In its third edition, PwC’s Sports Survey collected the views of 470 sport industry leaders on a wide variety of trends that are prevalent in today’s market. This annual report captures the industry’s collective wisdom on its growth prospects and the key threats it is facing. Additionally, it features three deep dives assessing the future of the sports media landscape, how to drive ROI through sports sponsorship going forward, and how to approach the fast-growing space of esports.

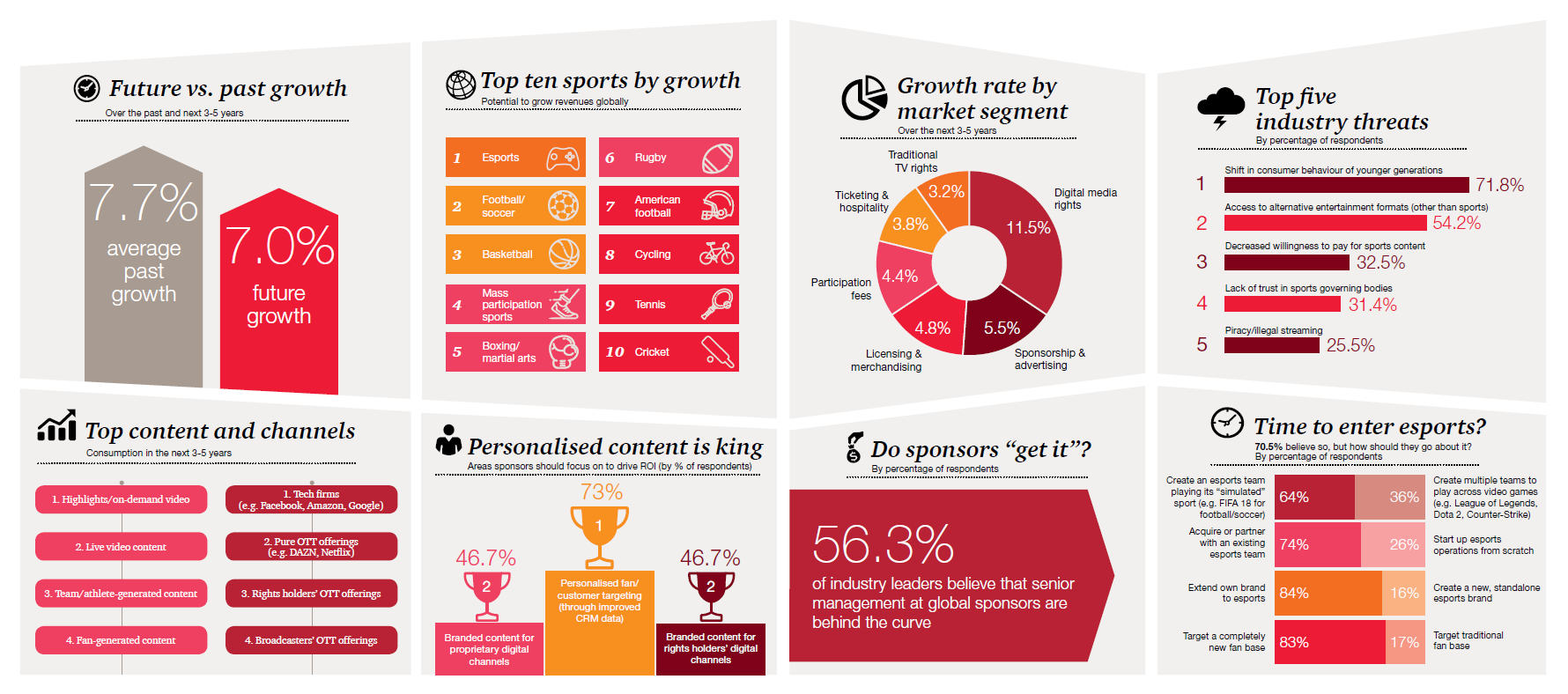

Sports industry leaders expect the sector’s growth to continue at a healthy rate of seven per cent annually over the next three to five years. However, growing concerns over shifts in consumer behaviour among younger generations have led to less confidence in sustained growth during the transition to digital. The consumption of highlights is expected to grow faster than live sports content, and the ability to target fans through personalised content will be a top priority. Furthermore, traditional sports can no longer ignore esports and should devise a clear strategy to enter the space. These are some of the key findings of the 2018 edition of PwC’s Sports Survey.

"In the face of intensifying competition from alternative entertainment formats, brands and rights holders need to wake up and smell the coffee. We are fast approaching a tipping point where digital will overtake linear in terms of media consumption, and so sports content will need to find creative ways to appeal to fans that are 'digital first' in order to maintain their attention."

Are highlights overtaking live?

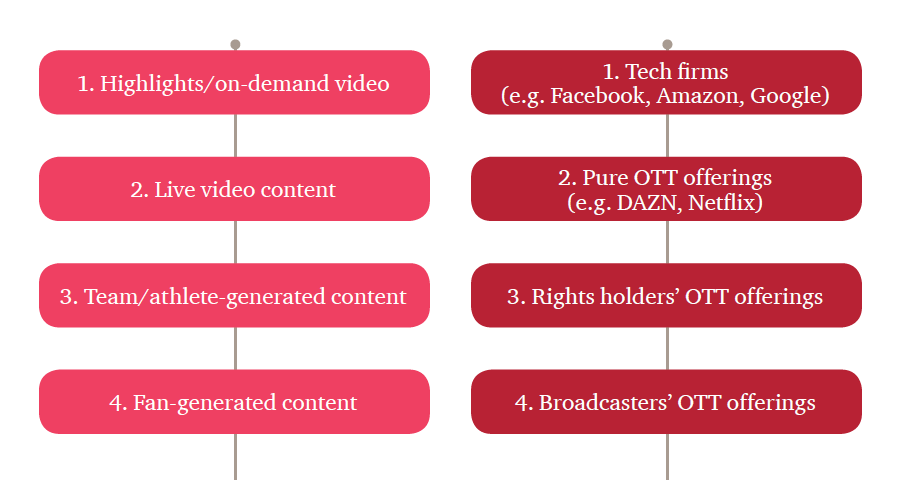

Given the seemingly irreversible transition from linear to digital media consumption across the board, we predict the consumption of non-live sports content to grow at an accelerating pace relative to live going forward. This clearly underlines the importance of offering fans appealing content to engage with before and after, as opposed to just during, sporting events.

It's all about the fans!

When asked where sponsors should be focussing their energy in the next three to five years to drive higher returns, nearly three quarters of sports leaders chose personalised fan/customer targeting through improved CRM data. By contrast, over half believe that senior management at global sponsors either do not, or only partially appreciate the shift in consumer behaviour with regard to sports media.

Time to enter the esports arena?

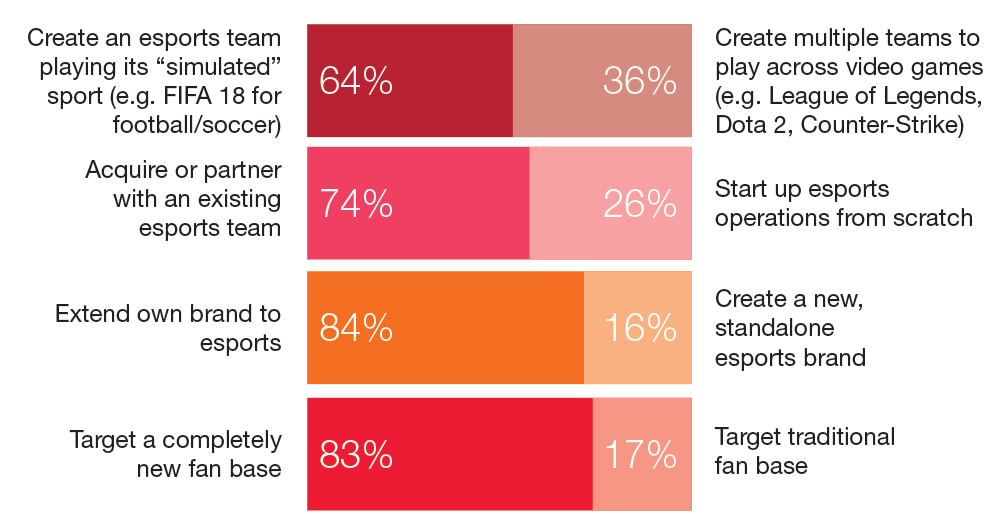

Esports is now perceived as having the highest potential to grow revenues globally among sports disciplines, with perennial powerhouses football and basketball in close pursuit thanks to their ongoing efforts to continue growing their respective sports internationally. The bullishness around esports may explain why 70.5 per cent of sports leaders see it as necessary for traditional sports to develop a strategy to enter the space, where they can learn most in terms of fan and community engagement.

Contact us

Reto Brunner