If you have operations or investments in the European Union, the EU Anti-Tax Avoidance Directive (ATAD and ATAD II) may increase your tax burden.

ATAD (Anti-Tax Avoidance Directive)

ATAD in a Nutshell

What is it about?

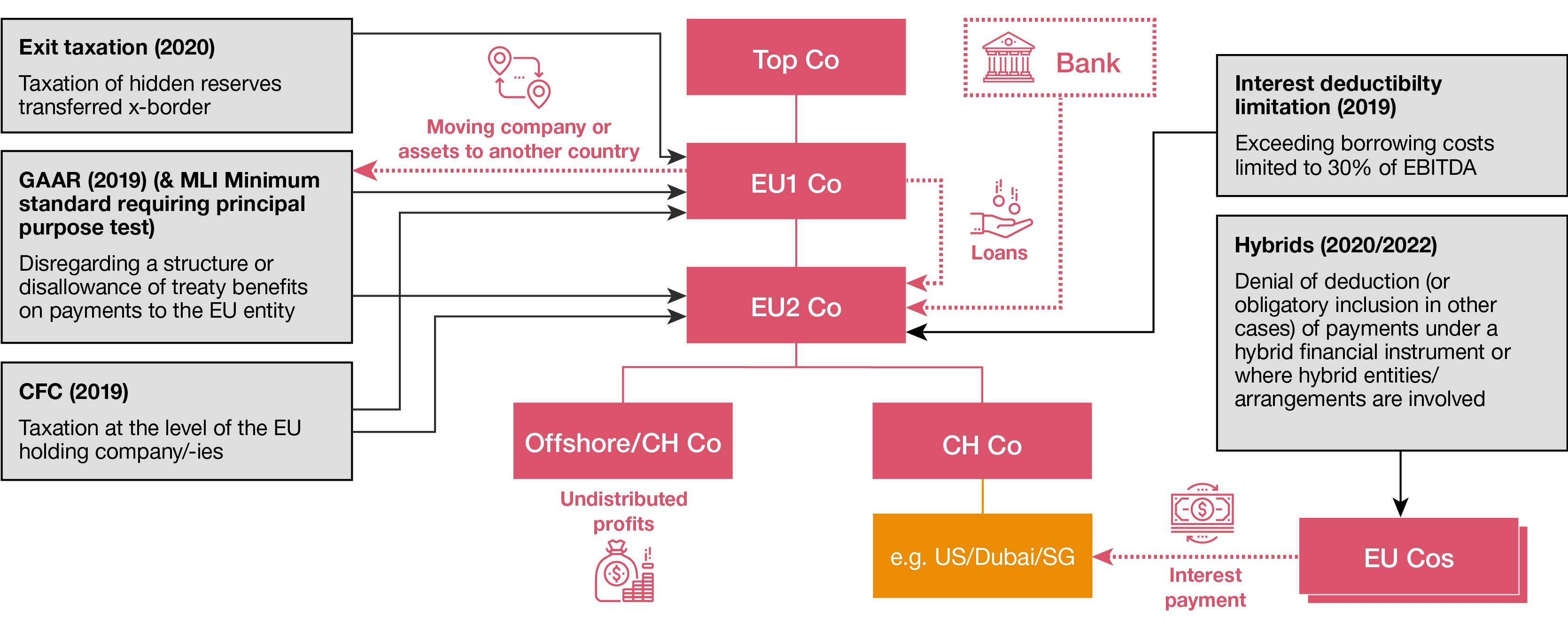

The EU Anti-Tax Avoidance Directives (ATAD I & II "ATAD") form part of a larger anti-tax avoidance package adopted by the European Union in response to the OECD's BEPS action plan.

ATAD contains the following five anti-abuse measures:

- Interest deductibility: limited tax deductibility of net financing expense

- Exit taxation: mandatory taxation of hidden reserves upon relocation of entities/assets

- General Anti-Abuse Rules (GAAR): disregarding of non-genuine arrangements

- CFC Rules: mandatory inclusion of certain types of non-distributed income of foreign subsidiaries/Pes in tax base of parent/head office

- Hybrid Mismatches: mandatory add-back (denial of deduction or requirement for inclusion) of double deductions or deductions without inclusion due to differing qualification of payments, entities, financial instruments, etc.

Importance for your company

- ATAD applies to all taxpayers (including EU permanent establishments of non-EU companies) that are subject to corporate tax in the EU.

- Most of the new rules apply as of 1 January 2019 (e.g. interest limitation rules, general anti-abuse rules, CFC rules, etc.).

- Additional rules regarding exit tax and anti-hybrid mismatch rules apply as of 1 January 2020.

- The rules may have considerable impact on cross-border transactions involving an EU entity.

Actions

- Assess whether ATAD has an impact on your group companies in the EU.

- Country-specific analysis is required since some countries may impose stricter rules or decide on earlier implementation.

Last rules (Anti-Hybrid Rules or "ATAD II") now also in place

A part of ATAD (referred to as ATAD II, in place since January 2020) is targeted at so-called hybrid mismatches which result in negative tax outcomes (double non-taxation). Hybrid mismatches are evaluated by comparing the tax treatments of entities or transactions in different jurisdictions.

Are your holding and financing structures still efficient?

The impact on multinationals with operations in the EU can be significant, especially because ATAD II may result in a denial of deductions or obligatory inclusion of certain actual or deemed payments that were so far “unproblematic” from a tax point of view.

The ATAD II analysis should not be limited to “obvious” hybrid entities and instruments but should also be done for:

- payments which are deducted in two or more jurisdictions

- payments deductible in the source (EU) state and not included (or not sufficiently taxed!) in any other state (EU/non-EU)

- allocation differences among entities/permanent establishments or partner and partnership.

The international tax landscape will continue its transformation but the general trend is obvious: Pillar 2 of the OECD’s new "Programme of Work to Develop a Consensus Solution to the Tax Challenges Arising from the Digitalisation of the Economy" aims to establish a similar system, focusing on new income inclusion rules and certain deductibility restrictions where a minimum level of tax is not achieved.

Are your investment structures still efficient?

Although the fund industry is not the main focus of ATAD II, the new rules are expected to have a significant impact where alternative asset classes are invested in Europe.

Under the new rules, interest deductions in investment countries may depend on the exact tax treatment of the same investment by each of the investors. This, in turn, means that the manager of the investment needs to know and evaluate how investors are taxed.

Therefore, the new rules are particularly relevant for the fund industry at fund and platform level, as well as from an investment structuring perspective, so it’s time to review your investment structures in order to maintain efficient tax return.

How ATAD works