Economic crime remains a persistent threat

Over seven thousand respondents completed PwC’s 2018 Global Economic Crime Survey, including 101 respondents from Swiss organisations. And the results are surprising. Despite a number of recent high profile fraud cases our survey suggest that the problem isn’t proliferating in Switzerland – only 39% of our respondents reported that their organisations experienced fraud within the last 24 months.

But bribery and corruption are increasingly on the radar. In 2018, 27% of the Swiss respondents reported that they had been asked to pay a bribe, up from 9% in 2016. In addition one in five respondents (20%) believe that their firms lost an opportunity to a competitor who paid a bribe.

Additionally the examination of the survey data reveals that the financial impact of fraud on Swiss respondents has been significantly higher than the financial impact observed globally. The mean direct loss attributable to each incident of fraud in Switzerland was almost CHF 10 million - more than five times the global figure. This may be due in part to the size of the Swiss economy and the prominence of banking and financial services sector.

Fighting fraud with eyes wide open

While the lower fraud level reported in Switzerland may be due to an effective legal framework and law enforcement system, it could also reflect a temptation for organisations to overestimate the effectiveness of their systems and controls.

Only one in three (33%) Swiss respondents performed a general fraud risk assessment over the two-year survey period which is substantially less than respondents globally (54%). Against this backdrop there’s a considerable risk that economic crime will go unnoticed and unreported, especially if an organisation doesn’t have access to management reporting concerning fraud.

Fraudsters down but not out, and moving quickly with the times

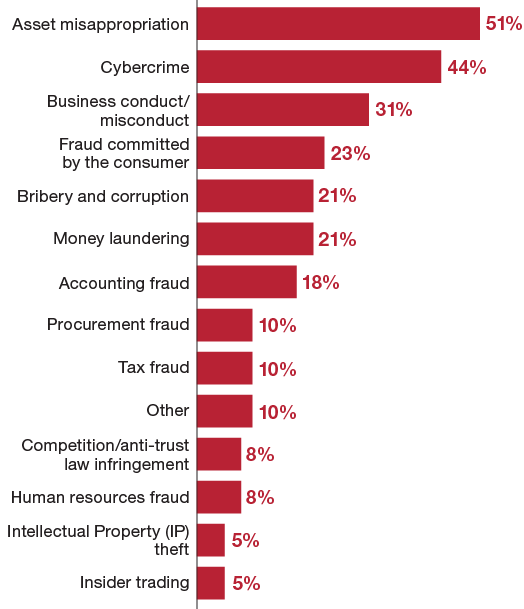

Whilst the 2018 survey illustrates a gap between the reported levels of fraud in Switzerland and globally, the fraud landscape in Switzerland did not depart significantly from that observed globally. In the past 24 months, the two highest number of reported fraud types in Switzerland (and globally) were asset misappropriation (51%, 45% globally) and cybercrime (44%, 31% globally).

Unlike other types of fraud, cybercrime is a means to commit other types of fraud rather than being a stand-alone offence. Three in ten Swiss respondents suffered disruption to their business processes after having been the victim of a cyber-attack. More than a quarter of Swiss respondents (28%) were a victim of extortion and more than a fifth (23%) reported that a cyber-attack was used as a conduit to commit asset misappropriation against their organisation.

Efforts have to be more intelligent and better coordinated

Only 54% of Swiss respondents have an operational cybersecurity programme, 5% below the global average and 7% below the average for Western Europe. Overall the global survey reveals serious blind spots when it comes to recognising the specific risks of fraud and economic crime.

Based on our results we can suggest four golden rules of effective fraud prevention:

- Recognise fraud when you see it

- Take a dynamic approach

- Harness technology

- Invest in people, not just machines

Contact

Partner and Forensic Services and Financial Crime Leader, Zurich, PwC Switzerland

+41 58 792 17 60

Ralf Baumberger

Partner, Forensic Services, TIS and Global Client Partner United Nations, Zurich, PwC Switzerland

+41 58 792 17 63