{{item.title}}

{{item.text}}

{{item.text}}

From 2018 to 2020, most private and retail banks in Switzerland were able to increase their business volume. However, only large private banks seem to understand how to capitalise on their size and generate substantial economic profit. This is reflected in a significantly higher average operating return on their regulatory required equity compared with their peers. Although retail banks in general have struggled to create sizeable economic value, they have been very resilient over the last few years despite the challenging market environment.

Despite the pandemic, in 2020 large private banks posted strong results thanks to their global footprint and diverse service offering, achieving a cluster-accumulated average operating RORE significantly above the other clusters. Medium-sized banks, by contrast, saw their operating RORE deteriorate from 2018 to 2020, largely owing to lower operating income margins. Small private banks also saw operating RORE decline in 2020.

Every volume cluster in the retail banking industry saw relatively stable RORE from 2018 to 2020, but returns were lower in 2020 because of declining income margins. In fact, governments’ responses to COVID-19 have lowered interest rates even further, putting more pressure on retail banks’ core return from interest activities and leading to a general decline in net interest margin.

Although private banks generally operate a balance-sheet-light business with fewer risk-weighted assets than their retail counterparts, medium- and smaller private banks have failed to exploit the advantage in terms of RORE and clearly have room for improvement in this respect. There is strong scale dependency in the private banking sector, whereas no similar effect can be observed in the retail banking industry, since comparable returns are achieved across all volume clusters.

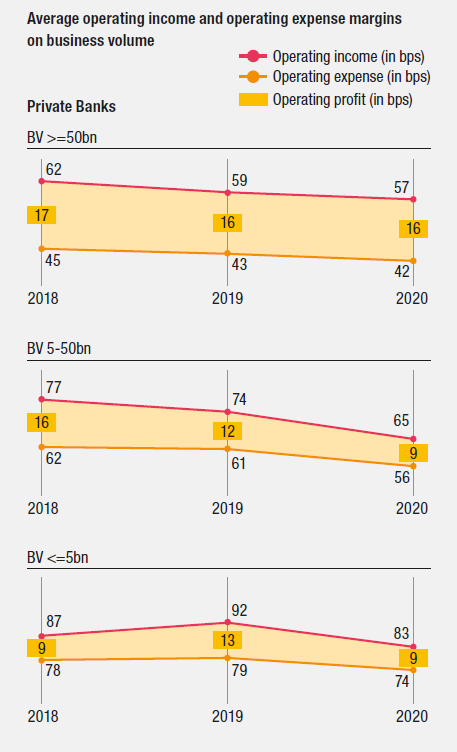

In both the private and retail banking industry, institutions with large business volumes generally had lower operating income (OIC) margins than medium- and small-sized banks over the three years observed. This is due to a higher proportion of institutional and corporate clients, who generally yield lower margins than private clients. Small private and retail banks in particular have been able to achieve higher average operating income margins because they mainly focus on a private clientele.

In general, the average OIC margin relative to business volume declined from 2018 to 2020 in all clusters. In both private and retail banking this was mainly due to even lower interest rates amid the uncertainty of COVID-19. Commission and trading income margins at private banks were fairly stable.

Smaller banks in particular have seen higher personnel costs as part of their OPEX margins relative to their business volume than large banks, in both the private and retail segments. There is a clear difference in the cluster-accumulated average OPEX margin between medium-sized private and retail banks. Medium-sized private banks have posted significantly higher OPEX margins, whereas in retail banking the difference between large and medium players is only small.

Overall, retail banks are able to generate higher operating profit margins on their business volume. This benefit, however, is offset by the higher capital requirements that eventually lead to lower operating RORE.

See further operating margin breakdowns for retail banks in the full report.

Unlike retail banks, private banks have only a small portion of their business volume tied up in the lending business, which is merely an add-on to traditional private banking activities, such as Lombard lending.

Small and medium-sized private banks reported a significantly higher RWA density than large private banks over the observation period. One key aspect of the higher capital consumption of small- and medium-sized banks is their higher loan penetration.

Besides the positive scale effects, the lower average RWA density is an additional reason why large private banks outperform in terms of operating RORE.

Retail banks, due to their focus on the lending business, have a significantly higher RWA density and are required to hold more regulatory required equity capital than private banks. Smaller retail banks have much higher RWA densities than their large and medium-sized peers, primarily because a higher proportion of their business is tied up in lending, whereas large- and medium-sized peers have a more diversified business model including off-balance-sheet wealth management.

Private banks have a lower RWA density than retail banks, but only large private banks can turn lower capital consumption into a superior operating RORE. The fact that small and medium-sized private banks are less efficient erodes the benefits of lower capital consumption.

"Merely large private banks generated significant value for their shareholders, whilst other private and retail banking clusters only achieved limited value generation over the last few years. Thus, they have to adjust their business models to improve their performances going forward."