Given the volume and value of dealmaking going on in this space, we wanted to get to know the market better ‒ and specifically the deals going on closer to home in Germany, Switzerland and Austria (GSA). To do this we analysed the last decade’s transactions in these countries and asked 30 bank executives for their views on accessing FinTech assets.

Here are the four main takeaways of our analysis of deal data in the GSA region:

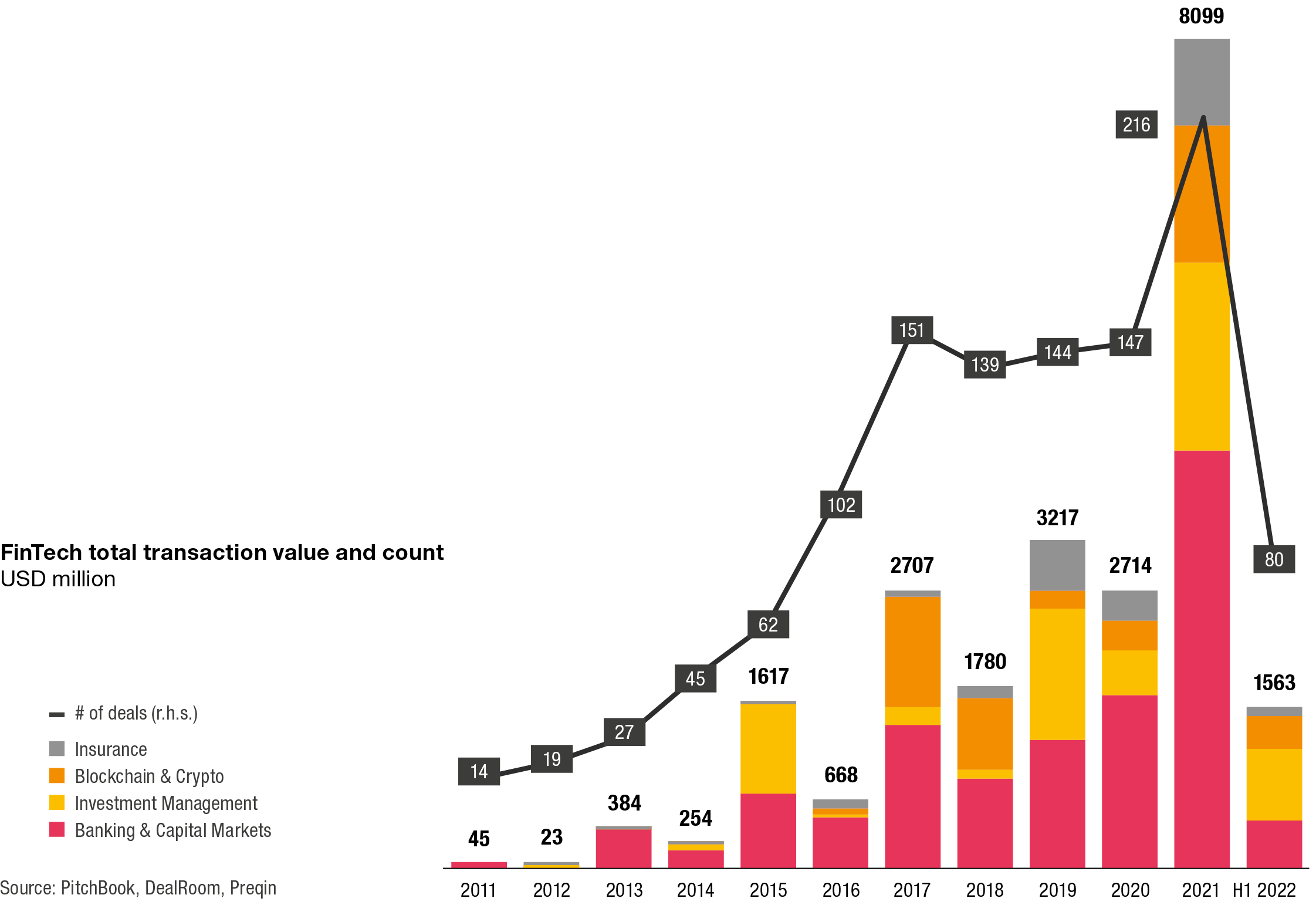

- Deal activity is accelerating, with 50% of total deal value observed in the last 2.5 years

- Median transaction deal value was up from USD 1.3m in 2016 to USD 6.5m in 2021

- Blockchain is emerging as an industry and is predicted to continue to attract strategic investments in the mid to long term

- Between 20% and 25% of FinTech investors are strategic investors, up 2.7x in the last decade

And here are the four main takeaways from our survey of banks in Switzerland and Liechtenstein:

- All categories and sizes of banks are interested in FinTech investments, with larger and mid-sized banks taking the lead

- Banks interested in FinTech investments lack a clear strategy and internal know-how

- The preferred option for either acquiring technology or developing a new business model is a minority investment in a European-based revenue-generating WealthTech or blockchain company

- FinTechs are used as a means of enhancing the product offering and/or improving distribution channels

Are banks making the most of the opportunities in a booming market?

To learn more about the FinTech deals space in Germany, Switzerland and Austria, download the full study by clicking on the link below.

Development of the market and involvement of strategic investors

The value and number of FinTech transactions went stratospheric in 2021, although things slowed considerably in the first half of 2022. Strategic investors started off fairly hesitantly in this space, but have steadily accelerated their involvement and become bolder in their investments and acquisitions.

Are wealth managers keeping up with progressive clients?

6 key learnings for today's new normal

Appetite for FinTech, but lack of clear strategy

Of all the banks interviewed, 45% ‒ and the majority of medium-sized and large banks ‒ had already invested in FinTech in the past. All types of banks are interested in FinTech, from retail, private and cantonal banks to dedicated online and digital asset banks. Around two-third of banks say they’re not looking to invest in FinTech in the near term; most are waiting for the market to mature further or are building in house capabilities. Another significant finding of our research ‒ also suggesting an opportunistic approach ‒ is that not all banks that intend to invest in FinTech have a formal, documented FinTech strategy. Those that do have one tend to be dedicated niche players (for example focusing on crypto) or medium-sized to large players that make no secret of their affinity for FinTech. In light of the fact that 84% of financial services companies worldwide claim to have a formal FinTech strategy (according to PwC’s latest FinTech report), the figures for Germany, Austria and Switzerland suggest this region has some catching up to do in terms of adopting a clear strategy.

Dealmaking preferences

Our research indicates that the preferred approach to accessing FinTech is via minority investments and partnerships. This suggests that many banks are taking an exploratory approach to FinTech and trying out smaller stakes in several assets to see how they pan out rather than making larger FinTech acquisitions. Most are also fairly conservative in terms of preferring revenue-generating FinTechs with functioning business models as opposed to early-stage start-ups (an option considered by only 20% of our sample). Most are also looking fairly close to home for opportunities in the European market. None said they were considering targets in the US.

Most banks see WealthTech and blockchain/crypto ‒ which are capital-light and promise high margins ‒ as the most attractive FinTech verticals to invest in. InsurTech, lending and payments/billing are seen as the least interesting vertical options.