{{item.title}}

{{item.text}}

{{item.text}}

Insurtech is here to stay, with mergers and acquisitions as well as growth financing targeting the sector on the increase. How is the M&A scene evolving? What are the motivations for deals? Who’s behind them? What are the prospects going forward? In the first edition of our Insurtech Deals Market Insights we take a look at Insurtech transactions globally through September 2021, with a specific focus on interest from European investors in this segment, the areas of the insurance value chain that are attracting the most capital, and the challenges that investors need to consider when valuing such businesses. In the process we come up with some valuable insights. On this website you’ll find some of the key takeaways.

Insurtech investments globally have been increasing year on year, with over 2700 transactions reported since 2016. This resulted in a compound annual growth rate (CAGR) of around 15.7 % for the five-year period through 2020. Assuming an annualised growth rate with no seasonality effect, growth of an additional 18 % is anticipated through Q4 2021. This all indicates that Insurtech deals are currently on a strong trajectory. Many top executives from (re)insurance companies and industry experts see the trend continuing into 2022 and beyond. The growth of the market is driven by most incumbent carriers’ desire to digitise every area of the value chain, as well as by new market players and entrants that are taking advantage of innovation to get a foot in the door.

Insurtech investments by European investors ‒ basically mirroring global developments ‒ are expected to double in volume in 2021 versus 2016, with 269 transactions (118 in 2016) expected to close. A total of more than 1100 transactions have been observed over the past six years, with a total reported deal value of USD 22.3bn.

European investors display a strong affinity with investments in Insurtechs located in Europe and North America, with 48 % and 31 % respectively. In Europe, targets have mainly been based in the UK, France and Germany.

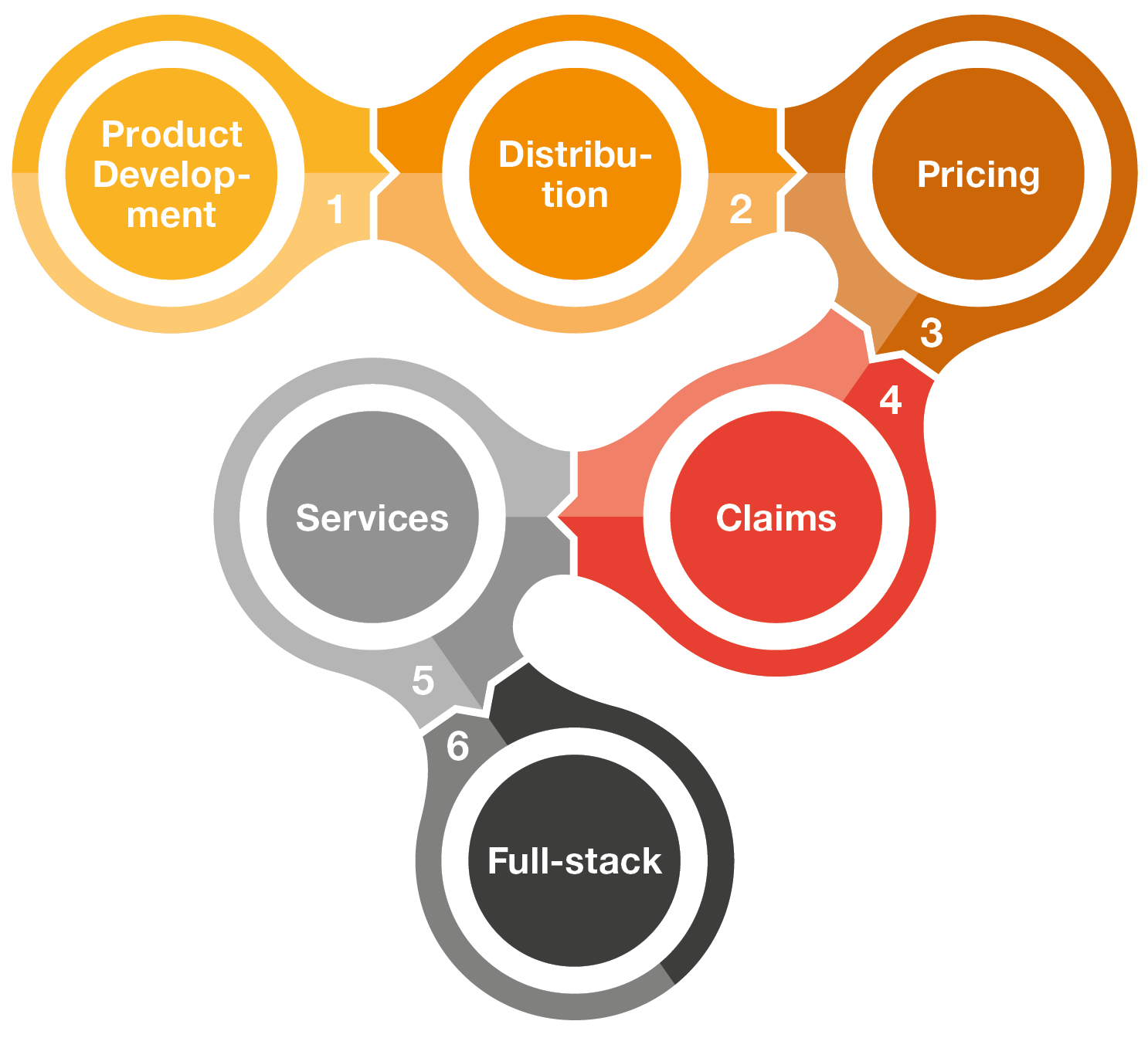

To understand where Insurtechs are focusing their efforts, we took a deeper look into the (re)insurance value chain. Insurtechs aim to generate value by reinventing or supplementing a part of the insurance value chain. We have broadly segmented the value chain into six main areas which we use as a basis for analysing Insurtech transactions of recent years.

Product development: Insurtechs create modern and customer-focused products for emerging segments (e.g. gig economy and freelance workers) or attaching insurance to other product sales.

Distribution: Insurtechs seek to improve the customer experience at the point of sale by aggregating quotes, providing tailored advice or offering more streamlined binding.

Pricing: Insurtechs often use big data, AI and IoT devices to improve the accuracy of policy pricing.

Claims: Insurtechs generally use technology to quicken the claims closure rate and improve communication with the claimant.

Services: Insurtechs can offer additional benefits to a carrier’s insureds, such as risk management services or financial advice.

Full-stack: Insurtechs are developing solutions that extend across the entire value chain.

Insurtech M&A activity has remained buoyant despite the pandemic. Driven by (re)insurers’ growing interest in building or augmenting their capabilities along the value chain to remain relevant in the market, European investors have been showing increased interest in Insurtechs. Going forward European players, both traditional and non-traditional, can be expected to maintain and increase their involvement in this sector, targeting much of their investment at US-based Insurtechs, particularly those focused on developing capabilities in services.

“We have seen Insurtech investments propel companies ahead while accelerating their digitisation journey. Ensuring that you have the right strategy and access to opportunities in the deal markets is critical to successfully staying ahead in today’s ever-evolving digital age.”

In Q1 2022 we’ll be publishing a deep dive focusing on Swiss-headquartered (re)insurers and their digitalisation journeys, as well as their approaches to partnering with Insurtechs to access promising technologies and capabilities.

#social#

Christoph Baertz

Partner, Leader Financial Services Deals, PwC Switzerland

Tel: +41 79 598 71 83

Bernice Van Rensburg

Director, Financial Services Deals, PwC Switzerland

Tel: +41 79 618 95 46

Senior Manager, Sustainability Leader for Deals Financial Services, Zurich, PwC Switzerland

Tel: +41 58 792 26 46