{{item.title}}

{{item.text}}

{{item.text}}

After the uncertainties of 2023, dealmaking in the technology, media, and telecommunications (TMT) sector is set to grow again in 2024, supported by abundant private equity capital and pent-up demand for deals. The focus will be on strategic deals and maximising deal value. And what about developments and perspectives in Switzerland?

In 2023, global deal values in the TMT sector remained lower compared to previous years. Factors contributing to this decline include tighter monetary policy, inflationary effects, geopolitical tensions, and changing regulations. Furthermore, valuations in the TMT sector are more sensitive to interest rates than other industries, leading to a wider valuation gap between buyers and sellers. Looking ahead in 2024, optimism surrounds TMT dealmaking, driven by increased certainty in respect of interest rates, record levels of private equity (PE) capital, pent-up demand for transactions, and advances in generative AI.

We expect significant M&A activity in several key sectors. The software industry continues to attract investor interest, particularly from PE firms, which now account for around two-thirds of all software transactions globally. Despite a dip in deal volume and value in the second half of 2023 due to economic and financing challenges, the reliable recurring revenues of software make it a standout for continued dominance in technology dealmaking.

Meanwhile, the telecoms sector is undergoing transformational consolidation and netco (network company) models, which separate infrastructure ownership and operation from service provision, are re-emerging (more details here). This trend towards greater cost synergies, which is particularly pronounced in Europe, is attracting alternative capital, presenting significant opportunities for strategic investors and private equity.

The streaming services sector is also poised for consolidation. The end of the writers’ and actors’ strikes in the US brings less uncertainty about costs and more predictability in content production. Improved data analytics on consumer preferences will allow the streaming platforms to further refine their operations. Combined with an ecosystem ripe for consolidation, this suggests that streaming companies will be looking for strategic partnerships in the near future.

Click the tabs to view the chart and commentary for each region.

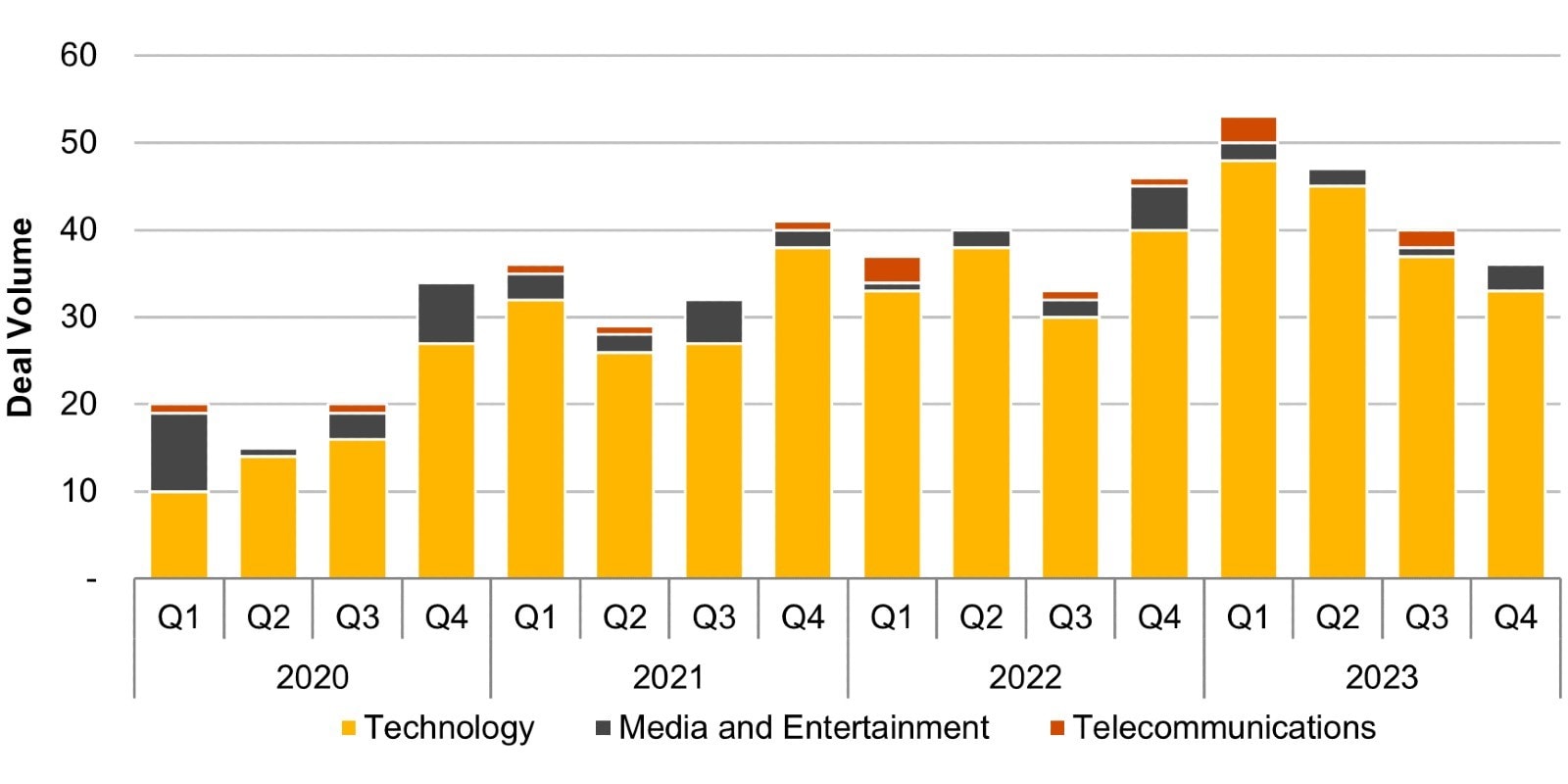

In the first half of 2023, global M&A activity in the TMT sector reached a new high of around 8500 deals, surpassing the previous high of 8400 deals in early 2021. However, the second half of the year saw a 31% decrease in deal volume compared to the first half, with deals falling below 6000. Overall, 2023 witnessed a 1% year-on-year decline in deal volume and a 44% drop in deal value, reflecting smaller deals and lower valuations. In addition, the number of TMT megadeals fell significantly from 42 in 2021 to 24 in 2022 and 11 in 2023.

In 2023, 85% of the deal volume in TMT M&A came from the technology sector, with software deals accounting for three-quarters of deals. It’s expected to remain a key M&A area in the midst of digital transformation. The largest deal in 2023 was Cisco’s proposed US$28bn acquisition of Splunk, reflecting the high value of the sector. In addition, 67% of TMT leaders plan to use M&A to accelerate technology adoption, according to PwC UK’s Value Creation Transformation Survey.

“In 2024, maximising the value of each transaction will be a key success factor of M&A, even more so given the higher cost of capital.”

Vincent LuescherDirector, Deals Technology, Media & Telecommunications, PwC SwitzerlandIn 2023, private equity significantly influenced software M&A, being behind two-thirds of the deals, highlighted by major acquisitions by Silver Lake and Blackstone. Software companies will continue to pursue acquisitions to gain new capabilities and enter new markets in 2024, despite a general focus on cost reduction and AI investments.

The IT services sector faces challenges in 2024 due to delayed implementation of new IT programmes amid economic uncertainties, which is likely to impact M&A activity. We expect areas such as IT service management, cybersecurity, and DevOps to perform well, potentially driving M&A activity in these segments. The impact of generative AI on IT services is mixed, offering productivity improvements and competitive advantages, but also challenging existing business models, such as in software testing. Despite the investment buzz around generative AI, dealmakers may be reluctant to invest until they get a clearer picture of the situation.

Semiconductor M&A in 2024 will be influenced by regulatory and geopolitical challenges, as evidenced by thwarted deals such as those of Nvidia and Sai MicroElectronics. This environment is expected to continue, impacting deal structures, and limiting international megadeals. Furthermore, the sector is prioritising supply chain resilience and strategic portfolio adjustments in response to chip shortages and global disruptions, favouring organic growth over acquisitions. Companies such as Intel are considering divestitures, and IPOs of certain businesses serve to streamline operations and focus on core strengths.

The post-pandemic demand for live events and immersive experiences is driving growth, highlighted by the success of concerts, blockbuster movies (Barbie, Oppenheimer), and the impact of celebrities such as Taylor Swift and Beyoncé on the US economy. Bloomberg Economics estimated that together, the above two artists’ tours and the two US blockbusters contributed US$8.5bn to US growth in the third quarter of 2023. Spending in the entertainment and media sector, including film, TV, music, sport events, and gaming, is expected to increase by 4.2% in 2024, according to PwC’s Global Entertainment & Media Outlook 2023–2027.

This experience economy is attracting investment from private equity, sovereign wealth funds, and corporate investors focused on the potential for economic impact and consumer engagement. Intellectual property is seen as a key asset for creating engaging consumer experiences, while technologies such as geospatial analytics are being targeted for M&A to enhance event experiences and profitability.

Telecom operators are using M&A to transform their businesses in the face of inflationary pressures, capital constraints, as well as higher financing costs and competition. They are seeking economies of scale and synergies to develop the 5G networks that customers are demanding. The sector is focused on efficiency, scale, freeing up cash, and attracting investment. Notable strategies include in-market consolidation, as seen in mergers such as Vodafone/Three in the UK and Orange/Masmovil in Spain, which may also facilitate new market entries.

There’s also a trend towards separating network companies (netcos) to optimise capital allocation and achieve scale, with significant transactions in several countries. Telecoms are also divesting non-core services to simplify their operations and fund necessary investments, alongside a push to consolidate digital infrastructure (infraco), including tower and fibre operations, to maintain competitiveness and financial strength.

Overall, Switzerland’s share of global TMT deal volume has increased from 0.7% in 2020 to 1.2% in 2023, illustrating the attractiveness of the Swiss technology sector. In FY23, the total number of TMT deals involving Swiss targets reached a new record high of 176 deals, compared to 156 deals in 2022, 138 deals in 2021, and 89 deals in 2020. And while deal volume decreased in the second half of 2023 (–24%), the decrease remained lower than the global decline in deal volume (–31%), reflecting the high resilience of Switzerland’s TMT M&A market, particularly in a global macroeconomic environment affected by headwinds.

Comparing Swiss industries, TMT remains the most active sector in Switzerland, accounting for more than 33% of total deal volume in 2023 (up from 29% in 2022), followed by industrial manufacturing and the healthcare and pharma sector.

Within TMT, the technology sub-sector remains the main driver of M&A activity, accounting for 92% of deals in the second half of 2023. This is partly due to the density of technology players active in Switzerland, particularly in the software sector, but also because software companies’ valuations have seen less of a correction over the past 12 months than other technology sub-sectors, such as IT services. Furthermore, the subscription-based business model of software companies and their more predictable recurring revenues and cash flows make them very attractive, especially for financial investors.

Some of the most significant TMT deals (based on published deal values) included:

In terms of buyer profile, the trend towards private equity buyers continued in 2023. Almost two-thirds of the Swiss TMT deals were triggered by private equity (or private equity-backed) companies. Notable examples include the acquisition of Proffix Software, a developer of ERP solutions for SMEs, by Forterro UK (a portfolio company of Partners Group) and the acquisition of bytics Group, a specialist in cloud solutions, by Arcwide of the Netherlands (partly owned by IFS, a portfolio company of EQT).

The above examples also highlight the continued attractiveness of the Swiss TMT market for foreign acquirers, as they were involved in 64% of TMT deals in Switzerland. Looking the other way, there were several significant Swiss TMT buyers that expanded their international operations through acquisitions outside of Switzerland:

As valuations readjust after macroeconomic and geopolitical uncertainty slowed M&A activity in the second half of 2023, there is a notable optimism surrounding dealmaking in the TMT sector. This is driven by advances in generative AI and other emerging technologies, increased certainty regarding interest rates, unprecedented levels of capital available for private equity, stabilising valuation levels, and a palpable demand for dealmaking. As a result, we expect the TMT sector to further consolidate its leading position when it comes to M&A activity in Switzerland in 2024.

{{item.text}}

{{item.text}}

Vincent Luescher