{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

Dr. Sebastian Klotz

Manager, ESG and Digital Technology, PwC Switzerland

Oliver Hulliger

Senior Manager Customs & International Trade, PwC Switzerland

Do you operate in the European Union (EU)? Do your operations rely on products such as aluminium, cement, electricity, fertilisers, iron and steel, hydrogen, precursors or certain downstream products such as screws, bolts etc.? Do you source these products from outside the EU?

If your answer to these three questions is yes, then the Carbon Border Adjustment Mechanism (CBAM) will start affecting you in less than ten months. Are you ready?

Yesterday, after months of negotiations, the European Parliament and the Council of the EU finally reached a deal. As of 1 October 2023, EU-based businesses will need to report on carbon emission-intensive products imported from outside the EU. From 2026, these emissions will also need to be financially offset.

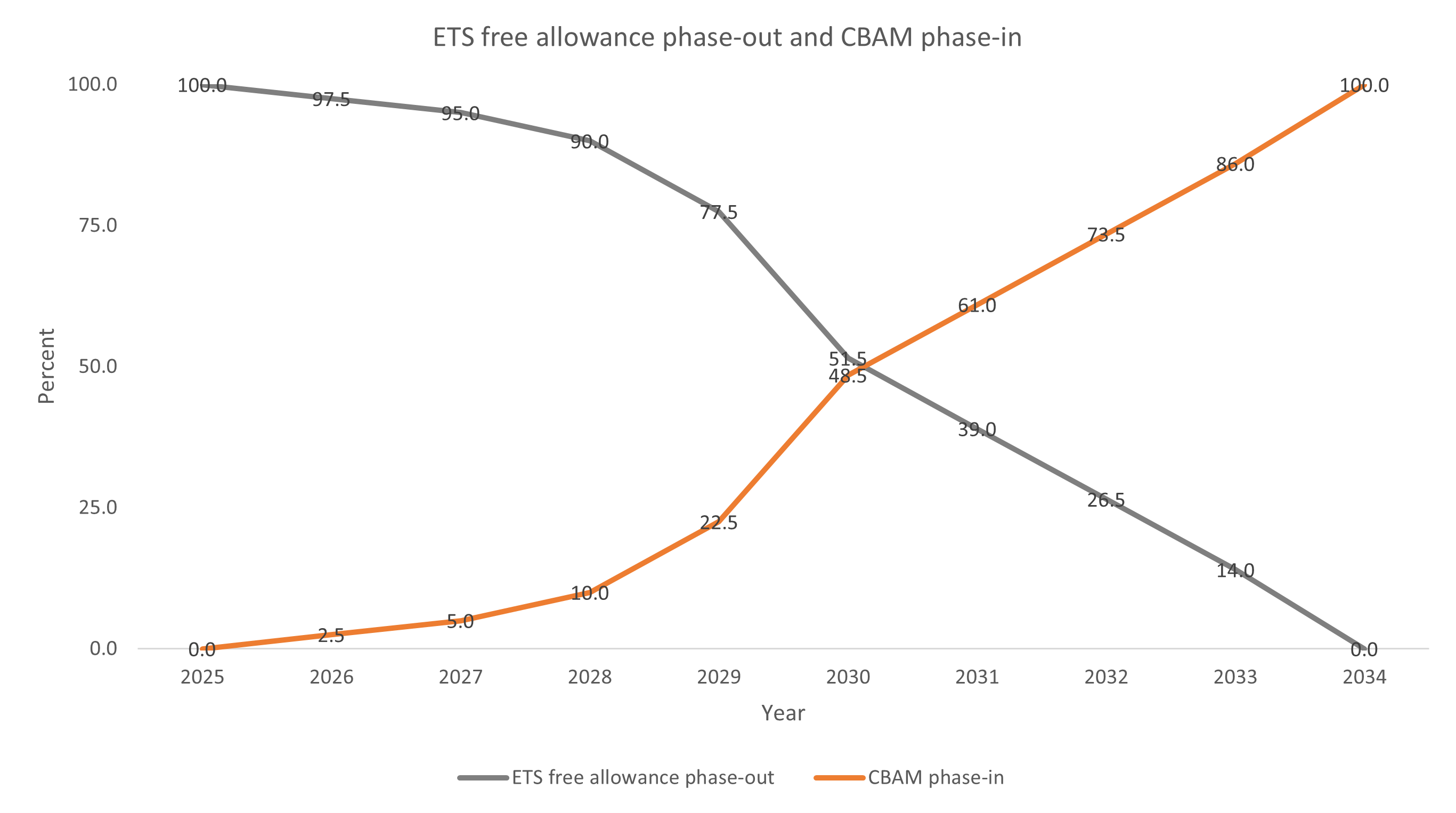

The EU’s Green Deal, launched in 2019, aims to reduce carbon emissions by at least 55% by 2030. To achieve this, the number of freely allocated emission allowances in the EU’s Emission Trading System (ETS), a cap-and-trade system established in 2005, will be gradually phased out by 2034. In parallel, the CBAM will be phased in to ensure the international competitiveness of EU-based businesses compared to businesses which are based outside the EU and which may benefit from less stringent environmental regulations. Essentially, the CBAM aims to establish a competitive level playing field by compensating for the differences in carbon prices between domestic and imported products.

Figure 1: ETS CBAM Timing

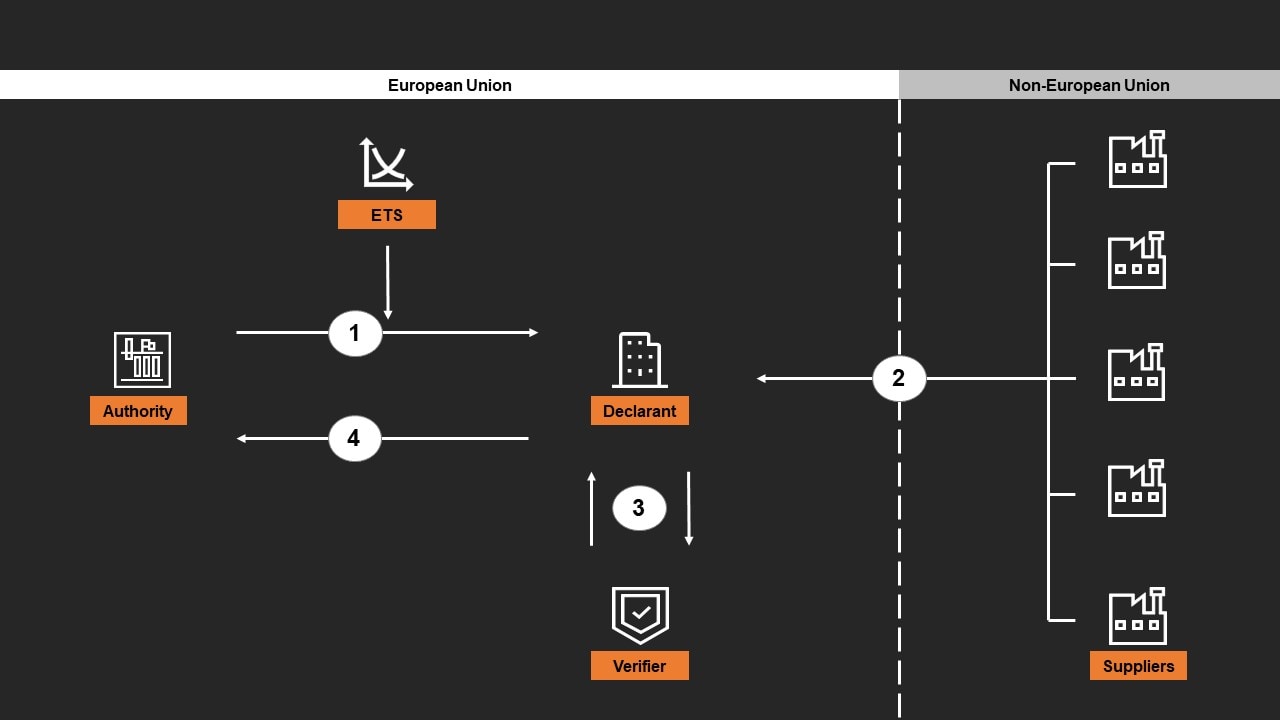

In the CBAM, so-called declarants play a central role. Once declarants have successfully applied for authorisation, they may purchase CBAM certificates to financially offset the emissions embedded in the products imported from suppliers outside the EU. The price of these certificates will mirror the current carbon price in the EU ETS and will be published by the relevant EU authority on a weekly basis. When importing CBAM-relevant products, declarants need to collect the following data:

The data collected needs to be verified by an accredited verifier and be submitted to the EU authority, along with the certificates corresponding to the embedded emissions.

Figure 2: CBAM Mechanism

The CBAM will enter into force in two stages:

The CBAM covers around 500 products from the following product groups:

This list of products is likely to be extended. Before the end of the transitional period, the European Commission will be tasked to assess whether other products, such as organic chemicals and polymers, are to be included in the fully operational CBAM. The addition of organic chemicals and polymers alone would add around 800 products to the CBAM scope. By 2030, the CBAM is supposed to cover all products covered by the ETS.

In legislative terms, yesterday’s deal reached by the European Parliament and the EU member states presents a provisional agreement which requires formal approval. As this is regarded a formality, businesses are well advised to:

Switzerland is on the exemption list from this regulation for the time being. Nevertheless, all businesses that carry out cross-border activities in the EU with products originating from outside the EU and EFTA-states are affected by the CBAM administratively and financially, either directly or indirectly.

There is less than ten months left to prepare for the CBAM. Since many details of the CBAM have now been confirmed, we encourage businesses to act now.

Please reach out to us if you’d like to learn in more detail how the CBAM will function and how it will likely affect you under different scenarios. Our product and service portfolio ranges from quantitative impact analyses to our technology-powered Carbon Pricing Reporter. Together, we’ll get you up to speed on the upcoming CBAM and ensure your smooth transition into efficient carbon emission reporting.

#social#

Simeon L. Probst

Partner, Customs & International Trade, PwC Switzerland

Tel: +41 58 792 53 51

Senior Manager | Trade, Technology, and Sustainability, PwC Switzerland

Tel: +41 79 891 22 89

Oliver Hulliger

Director, Customs & International Trade, PwC Switzerland

Tel: +41 58 792 56 96