{{item.title}}

{{item.text}}

{{item.text}}

Social insurance consulting: the 4th pillar of your compliance. We support you in ensuring employer compliance with all aspects of Swiss social insurance.

Each social security system is unique and highly complex. As an employer you must perform many tasks and meet a number of obligations to comply with the social insurance requirements. This entails risks that you must deal with appropriately to avoid non-compliance and the possibility of penalties and late interest charges.

We’re committed to providing social insurance advice to reduce the complexity of the subject and make you aware of the issues. With a wide range of services, qualified experts and many years of experience in supporting employers, we help you avoid the risks and use your resources efficiently.

As an employer you’re responsible for calculating and remitting the correct social security contributions.

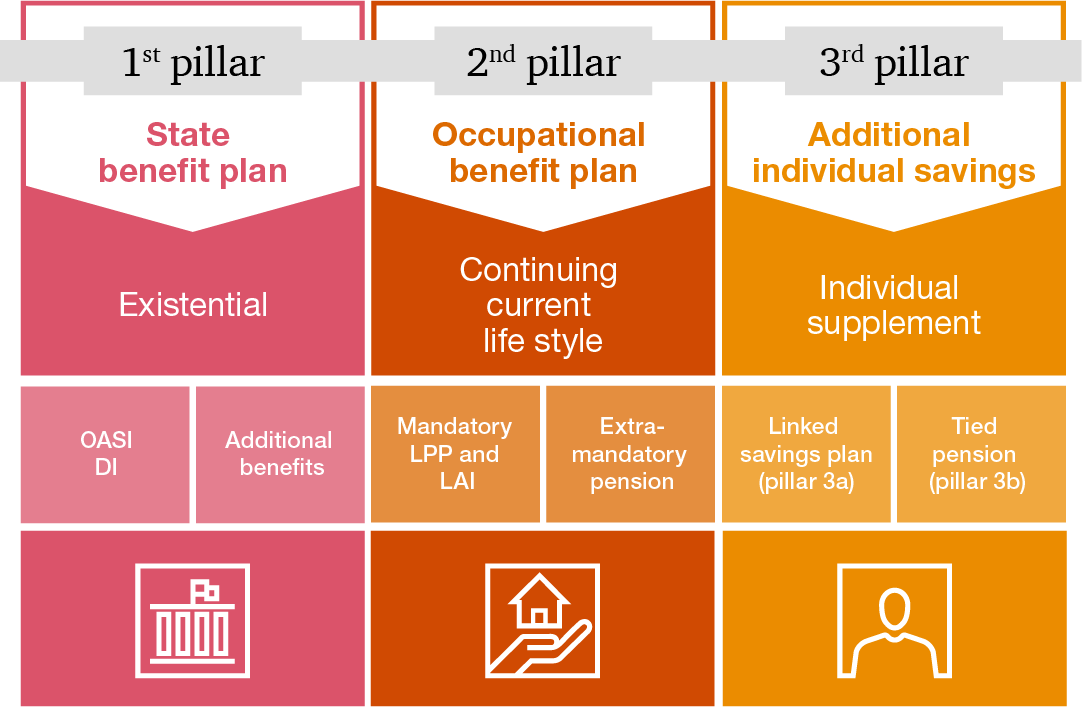

In Switzerland, provision for the risks of old age, disability and death is based on a three-pillar system. Both the first pillar and the occupational second pillar have a direct impact on your payroll. Complying with the applicable laws requires some administrative effort. In addition, changes in the law and practice must be kept in mind, preferably at an early stage. We can take care of both so that you can focus on the essentials.

In addition to advising employers on Swiss social insurance schemes, we also provide support in international situations:

International situations can include:

In such constellations, we can evaluate which social security system your employees are subject to and, if necessary, help you obtain an A1 certificate/CoC. If necessary to process social security contributions in Switzerland, we can also offer further services analogous to ANobAG or seek continuation.

In addition, we can advise you on questions around the tax implications for employees, whether in relation to withholding tax or in connection with any double taxation agreements.

Employees who temporarily work for your company in another country are subject to Swiss social security legislation during this period. Certain requirements must be met.

The complexity of accounting obligations and insurance cover for foreign assignments should not be underestimated. We’ll be happy to support you with our social insurance advice and expertise.

The dialogue with authorities and insurance companies in Switzerland is often time-consuming and complicated. We’ll be happy to help you deal with all social security issues as efficiently as possible. You can count on our active support and advice for the following issues:

{{item.text}}

{{item.text}}

https://pages.pwc.ch/view-form?id=7014L000000Q3MGQA0&lang=en&embed=true

Stephen Turley