As the telehealth market matures, pharma and medtech players need to understand the opportunities and challenges involved in their go-to-market.

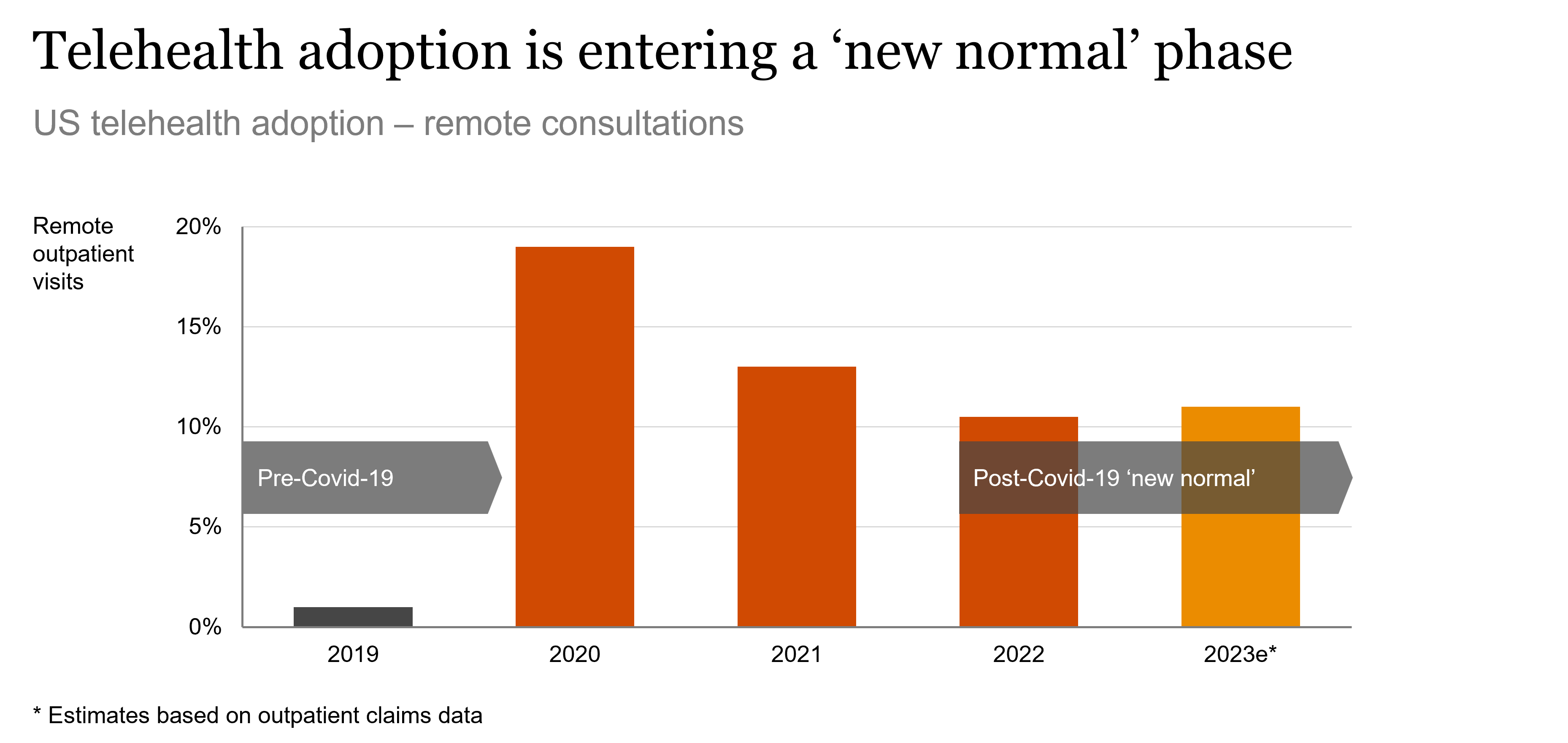

Telehealth boomed in 2020, the first year of the pandemic, largely as a result of reduced capacity and concerns about in-person consultations, as well as investors spotlighting digitalised and remote services. But with the hype cycle now past its peak, we see telehealth maturing into a ‘new normal’ phase. This is characterised by a slow but steady increase in adoption, notably for specific conditions (e.g. for mental health and non-serious acute conditions) and services (e.g. triaging and asynchronous telehealth).

Figure 1: Telehealth’s growth trajectory

Source: PwC analysis based on FairHealth.org data

The continued development of the sector is being driven by some fundamental shifts. On the demand side there are growing consumer expectations for more flexible and decentralised care models (i.e. ‘care anywhere’), and providers and payers hoping to address staff shortages and alleviate cost pressures. On the supply side, HealthTech companies are building the enabling infrastructure while regulators are updating the regulatory frameworks to support remote care delivery.

Figure 2: Factors driving the shift to telehealth

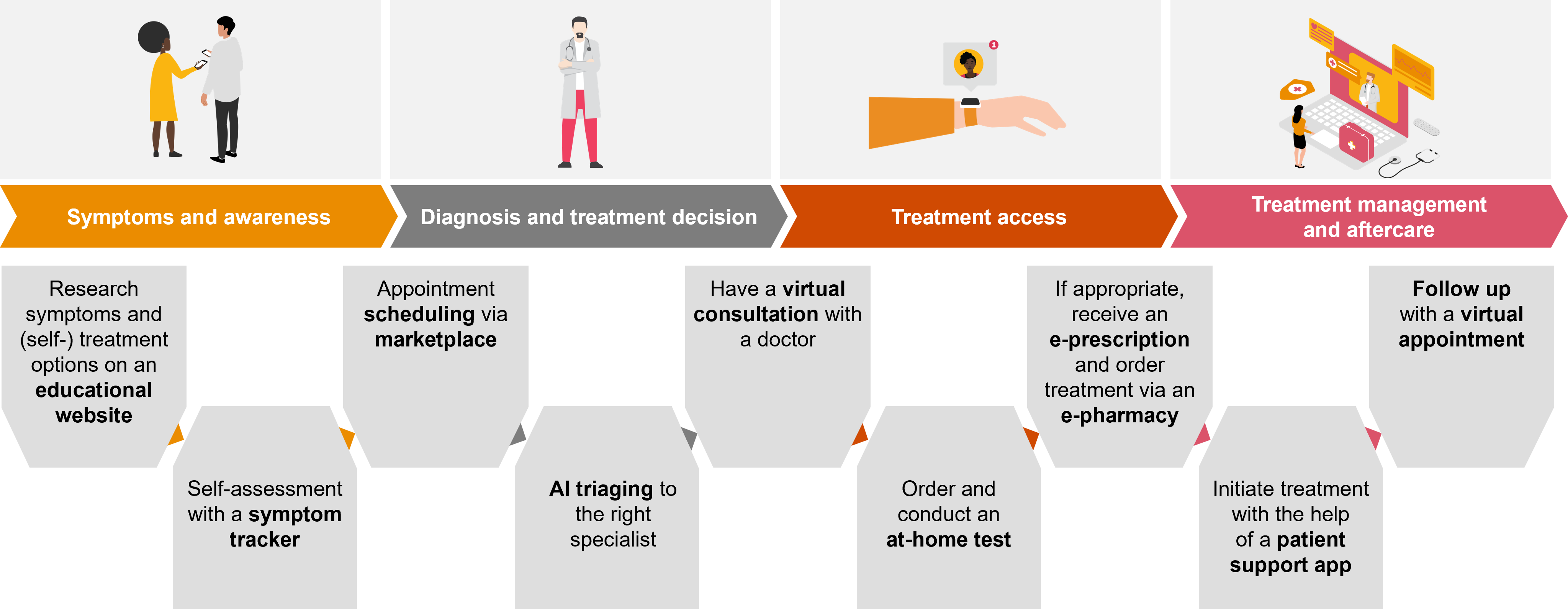

While the change is not happening fast enough for some, many patients do in fact already have access to a continuous telehealth journey (as shown in Figure 3 below). So as telehealth continues to gain traction, pharma and medtech companies need to consider two key questions:

- How do such non-traditional hybrid care models affect their go-to-market strategies?

- How to play in this highly dynamic market

Figure 3: An illustrative telehealth patient journey

Many industry players are already making moves in this new market, and there are multiple partnering initiatives underway between pharma companies and telehealth players. These range from co-promotion of over-the-counter medicines to direct-to-consumer channels that offer patients on-demand consultations.

In our analysis of these new markets, we have identified four main opportunities for pharma and medtech players. These not only mitigate potential threats to established companies from telehealth, they also enable models that will increase access to therapies and improve patient outcomes.

Figure 4: Key telehealth opportunities

Critical success factors in a telehealth strategy

The opportunities outlined above all hold considerable promise, with some players already moving forward into the implementation stage. Our work with clients in the field enables us to identify the four most critical considerations that companies need to bear in mind as they formulate their telehealth strategies:

- Get the portfolio fit right

There’s no one-size-fits-all approach. For a telehealth strategy to make the right impact, it must both address the unique challenge within the care journey as well as meet the specific needs of the company’s brand. For example, chronic and high prevalence diseases will map to different opportunities than rare, difficult to diagnose conditions. - Take a local approach

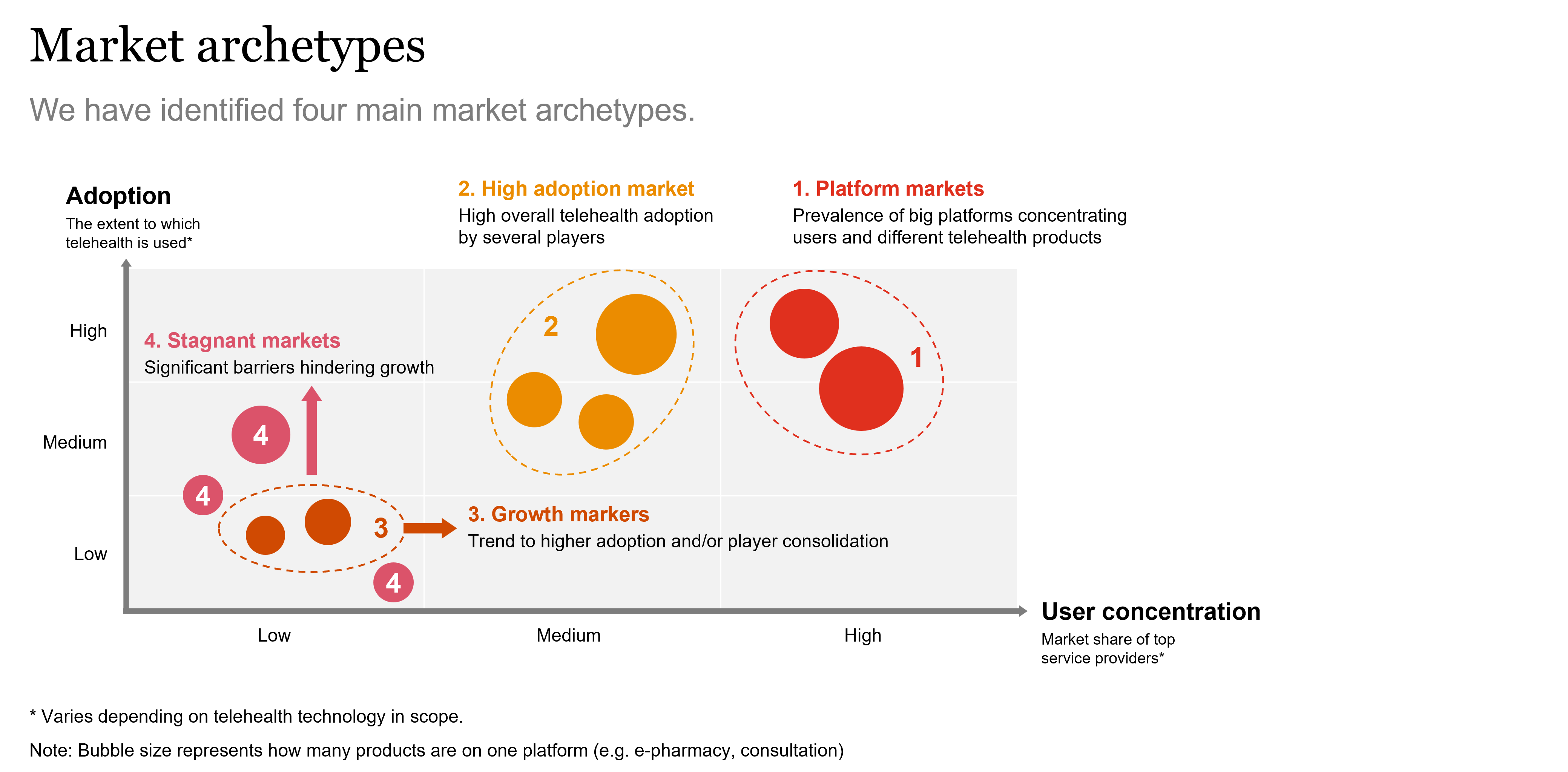

Various market archetypes are developing based on regional differences between regulatory frameworks, telehealth maturity, products and services and the scale of key players. Companies therefore need to identify the market archetype(s) (see Figure 5 below) that best suit their strategy. For example, in some markets the regulatory framework allows large players to concentrate several services – such as consultation, testing, prescription and delivery – on the same platform. Others require separation between these services. Consequently, for example the bundling of telehealth services with medication (opportunity 2), are easier to implement in platform markets while require a more nuanced approach in others.

Figure 5: Telehealth market archetypes

- Know your partner

Many telehealth players, who are still experimenting with different business models, are yet to turn a profit. And as market pressures have recently increased, we’ve seen several players forced to exit the market or pivot their strategies. For example, Babylon Health, a once-dominant telehealth company, made several major changes before filing for bankruptcy in 2023, one of which was to leave the UK market. That move forced the NHS to find a new option to support patients (Figure 6). In light of this, it is crucial to carry out solid due diligence on any potential partner. Having an exit strategy that minimises any negative impacts on your reputation and/or business is also vital.

Figure 6: Babylon Health’s rise and fall

1 Babylon Holding Investor presentation 2020, 2021

2 Wired: babylon-disrupted-uk-health-system-then-left

- Stay clear of the grey zone: As the regulation of telehealth services and its interpretation are still evolving in many countries, it’s important to avoid any real or apparent conflict of interest between different healthcare stakeholders. For example, in Germany a telehealth provider and an e-pharmacy were forced to end their cooperation after a court ruled that there was insufficient separation between the prescriber and seller of the medicine, and that their combined offering was violating strict advertising laws regarding telehealth.

How PwC helps with telehealth strategies

PwC is helping global pharma and medtech companies to explore how they can leverage telehealth to create value for themselves and their patients. This includes understanding what to do (identifying opportunities for their portfolio), where to start (market and product fit) and how to execute (building and engagement strategy). Our global network of member firms allows us to localise every company’s strategy with deep market expertise (see case study).

Case study

PwC recently worked with a global company to define a telehealth strategy for its pharmaceuticals portfolio in 10 key markets. To support them we:

- Conducted a landscape analysis to identify the most relevant telehealth technologies based on their adoption

- Mapped a telehealth customer journey from awareness to therapy management

- Identified market opportunities in line with the company’s portfolio and strategic priorities

- Prioritised the most relevant players with the highest partnering potential

- Consolidated our findings in a localised strategy.

- Key success factors for this project were our deep experience in both digital health and commercial go-to-market strategies for pharma. In addition, our global network allowed us to quickly mobilise and build a unified team with experienced local resources in all key markets.

Contact us

Lingli He

Jonathan Sander

Senior Manager, Commercial Strategy for Pharma and Life Sciences, PwC Switzerland

+41 058 792 18 79

Catijn Schierbeek

Manager, Commercial Strategy for Pharma and Life Sciences, Zürich, PwC Switzerland

+41 79 833 53 12