Where is public tax transparency headed?

In the four years since we published our first Swiss benchmark study, we’ve been predicting that it’s only a matter of time before public tax transparency kicks off and is embraced by companies across the board. Has that time now come? The rapid and significant changes reflected in this, the latest edition of our Tax Transparency Benchmark study, suggest that it has.

We suspect that this will turn out to be a pivotal year in terms of public tax transparency, primarily because the EU’s public CbCR Directive takes effect and must be adopted in national legislation.

Scope and results of the benchmark study

As in the last four years, we distinguish between three different areas of disclosure: Tax Strategy and Risk Control Framework (TSRCF), Country-by-Country Reporting (CbCR) and/or Total Tax Contribution (TTC). Each area is assigned to the classes ‘Minimal’, ‘Medium’ and ‘Advanced’ according to pre-defined criteria (comprehensive information on the areas and criteria are available in the methodology section in the appendix of the study). Based on that, we have evaluated the companies’ overall public tax transparency level.

While the areas of disclosure analysed have not changed, there has been a change to the sample of companies included in the benchmark. During the transitional period this will slightly affect the comparability of the findings, but it will ensure greater consistency in the longer term.

We want the findings of the present Swiss benchmark study to be comparable with the DACH Tax Transparency Study, but we also want to preserve continuity with previous Swiss benchmark studies. In the present benchmark study, we have therefore included the 50 companies from the previous benchmark study as well as the companies featured in the DACH Tax Transparency Study (which partly overlap).

Results

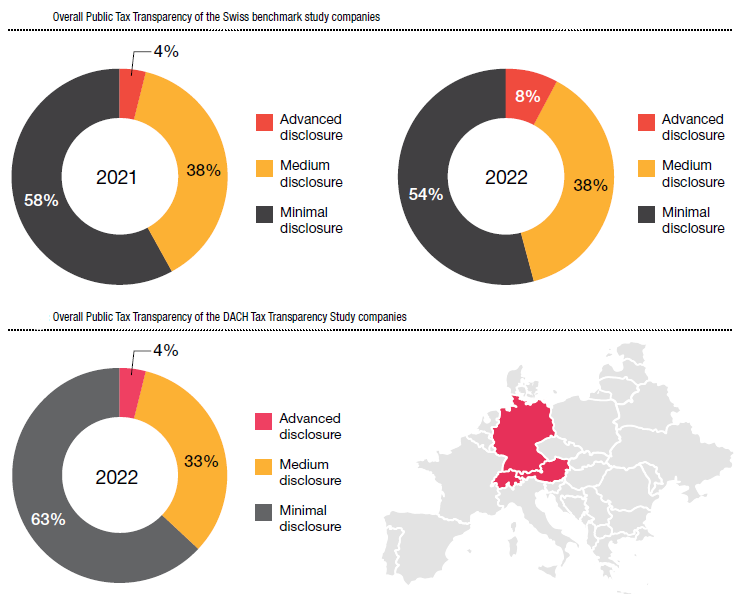

In 2022 the percentage of companies rated Advanced overall (for the same sample as in the previous Swiss benchmark studies) doubled from 4% to a much more substantial 8%. The proportion meeting the standard of Medium disclosure remains unchanged at 38%. A 4-percentage point decline in the number rated Minimal overall (down to 54%) tallies with the 4-percentage point increase in Advanced disclosers.

The new sample (DACH Tax Transparency Study companies) yields slightly different results, with 4% rated Advanced, 33% Medium and 63% Minimal (see Figure 3). There are no year-on-year comparisons for this sample. However, the figures suggest that the DACH Tax Transparency Study companies lag the Swiss study companies slightly over all levels of disclosure.

Takeaways

Our 2022 study of Swiss companies suggests that the trend towards more transparency on tax continues, both overall and across all the areas of disclosure we measure.

We suspect that this will turn out to be a pivotal year in terms of public tax transparency. Why? Primarily because the EU’s public CbCR Directive takes effect and must be adopted in national legislation. This will be a gamechanger, and not just for the EU-based companies affected by the new regulations. Swiss entities of a certain size doing business in the EU’s single market will also feel the impact. For companies in scope, Country-by-Country Reporting will no longer be optional.

Download the study for more exclusive insights

https://pages.pwc.ch/core-asset-page?asset_id=7014L000000542eQAA&embed=true

Public tax transparency benchmark study 2021

Public tax transparency benchmark study 2020