Digital transformation is currently a much-discussed topic in many organisations, particularly in the financial services sector, and many organisations have made digital transformation an integral part of their business strategy.

They are either planning to implement or have already implemented emerging technologies (e.g. blockchain, big data analytics, the Internet of Things, cloud computing, artificial intelligence, augmented/virtual reality, drones, etc.) to be able to meet changing customer expectations, boost their business performance, and create a business advantage over competitors. The implementation of emerging technologies encompasses a whole range of new and digital risks, it will therefore inevitably change the behaviour of organisations in terms of how many and specifically what risks they are willing to take.

Digital transformation affects risk appetite

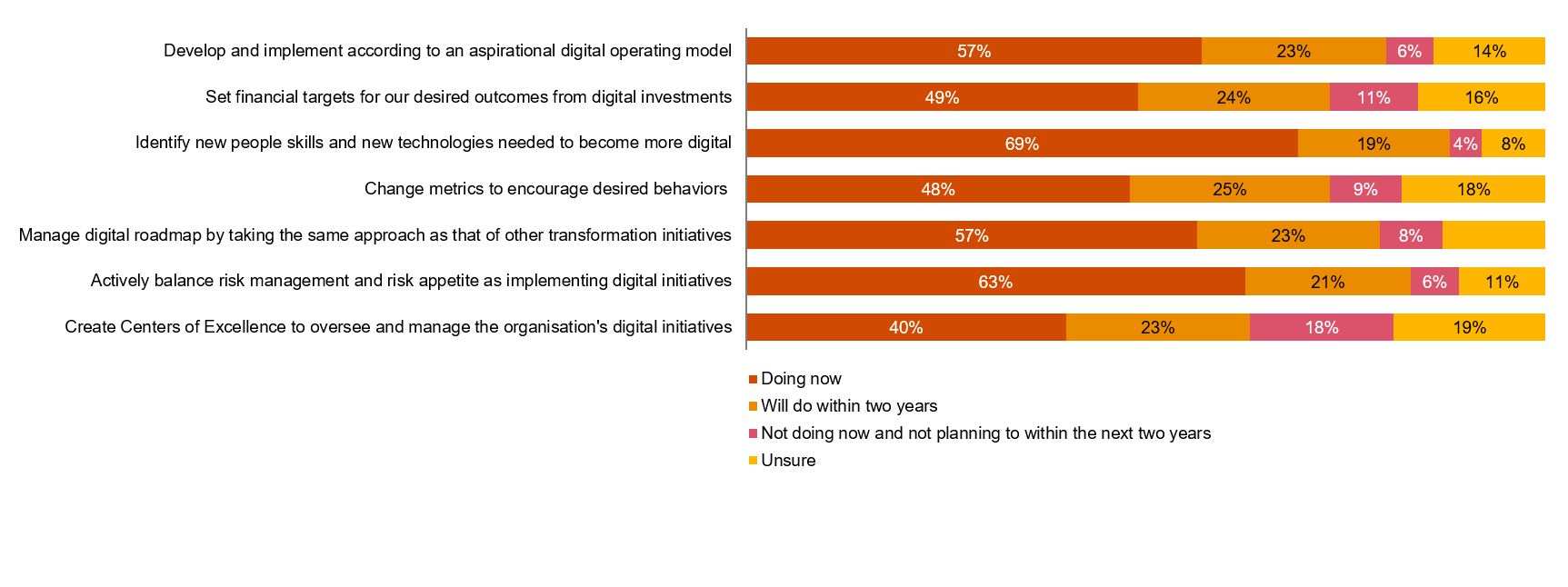

The ‘PwC 2019 Risk in Review Study’ discloses that 63% of organisations globally are actively balancing risk management and risk appetite during the implementation of digital initiatives. A total of 21% are planning to do so within the next two years.