Relative to other sectors, investor interest in pharmaceuticals and life sciences (PLS) as well as healthcare services (HCS) remains strong and is expected to persist in the second half of 2023. Despite increasing regulatory scrutiny, M&A continues to be a key tool for change, especially for big pharma investing in midsize biotech to fill pipeline gaps. Further key focuses are portfolio optimisation and asset divestiture. Private equity is keen to invest in innovative healthcare assets.

Due to limited initial public offerings, sales processes are becoming the main exit strategy. High-interest rates make divestitures increasingly important as a way to raise capital. Underperforming public companies are susceptible to acquisitions by well-funded private equity firms. Generative AI adds dynamism to the market, spurring health players to acquire expertise for integration into their services.

In addition, health industries present appealing ESG investment options as they address societal challenges such as access to affordable healthcare. Consequently, we anticipate an expanded incorporation of ESG factors in business models and due diligence processes.

“Savvy health industry dealmakers will leverage M&A to drive innovation, align growth with business goals, and upgrade their pipeline and product portfolio to stay competitive.”

Luca BorrelliPartner, Pharma and Life Sciences, PwC SwitzerlandKey issues driving M&A activity in health industries

Pharmaceuticals and life sciences (PLS)

Big pharmaceutical firms are pursuing M&A, including international deals, to replenish their pipelines and fulfil growth objectives due to forthcoming patent expirations in the coming years. Regulatory scrutiny has slowed some larger deals in the first half of 2023, leading to a cautious approach to transformative deals. As a response, firms are expected to focus on acquiring smaller and medium-sized companies to lessen regulatory hurdles.

Rising interest rates and falling stock prices are prompting companies to accelerate their divestiture plans to raise capital for future acquisitions. Large pharma companies are especially focused on divesting to align strategic goals, counter upcoming patent expirations, and optimise portfolios. The recent transition in leadership at major pharma companies may stimulate portfolio reviews and a surge in divestitures and acquisitions. Private equity interest remains strong in the areas of contract research organisations (CROs), contract development and manufacturing organisations (CDMOs), and medtech companies, with declining public valuations enabling public-to-private transactions.

Healthcare services (HCS)

The consumerisation of healthcare persists, with vitamins, supplements, and nutraceutical companies maintaining their allure and their high multiples. Newly independent over-the-counter and consumer health businesses are expected to leverage M&A for transformation and portfolio expansion. Private equity firms are likely to continue their buy-and-build strategy for cost efficiency and scale.

Fragmented specialist care sectors such as private clinics, dermatology, and veterinary care are predicted to consolidate further. Value creation and integration will be crucial for dealmakers preparing for future exits. Healthcare and hospital settings face fiscal and operational challenges, including skilled staff shortages and wage inflation. With reduced government support, these pressures may prompt restructuring and distressed M&A.

Digital solutions, particularly in telehealth and health tech, are in demand for their ability to address operational issues and enhance patient-centric care. A rise in AI interest urges healthcare providers to integrate large language models for enhanced patient engagement and administrative efficiency. M&A, partnerships, and alliances are expected to facilitate the introduction of AI-powered tools like chatbots in health services.

Given the hunger and need of pharma companies to fill their pipelines, we expect biotech and pharma M&A to pick up further, especially for assets in late-stage clinical trials and companies with several promising drug candidates.”

Luca BorrelliPartner, Pharma and Life Sciences, PwC Switzerland2023 full-year M&A outlook for health industries

M&A continues to be an important mechanism for health industry firms to create long-term value, transform their business in a sustainable way, and achieve the desired outcomes for their stakeholders. Even with regulatory challenges, M&A momentum in this sector is expected to stay strong and potentially speed up in the coming months: buyer-seller valuation gaps lessen, and companies seek innovative tech and AI solutions for their strategic and operational needs. Dealmakers should gear up for an active latter half of 2023.

And what about M&A in the Swiss health industry?

PwC ranked #1 Global and European M&A Advisor by Volume for H1 2023

Our PwC Corporate Finance team has ranked as the Global and European #1 M&A Advisor by Volume for H1 2023 by Thomson Reuters/ Refinitiv, Bloomberg, Dealogic and MergerMarket

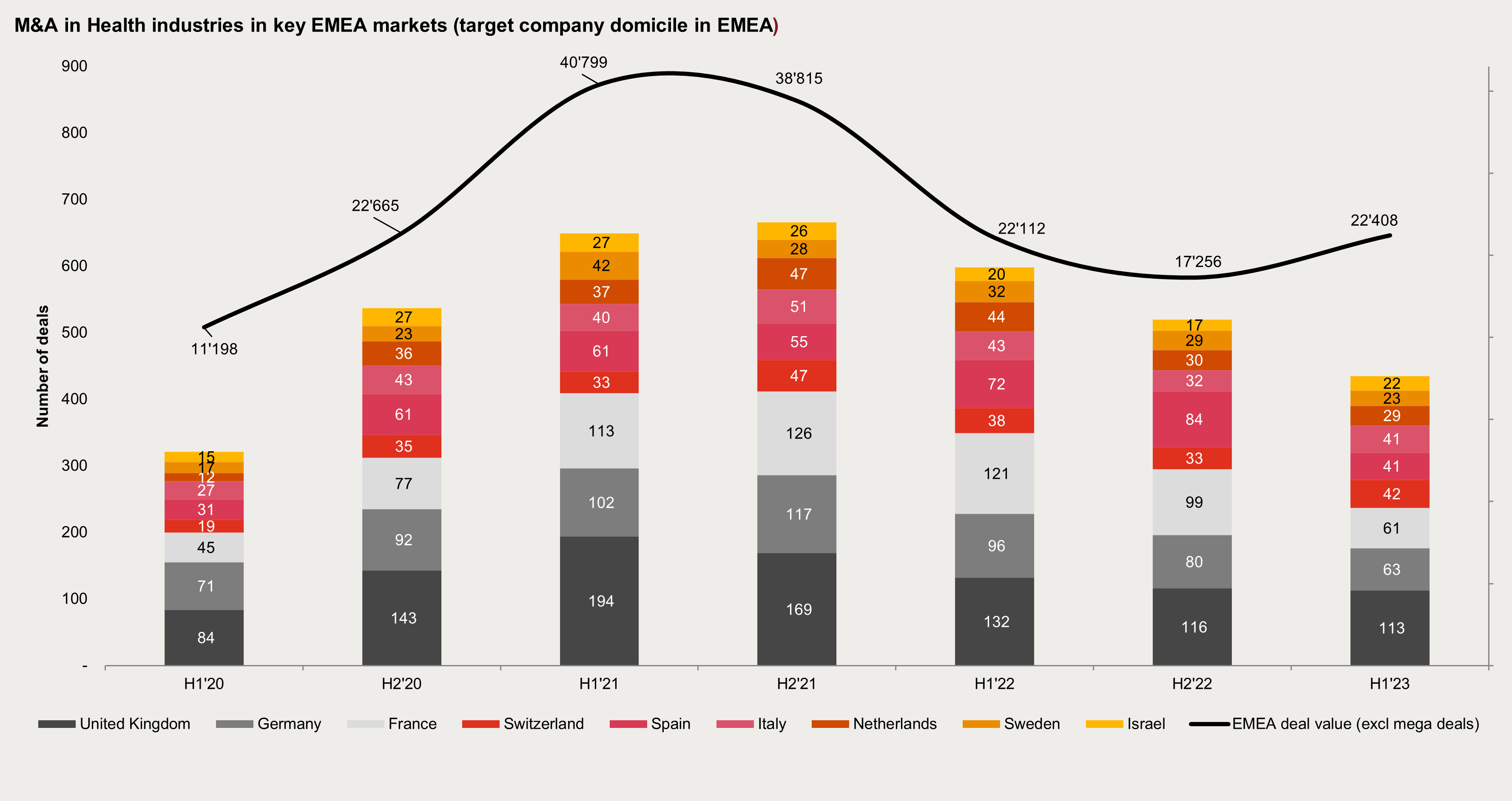

Historical deal activity in EMEA (Europe, Middle East, Africa) has followed the global trend with the key markets UK, Germany, and France showing high seasonality in the past years and volume losses in the first six months of 2023.

Switzerland, however, appeared to have broken out of the downward trend with a higher number of Swiss targets for sale than in the two preceding semesters. Interestingly, the first half of the year saw a surge in total deal value (excluding deals with a valuation in excess of USD5b), while the number of deals dropped. This possibly hints at higher quality assets being sold or higher premiums being paid.

When looking at Switzerland in isolation, we see that market stabilisation is driven to a large extent by robust Pharma and Life Science activity in spite of the still challenging macro environment of rising and uncertain interest rates. Overall, Switzerland's resilience may be partly due to the fact that monetary policy has not changed as much as in other European markets.

The reversal of the downward trend is in part reflective of corporates recalibrating their portfolios and acquiring capabilities and pipeline products. Novartis, for example, continues to execute their strategic transformation by divesting its “front of eye” ophthalmology assets and reinvesting into its innovative medicines portfolio with the acquisition of Chinook Therapeutics.

The planned spin-off of Sandoz will be a major event in the second half of the year. While there is a big focus on the patent cliff that threatens big pharma’s revenue streams, it will be interesting to see how the market will take up the respective biosimilars and how the large generics companies will fare. In generics, I expect M&A to remain a main tool to execute transformation. The large generic companies will focus on biosimilars and newer and complex generics to fight the continuous price pressure. Portfolio optimisation and related M&A will be at the heart of value creation plans.

Value creation will also be at the forefront of private equity transactions. PEs are longing for a stabilisation of debt markets as there seems to be a lot of pent-up aggression to make deals. Despite softer valuations following the post-Covid M&A frenzy, simple bolt-on strategies may not yield the expected returns anymore. I expect PE houses with strong industry teams to be the most successful and hungry to invest in assets with a clear value creation plan that will be executed over the investment period.

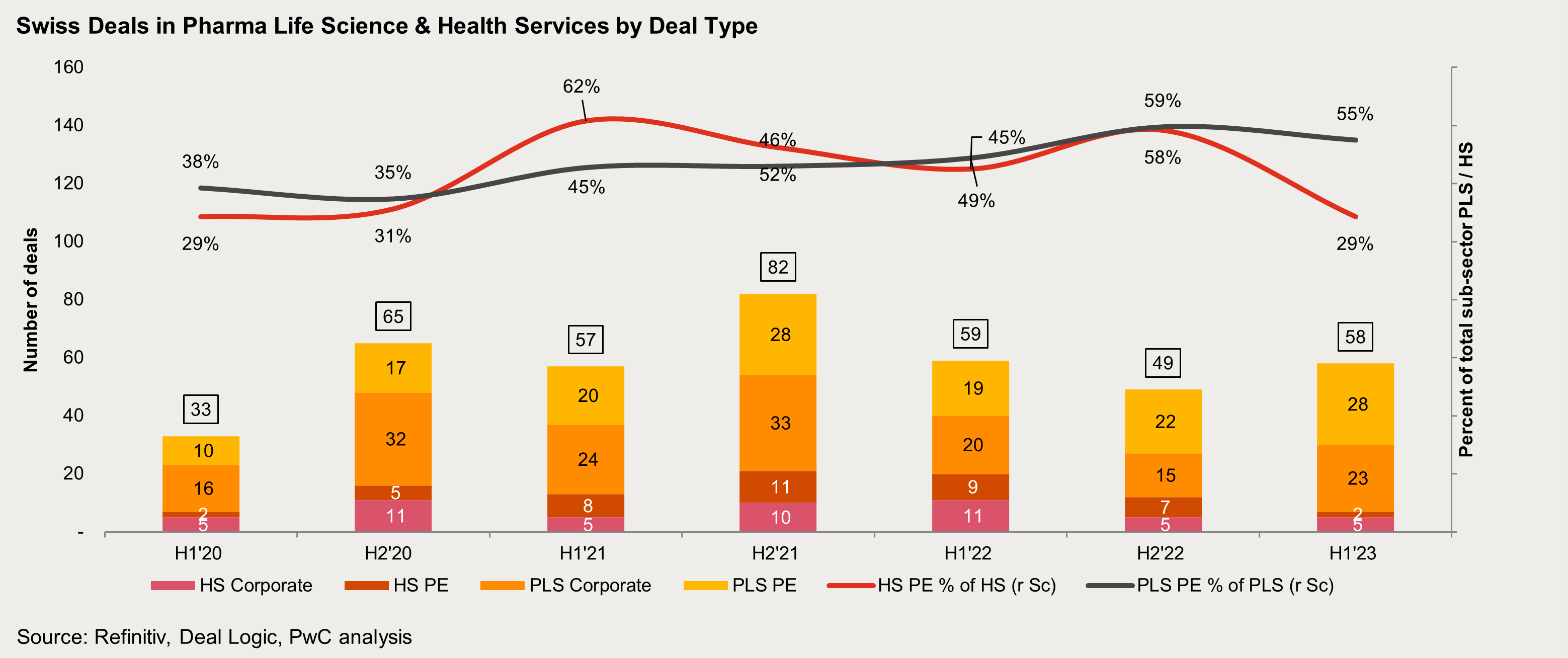

Over the years, private equity has become more prevalent in Swiss deal making. In fact, in Pharma and Life Sciences, PE and VC deals have become an integral part of the Swiss M&A environment, with about half of the transactions involving one or more financial investors. This trend has been robust and has broadly persisted in the health sector in the first half of the year.

Similar to the wider industry trend, we have seen a stabilisation of Swiss PE activity following the slowdown caused by the shift in monetary policy. At the heart of Pharma and Life Sciences, private equity deals often involve specialised pharma service players or contract manufacturers as well as VC that invest in biotech. As investors and scholars expect the macro environment to soften and interest rates to rise at a slower pace or to even flatline, PE deals will likely further drive Swiss M&A activity towards the end of 2023 and into 2024.

Top M&A Deals of Switzerland in the first half of 2023

| Buyer | Target | Deal value ($m) | Timing | Comment |

| Novartis AG | Chinook Therapeutics Inc | 3,250 | Q2 | Novartis today announced that it has entered into an agreement to acquire Chinook Therapeutics, a Seattle, WA, based clinical stage biopharmaceutical company with two high-value, late-stage medicines in development for rare, severe chronic kidney diseases. The agreed deal, which is subject to customary closing conditions, is fully in line with Novartis strategy to focus on innovative medicines and will significantly expand its renal portfolio, complementing the existing pipeline. |

| Bausch + Lomb Ireland Ltd | Novartis AG-Dry Eye Pharmaceutical Asset | 2,500 | Q2 | Novartis announced today that it has signed an agreement to divest ‘front of eye’ ophthalmology assets to Bausch + Lomb, a global eye health company, in a transaction valued up to USD 2.5 billion, including USD 1.75 billion in upfront cash, plus additional milestone payments. The deal includes Xiidra®, the first approved prescription treatment for the signs and symptoms of dry eye disease, and investigational medicine SAF312 (libvatrep), in development as a first-in-class therapy for chronic ocular surface pain (COSP), as well as the rights for use of the AcuStream delivery device in dry eye indications and OJL332, a second generation TRPV1 antagonist in pre-clinical development. |

| Ironwood Pharmaceuticals Inc | VectivBio Holding AG | 1,155 | Q2 | Ironwood Pharmaceuticals, Inc. (“Ironwood”) (Nasdaq: IRWD), a GI-focused healthcare company, and VectivBio Holding AG (“VectivBio”) (Nasdaq: VECT), a clinical-stage biopharmaceutical company pioneering novel, transformational treatments for severe rare gastrointestinal conditions, today announced that they have entered into a definitive agreement for Ironwood to acquire VectivBio for $17.00 per share in an all-cash transaction with an estimated aggregate consideration of approximately $1 billion, net of VectivBio cash and debt |

| Investor Group | Galderma SA | 1,000 | Q2 | Galderma announced today a private placement of approximately USD 1 billion for newly issued shares, from a group consisting of current shareholders, new investors, as well as management. |

| Catalyst Pharmaceuticals Inc | Santhera Pharmaceuticals Holding AG | 231 | Q2 | Catalyst Pharmaceuticals, a commercial-stage biopharmaceutical company focused on in-licensing, developing, and commercializing novel medicines for patients living with rare diseases, today announced that Catalyst has entered into a definitive agreement with Santhera Pharmaceuticals Holding under which Catalyst will enter into an exclusive North America license, manufacturing and supply agreement for Santhera’s investigational product candidate, vamorolone, a dissociative steroid currently under FDA review for the treatment of Duchenne Muscular Dystrophy. |

“Acquisitions will continue to be a popular option for healthcare industry players looking to realise their growth plans and innovate their business model. Declining valuations – and narrowing buyer-seller valuation gaps – make a compelling case for M&A.”

Luca BorrelliPartner, Pharma and Life Sciences, PwC Switzerland#social#