“CEOs in the consumer sector are grappling with a challenging economic landscape, enduring changes in consumer patterns, and the continuous advancement of technology. M&A will serve as a catalyst, helping businesses effectively achieve their strategic goals.”

Simon MalinPartner, Deals Retail & Consumer Goods Leader, PwC SwitzerlandOverall, consumer sentiment shows signs of recovery, with increased online shopping and spending anticipated across various sectors. This optimism supports dealmakers’ investment strategies as they seek signs of stability.

We expect a further decline in valuations, with a persistent seller-buyer valuation gap possibly hindering some market transactions. With the prevalent economic stress, the number of restructurings is likely to grow, especially in retail and certain leisure sectors. This may lead to an increase in distressed M&A activity, with well-funded corporates and private equity funds expected to capitalize on such opportunities.

Business transformation and strategic agenda acceleration continue to be paramount, fuelled by the need to innovate and exploit technologies such as D2C and generative AI. This trend extends to improving customer experiences and enhancing supply chain resilience, with technology-driven, vertical M&As being on the rise. Consumer companies are expected to refocus on sustainability despite inflationary pressure, given consumers’ willingness to pay for sustainably produced goods. ESG factors in screening and due diligence processes are also gaining importance.

Many CEOs are likely to continue to focus on portfolio renewal and divestment of non-core assets and brands, given the rise in shareholder activism. In the next six months, we also see potential M&A activity in public-to-private deals, especially in the retail sector, where reduced valuations create opportunities for dealmakers.

Key issues driving M&A activity in consumer markets

Retail

In the second half of 2023, robust retail subsectors like consumer health and pet retail may see more M&A activity, often driven by the need for transformation or refinancing. Noteworthy transactions in the first half of 2023 highlight this trend, with deals involving companies like L’Oreal and JD Sports, and Migros’ acquisition of the Swiss online pharmacy business ‘Zur Rose’. There is also activity in fuel and convenience sectors, with Asda acquiring hundreds of petrol stations and takeaways from EG Group and The Co-Op, and Alimentation Couche-Tard purchasing TotalEnergies’ service stations in four countries – indicating an adaptation to a rising electric vehicle demand and broader investor interest.

Consumer goods

M&A activity in the consumer sector remains upbeat, spurred by strategic deals such as Altria’s acquisition of NJOY and Diageo's purchase of Don Papa Rum. We expect increased M&A in the fields of food ingredients and agri-business, exemplified by IRCA’s intended acquisition of Kerry Group’s Sweet Ingredients Portfolio. The pet products sector remains active, with deals like Post Holdings acquiring selected brands from J.M. Smucker. Consumer health and other sectors that are withstanding falling consumer spending should also continue to see M&A activity. Investors are showing growing interest in consumer services such as lawn care and food delivery, attracted by their recurring revenue and digital service delivery.

“I expect mid-market transactions to dominate the Swiss market as CEOs use strategic acquisitions and selective divestitures to position their portfolios for the future. Such smaller deals have the potential to drive transformation and growth.”

Simon MalinPartner, Deals Retail & Consumer Goods Leader, PwC SwitzerlandHospitality and leisure

The sports subsector dominated the hospitality and leisure sector’s M&A activity in the first half of 2023, highlighted by the proposed $6bn sale of the NFL’s Washington Commanders. We anticipate continued deals activity in this area for the remainder of 2023. As business travel nears pre-pandemic levels, M&A activity in the travel subsector is on the rise, with deals like Flight Centre’s acquisition of Scott Dunn and Hyatt’s planned acquisition of Mr. & Mrs. Smith. Although overall M&A volumes may remain subdued, we expect sustained interest in top-tier businesses, supported by continued corporate-led activity, as shown in Mohari Hospitality’s acquisition of Tao Group and Toridoll’s partnership with Capdesia on the take private transaction of The Fulham Shore.

Transportation and logistics

The transportation and logistics sector saw decreased M&A activity in the first six months of 2023, following a record-breaking period in 2021 to mid-2022 due to pandemic-fueled demand. With private company valuations needing realignment, deal flow may remain subdued, but public-to-private deals, like Brookfield Infrastructure’s acquisition of Triton International Limited, could increase. The trend of vertical integration is illustrated by CMA CGM SA Group’s proposed acquisition of Bolloré Group’s logistics business. We predict that capability-building M&A, especially in logistics services and technology, and small-to-medium-sized transactions will shape the sector’s M&A landscape in the second half of 2023.

PwC ranked #1 Global and European M&A Advisor by Volume for H1 2023

Our PwC Corporate Finance team has ranked as the Global and European #1 M&A Advisor by Volume for H1 2023 by Thomson Reuters/ Refinitiv, Bloomberg, Dealogic and MergerMarket

Consumer markets deal volumes and values, 2018-2022

2023 mid-year M&A outlook for consumer markets

We anticipate 2023 to be a testing year for consumer markets’ M&A due to the subdued economic backdrop and financing hurdles. Even with rising optimism, we expect smaller deal sizes and more intricate structures for financing and risk mitigation. Companies that are well prepared, seize the right opportunities, and effectively implement their strategies with the help of a well-thought-out value creation plan will be successful.

And how about Switzerland?

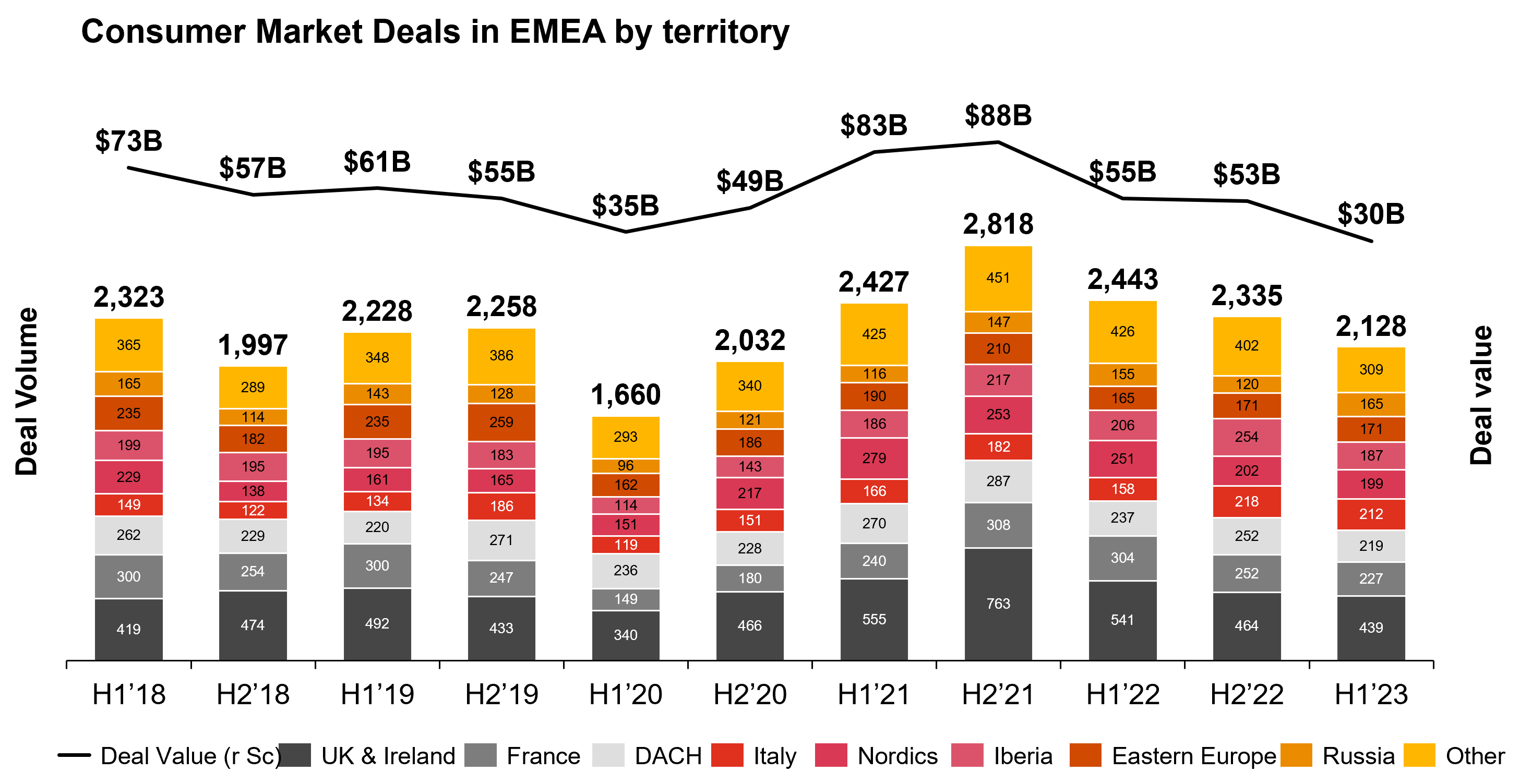

In the first half of 2023, deal flow in EMEA declined by around 9% compared to the previous half year. Almost all regions witnessed a reduction in M&A activity (as measured by deal volume), with the most pronounced contractions in MENA (– 39% compared to the previous half year), Iberia (–26%), and DACH (–13%). The only territory that experienced an increase in M&A was Russia, where deal volume rose 38%, potentially driven by Western players divesting their assets due to sanctions and political exposure.

The total value of consumer market deals in EMEA has dropped even more sharply, declining by 45% compared to the previous half year. At approximately $30B, deal value has hit its lowest point in the last five years, falling below values realized during the pandemic. Historically, the average deal value ranged from $20-35M (excl. mega deals). However, it declined to $14M in the first half of 2023, reflecting both a shift towards middle market M&A and declining valuations.

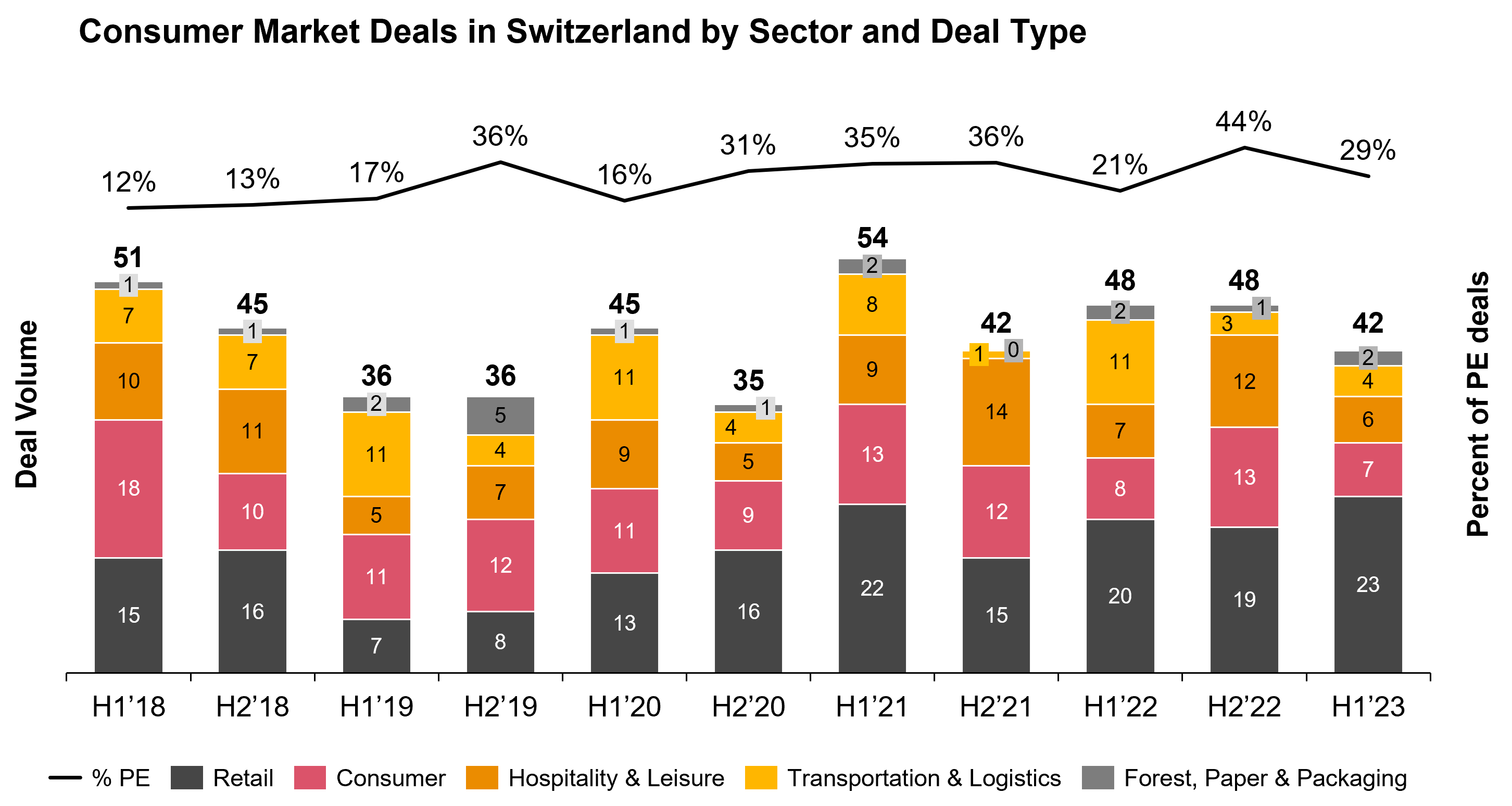

In Switzerland, deal flow has also declined during the first half of 2023, but remained broadly in line with historical averages.

- Looking at individual sectors, we observed a record level of Retail transactions in the first six months of 2023, as retailers continue to invest in new technologies, capabilities, and sales channels to meet consumer demands in the post-Covid world. Examples of this include Migros’ acquisition of the online pharmacy “Zur Rose”, as well as its direct competitor in the e-commerce space, the newly formed JV between Galenica and Shop Apotheke Europe.

- At the same time, deal activity has most notably slowed down in the consumer sector, especially within Food & Beverage, as well as the Hospitality & Leisure sector, with the most significant slowdown within Recreation & Leisure. The decline in Recreation & Leisure deals aligns with lower consumer spending in Switzerland, as the savings rate has reached a historical high of over 25% during the first quarter of 2023, compared to an average of 15% in 2022.

Looking ahead, I believe M&A activity in the Swiss consumer market industry will remain resilient during the second half of 2023, as it benefits from several structural tailwinds:

- A more favorable macro environment compared to most global economies, driven by lower inflation, modest interest rate hikes, a tight labor market with strong immigration, and an appreciating Swiss Franc boosting international purchasing power.

- Swiss corporates show strong balance sheets, enabling strategic optionality and fueling inorganic growth. The net debt/EBITDA ratios for publicly listed Swiss consumer market companies have reached a five-year low.

- The valuation gap has narrowed, as multiples have experienced a continued downward correction over the past twelve months, bringing price expectations of buyers and sellers closer together. The median EV/EBITDA (LTM) multiple for consumer market companies in the Swiss Performance Index (SPI) has contracted almost 2 turns over the past twelve months.

- Small and medium-sized enterprises (SMEs) are the backbone of the Swiss economy. As such, the average deal size in Switzerland tends to be smaller, making M&A activity less volatile in uncertain times when buyers are reluctant to commit significant capital towards mega-deals.

- Technological advances create urgency and accelerate the transformation journey of consumer market companies. Consequently, these companies are eager to acquire critical capabilities in differentiating areas such as AI, the metaverse (AR/VR), smart devices (IoT), big data, digitization, and so on. The same holds true for ESG, as sustainability continues to rise in importance for consumers.

There are also a few potential risks on the horizon, that may affect the Swiss economy, consumer confidence, and ultimately M&A activity, such as:

- Public companies in Switzerland have seen a contraction in their order backlog during the first half of 2023, and also indicated that they are less optimistic about new order volumes in the near term.

- The Purchasing Managers’ Index (PMI), which captures the sentiment in the manufacturing and service sectors, dropped in July 2023 to its lowest level since 2009.

- Global uncertainties around the Ukraine war, monetary policy, recessionary threats, etc., are unlikely to cease in the second half of 2023, and it is difficult to predict how these events will continue to affect the Swiss economy. That said, we likely won’t see a significant pick-up in Swiss M&A activity until these global risks are effectively addressed.

- As such, I expect deal flow in Switzerland to remain steady for the remainder of 2023, with a continued focus on the mid-market. Companies will selectively acquire new, differentiating capabilities, pursue bolt-ons, and enter adjacencies, while simultaneously divesting non-core assets to streamline their portfolio. Deal pricing will remain disciplined, with a strong focus on value creation.

Selected consumer market deals involving Swiss targets during the first half of 2023

Buyer |

Target |

Enterprise value ($m) |

Date ann. |

Description |

Migros |

Zur Rose |

360 |

2/23 |

Migros-Genossenschafts-Bund, through its subsidiary Medbase AG (a medical centers operator based in Switzerland), is set to acquire Zur Rose Group AG, a Switzerland-based e-commerce software company specialising in online pharmaceuticals store operations. |

Redcare Pharmacy NV |

MediService AG |

225 |

3/23 |

Shop Apotheke Europe NV, a software e-commerce company based in the Netherlands that operates online pharmacy websites, is set to acquire 51% of MediService AG. MediService AG is a Switzerland-based distributor of pharmaceuticals by mail order, a subsidiary of Galenica AG, a healthcare provider and manufacturer also based in Switzerland. |

TVS Motor Company Limited |

Swiss E-Mobility Group (Schweiz) AG |

79 |

6/23 |

TVS Motor Co Ltd, an India-based manufacturer of motorcycles, mopeds, and related parts, has, through its subsidiary TVS Motor Company (Singapore) Pte. Ltd, acquired 25% of Swiss E-Mobility Group (Schweiz) AG, a manufacturer of electric bikes based in Switzerland. |

XXXLutz KG |

Conforama Suisse SA |

N/A |

1/23 |

XXXLutz GmbH, the Austria-based furniture retailer, has acquired the remaining stake in Conforama Suisse SA, a Switzerland-based company engaged in the retail business of furniture, homeware appliances, electronic goods, and decoration, from Dan Mamane (a private Individual) who is based in Switzerland and has interests in companies engaged in the retail business of furniture and other household products. |

PAI Partners SAS |

Nestle SA (frozen pizza) |

N/A |

4/23 |

PAI Partners SAS, the France based private equity firm, has agreed to merge their frozen pizza asset to form a 50:50 joint venture with Nestlé SA. |

”We expect M&A activity in the Swiss Consumer Market to remain steady for the remainder of 2023. Corporates have strong balance sheets that enable optionality, asset valuations have become more affordable and organizations understand the urgency to invest in new capabilities to meet the ever-changing consumer demands in the past-Covid world.”

Simon MalinPartner, Deals Retail & Consumer Goods Leader, PwC Switzerland#social#