Transport and logistics deals are on the rebound

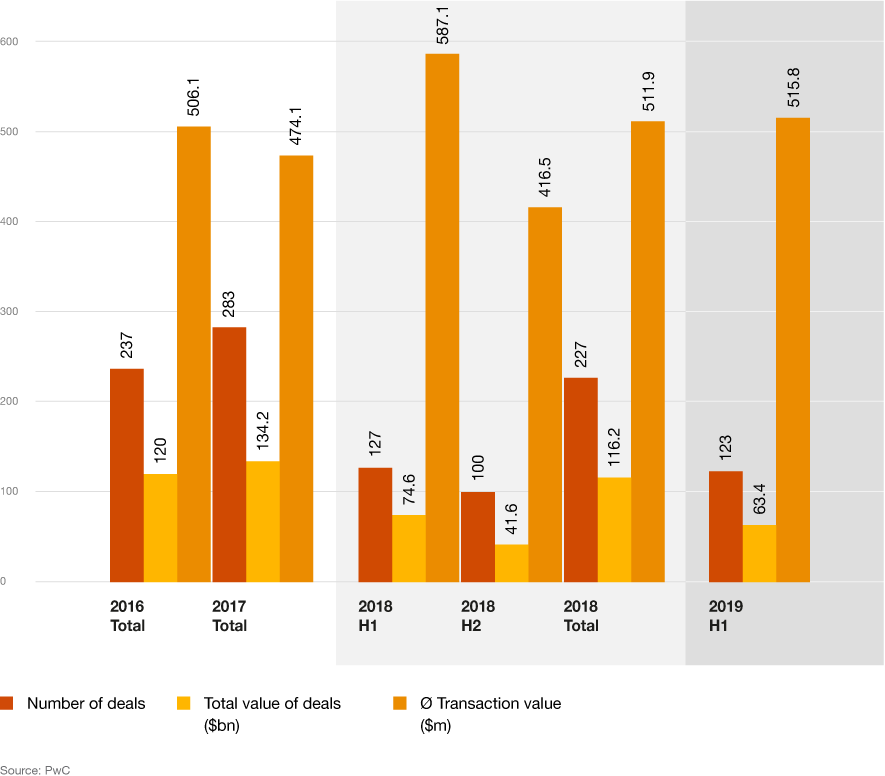

With 123 mergers and acquisitions in the first half of 2019, the transport and logistics industry is recovering from the weak second half of 2018, in which only 100 deals were announced.

The total value of transactions also increased considerably, rising from $41.6 billion in 2H2018 to $63.4 billion and thus reaching the average value of the last five years.

Blackstone megadeal dominates

The lion’s share was generated by Blackstone’s megadeal (value > $1 billion): the US investor bought urban warehouse assets for $18.7 billion. In 1H2019 a total of 12 megadeals were announced. Of those, six targets were in North America, three in Europe and just one in China (or rather Hong Kong). A full five deals were in infrastructure. Buyers are still focusing on a small number of high-priced objects, primarily in infrastructure, railway and port companies. In other subsectors, prices have dropped back to 2010 levels; the sales multiple is only 1.1.

While deal activity in China has plummeted, and Europe is still in the midst of a slump, the USA remain stable and South America is surprisingly active in terms of mergers and acquisitions. These are the results reported by PwC in their semi-annual analysis of global M&A activities in the transport and logistics industry.

"Transactions in the transport and logistics sector recovered in the first half of 2019 despite a number of uncertainties. The US-China trade dispute, tensions concerning Iran and Turkey, the impending Brexit, and even rising tariffs didn’t slow activities down. The level of deal activity in the transport and logistics industry is relatively high in comparison to other industries. This can be explained by the rising importance of logistics in times of e-commerce, but also in part to the fact that investors are acquiring infrastructure targets to equip themselves with longer-term and large capital commitments to weather an uncertain future."

Port terminals remain attractive investment targets

Three of the 12 megadeals announced in the first half of the year were in shipping or port infrastructure. Even in times of uncertainty, port terminals remain attractive assets for infrastructure funds, financial investors and other institutional investors due to their size and the stability of investment returns. Australian infrastructure investor Macquarie was involved in two megadeals which are representative of the industry as a whole: Macquarie sold its container terminal DCT Gdansk in Poland for $1.32 billion and strategically relocated its port operations to the US by acquiring the Long Beach Container Terminal (LBCT) for $1.78 billion.

E-commerce driving logistics and trucking

In terms of the number of transactions, the logistics and trucking sector, with a 37 percent share, once again came out on top in the first half of the year. The main driver is still the demanding logistics requirements of e-commerce, which is leading to consolidation and cross-border measures. Accordingly, the biggest deal of the first half of 2019 – financial investor Blackstone’s acquisition of an investment portfolio of urban warehousing – also took place in this segment. DSV also caused a stir with its bid to take over Swiss Panalpina for $4.66 billion. This would be one of the most significant consolidation deals in the history of the European logistics and trucking industry and could become a catalyst for activities in the next half year.

Transactions on hold in Europa, slumping in China, stable in USA

Continuing uncertainty about the impending Brexit is partly responsible for the small number (23) of mergers and acquisitions in Europe in the first half of 2019, as was already the case in the second half of last year. Only two deals targeted companies in the UK, and British investors participated in five European transactions. However, total deal value – mainly driven by three megadeals – remained relatively high at $54 billion.

In China, both the number and value of deals plummeted in the first half of 2019. Chinese deals accounted for some 40 percent of international mergers and acquisitions in 2H2018, but that figure is now at 26 percent. The liberalisation of the Chinese economy could prompt deal activity to pick up again in the medium term, but this crucially depends on how the trade dispute with the United States evolves.

In contrast to China and despite trade conflicts as well as mixed signals concerning its own logistics market and a dramatic rise in logistics costs, the USA remained on a solid level of 24 deals, four more than in the last six months.

Cautious optimism for the second half of the year

Looking at the upswing in deal activity in the first half of the year, it is likely that 2019 will see the market rebound from the low point it reached in 2018. But activity will probably not surpass the record numbers of 2017. In the next six months, further infrastructure deals in South America are expected, since a total of ten deals were already announced in H1 – as many as in the entire previous year. In addition to infrastructure, objects related to e-commerce, such as warehouses and courier, express and parcel services, will remain attractive targets for investment.

"Whether and how long the current pace of M&A activities will last depends on the political environment: if solutions to trade conflicts and political uncertainties still don’t emerge in the second half of 2019, buyers could once again become more risk-averse, which would have a negative effect on M&A activity."

Contact us

Gabriele D'Achille

Director, Consulting and Head of Transportation and Logistics, PwC Switzerland

Tel: +41 58 792 76 64