios provide the retail investor with a possible range of returns for future performance of both the product and the investment manager.

For products for which no actual past performance exists, meaning structured UCITS or other structured PRIIPs, the values to be used in the calculation may be based on the past performance of the underlying assets. The JCP makes two proposals on how to simulate such an approach.

Similar issues arise for insurance-based investment products (IBIPs) and Category 4 PRIIPs, where many assumptions to generate past performance figures are required to fulfil the future performance scenario calculations. Here the JCP recommends to follow the approach used for the UCITS KIID.

Another proposition is to extend the historical period used to measure the performance scenario from five to ten years. At this time, such an inclusion would diminish the overall positive performance, as the data would include the performance of the financial crisis of 2008-2009. In future, the impact may be negligible, as market cycles can last for more than 10 years and an introduction of this requirement would no longer include the last market downturn if introduced in 2020.

Visual Amendments and Narrative

Feedback from consumer testing rounds showed that the most effective way for retail investors to understand and compare the information provided is through simplicity in the presentation. As such, the JCP proposes to change the visual presentation and certain calculation methodologies of the performance scenarios including additional information. These measures should support the understanding of the KID performance scenario for retail investors.

Furthermore, the inclusion of additional narratives is recommended, to ensure retail investors understand that the scenarios are based on simulations and that the explicitly state of future performance cannot be accurately predicted. Additionally, the JCP proposes to reduce the number of displayed performance scenarios from four to two focusing on the stressed and performance scenario. This measure could enhance retail investors understanding of the KID by providing them with a clear range of possible outcomes. These measures were suggested as market research has shown that retail investors and other readers of a KID assume the moderate scenario to be the most likely performance outcome for a product.

Such a reduction of performance scenarios would be of questionable practicality for Category 1 PRIIP, as for these products only four estimates are made, rather than a multitude of possibilities based on random simulation. It also limits the overall information given to retail investors to assess different outcomes. Amendments to the visual presentation of performance scenarios are proposed regardless, to either use a modified table or graph for user-friendliness and simplicity.

Changes to the Market Risk Measure (MRM) Calculation

A strong comment by trade bodies representing PRIIP manufacturers has been that the current calculation method for MRM only applies to single investment or premium products. However, there is uncertainty regarding the approach to be used for PRIIPs with regular investor payments, such as regular premium insurance-based investment products (IBIPs). The current MRM formula for Category 2 PRIIPs cannot be applied if the invested amount accumulates over time, while the methodology for Category 3 PRIIP requires percentiles to be estimated and a bootstrapping simulation. Accordingly, the JCP recommends amendments to the MRM calculation formulas for both Category 2 and 3 PRIIPs. While the JCP acknowledges that there are some differences in the risk profile between single and regular payment products, they recommend taking a similar approach between the same products offered in single or regular payment form.

Changes to the Recommended Holding Period (RHP) - Products with an autocallable feature

Autocallable products end at different times depending on market circumstances. The SRI calculation currently depends on the effective holding period using annualized figures. The implications regarding the presentation performance scenarios at different holding periods currently is not addressed in the general rules, which has led to a non-harmonised application amongst manufacturers. However, the autocallable feature is insufficiently taken into account in this calculation and in the narrative of the KID.

Thus, it is proposed to include narratives to facilitate the understanding of this product feature and ensure a consistent approach by PRIIP manufacturers. Where a product is called or cancelled before the end of the RHP according to the simulation, performance would be shown at the intermediate holding periods (IHP) up to the call or cancellation, thus using the effective holding period to calculate the average annual return. Where it is called or cancelled outside of the IHP the performance at the call or cancellation date would be shown at the subsequent holding period.

Additional topics addressed in the JCP paper include the extending of the narrative surrounding the SRI. Trade bodies representing the manufacturers of PRIIPs have expressed concern that the SRI in isolation may mislead retail investors as the SRI does not capture all material risks. Here an extension of the narrative is recommended. Furthermore, additional flexibility of the text regarding the prescribed narrative for the disclosure of performance fees is to be considered, to allow for the range of different performance fee structures to be appropriately reflected. Finally, the usage of an assumed performance of 3% is proposed for the calculation of the reduction in yield (RIY). Other minor amendments will be included in the RTS to clarify or correct minor technical or specific issues.

Key Takeaways

- A final report addressing all relevant changes is expected to be published by the end of the second quarter 2019. The amendments are expected to apply from 1 January 2020.

- Methodology amendments are suggested regarding the illustration of the actual behavior of a product in the real market environment. (E.g. extension of the historical period; for structured products taking the underlying assets as an basis if no historical data is available)

- The KID was described to be subject to visual amendments, face a reduction of the provided performance outcome scenarios as well as the inclusion of a narrative to ensure that retail investors gain a better understanding of the product.

- The JCP recommends amendments to the Market Risk Measure calculation formulas for both Category 2 and 3 PRIIPs taking into consideration differences in the risk profile between single and regular payment products.

Stay tuned and always up to date with the #PwCLegalsRegulatoryRadar. Register here for PwC Legal's Regulatory Radar: https://store.pwc.ch/en/service/regulatoryradar