{{item.title}}

{{item.text}}

{{item.text}}

A year ago, we wrote that health industry companies will need to innovate and transform their businesses to achieve their growth targets. This remains true in 2024. As a result of easing headwinds in the valuation, economic, and regulatory environment, as well as increasing competition for innovative technologies, global healthcare M&A is set to rebound in 2024. Divesting non-core assets and addressing return pressures in the R&D pipeline are essential; developing digital capabilities to deliver cost-effective, value-based care and evaluating joint ventures and partnerships will play a critical role. In this blog post, we take a look at developments in Swiss and global M&A statistics, assess the key motives driving Life Science M&A, and offer a glimpse of what 2024 might hold for the industry.

In general, 2023 was a transitional year for many in the deal making space. The headwinds of increasing interest rates and wider economic and regulatory uncertainty in light of recessionary trends had led decision makers to hold off on M&A and wait for the dark clouds to clear. This trend was also visible in Pharmaceutical and Life Sciences (PLS), where the number of global deals fell again compared to 2022. We will look at the global and Swiss statistics in detail later.

However, towards the end of 2023 and at the start of 2024, the broader message in the market seems to be more bullish. The recent stock market rally has also led to a rebound in Pharma and Life Science indexes, such as the IBB or XBI, from their historical 2022 lows. The valuations of smaller assets in particular had suffered from higher interest rates, as the nature of R&D-focused biotechs involves earnings far in the future. In addition, these companies have suffered from tightening R&D budgets at Big Pharma players.

Now, we see that the sector has gotten used to higher interest rates and learned how to serve the market amid newly introduced legislation. For example, as a result of the U.S. Inflation Reduction Act (IRA) entering into force, Big Pharma has started to evaluate the impact it has on its offering. The resulting reassessment of the pipeline and realignment of R&D activity to conform with new regulatory norms has pushed M&A up the strategic agenda. By optimising their portfolios and R&D, corporates aim to ensure a balanced offering of products and therapeutical areas that meet future profitability goals. This reallocation of funds has affected companies along the value chain, with CROs, CDMOs and other R&D-related pharma services businesses struggling to find growth after the highs of previous years.

Beyond that, we see market forces with high potential to drive M&A activity: Large pharmaceuticals are focusing on mid-sized acquisitions of biotechs for pipeline development. The current mega topic of GLP-1 is likely to attract significant investment, as also non-Big Pharma players seek to enter the race to fight obesity.

Finally, global PLS have seen a shift towards cost-effective and value-based care, pushing established companies to modernise through digitalisation, which is leading to technology-focused acquisitions or partnerships. Taking the notable collaborations between Merck and Daiichi Sankyo or between Henry Ford Health and Ascension Michigan as examples, the rise in joint ventures and partnerships as alternatives to outright acquisitions becomes evident in both the pharmaceutical and healthcare sector.

GLP-1 (glucagon-like peptide-1) drugs, used to treat type 2 diabetes and promote weight loss, have become a major focus for the pharmaceutical industry, with sales potential estimated at more than US$100bn. Companies such as Novo Nordisk and Eli Lilly with existing GLP-1 products have seen sales and share prices rise. The rapid growth of the market is driving competition and innovation, particularly for biotech firms developing oral GLP-1 solutions, making them attractive M&A targets. Large pharmaceutical companies are actively investing in this area, as evidenced by Roche’s acquisition of Carmot Therapeutics and AstraZeneca’s licensing agreement with Eccogene. However, the emergence of GLP-1s has raised concerns about reduced demand for treatments in related health issues, affecting the share prices of some medtech companies. This shift is creating M&A opportunities as medtech companies try to adapt to the impact of GLP-1 drugs.

“Dealmakers are advised to start preparing for an active 2024. I expect an increase in healthcare transaction activity as the overall economic and regulatory landscape becomes more defined and the gap in valuation expectations between buyers and sellers narrows.”

Luca Borrelli,Partner Pharma and Life Sciences, PwC SwitzerlandIn response to patent expirations and pipeline gaps, large pharmaceutical companies are likely to pursue M&A with smaller biotech companies to support their growth strategies. While we have already seen this trend in 2023, demand for smaller companies is set to further pick up in 2024, with the rise in risk-free interest rates leading to intense competition for the most promising biotech targets.

In 2024, CROs (contract research organisations), CDMOs (contract development and manufacturing organisations), and medtech companies with robust cash flows are expected to be key targets for investment from the corporate and private equity sectors.

Furthermore, large pharmaceutical companies are expected to continue to divest non-core assets. This strategy aims to reduce research and development costs and free up funds for investments that are better aligned with their core business, making portfolio optimisation through M&A a key focus for these companies.

This year, the emerging potential of artificial intelligence (AI) in speeding up and reducing the cost of drug discovery and development is likely to drive pharmaceutical companies, biotech firms, and startups to engage in M&A to acquire AI capabilities for innovation in this field. See also our thought leadership piece on M&A trends in AI for drug discovery.

Hospitals are facing financial and operational difficulties as a result of the end of pandemic-related government funding, tighter national budget constraints, and ongoing clinical staff shortages. This presents opportunities for PE firms to invest in distressed hospitals with the aim of improving quality and efficiency of patient care.

To address these challenges, healthcare providers are increasingly turning to digital solutions. As a result, investments in telemedicine, health tech, and analytics companies are becoming more attractive as they offer essential capabilities to bridge these value gaps, with acquisition being preferred over in-house development. See also our specific article on how M&A can be a catalyst of digitisation in Swiss Health Care.

Growing long-term demand for consumer health products, driven by an ageing population and economic factors, is shifting spending towards over-the-counter (OTC) medicines and supplements. This trend makes consumer health companies attractive acquisition targets in 2024, particularly as newly independent OTC and consumer health companies seek transactions to speed up their transformation strategies.

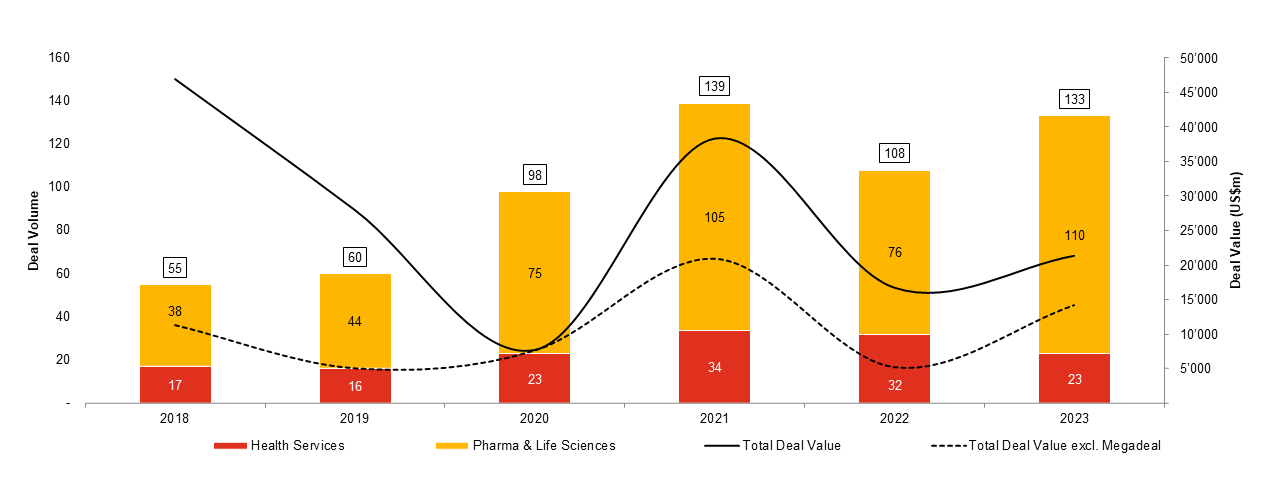

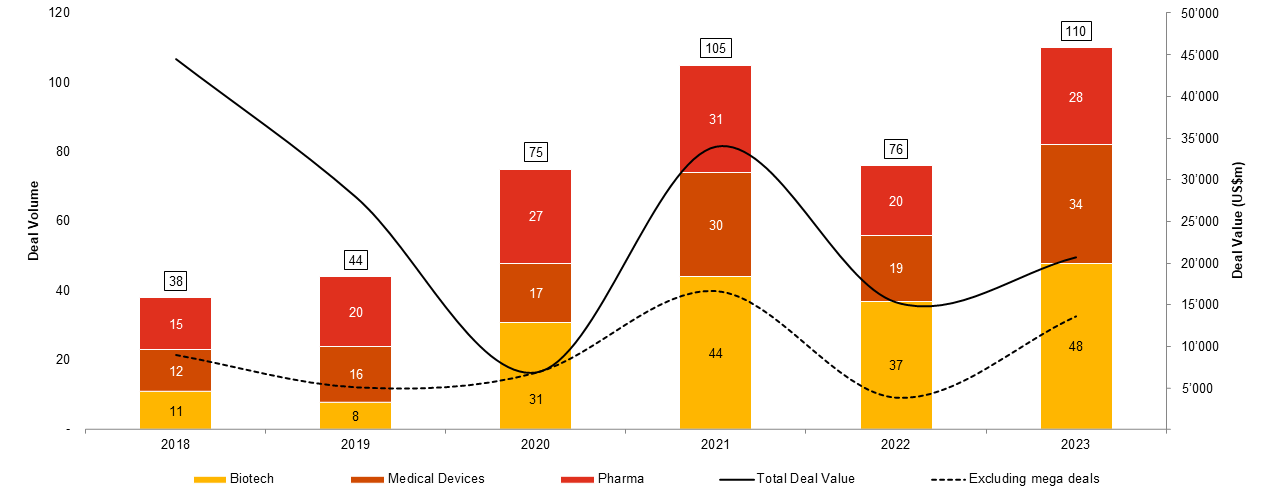

As noted above, 2023 was a mixed year for deal makers globally in the health industries space, which includes pharma and life sciences as well as health service businesses. While the amount spent on transactions (deal value) increased by 9%, the number of deals declined by 8%. In absolute terms, 2023 saw approximately 4700 M&A health industry deals globally. The lower deal count reflects, to some extent, a continuation of the slowing global trend following the M&A frenzy of 2021.

Additionally, the slower M&A market is mainly attributable to a lower number of health services deals (down by 19% from 2022). This subsector includes a wide range of deals, such as physician medical groups and hospitals.

In pharma and life sciences, we saw an increase in average deal size at a global level: While the total number of deals is broadly the same in 2022 and 2023, the total deal value has risen by 22%, partly reflecting higher average spend per deal.

M&A remains an important tool for health industry companies to create long-term value, sustainably transform their business, and achieve their growth objectives. The easing of dealmaking challenges, coupled with growing competition for innovative technologies, is expected to drive an increase in global healthcare M&A in 2024. Successful dealmakers will be those who think multiple transactions ahead, proactively evaluate their existing portfolios, act decisively in pursuit of value-enhancing objectives, and balance regulatory and macroeconomic risks.

Source: Refinitiv, Deal Logic, PwC analysis

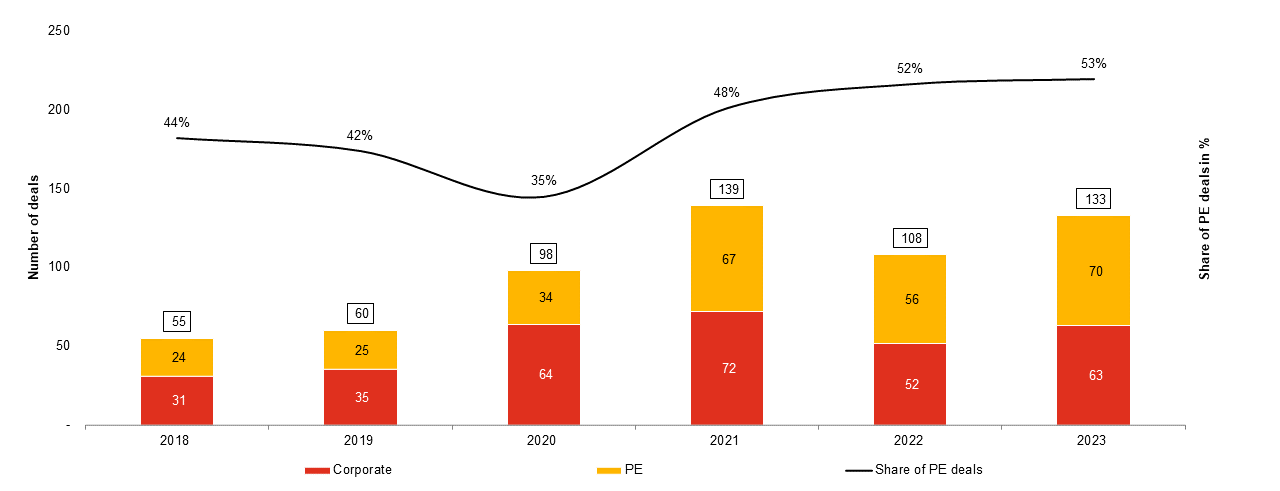

Contrary to the ongoing slowdown in global M&A activity, the Swiss market saw a reversal of the downward trend in health industries, with both the number of deals and total value in 2023 higher than in the previous year. Following a record year for Swiss health industry deals in 2021, higher interest rates as well as market and regulatory uncertainty weighed on the statistics. As businesses emerged from this transition in 2023, we saw a number of our predictions about future M&A motivations come true, pushing Swiss life science deal activity close to its historical record.

Corporates and Big Pharma in particular have finally returned to the negotiation table, making the Swiss health industry a busier deal environment again. They have settled into the “new normal” with interest rates seemingly at their peak and recognise the obvious need to innovate. Corporate M&A activity was fuelled by deals to fill the pipeline in light of a patent cliff and vigorous global competition from biosimilars, as well as by divestitures to re-centre outdated portfolios. The excess dry powder in pharma headquarters and PE houses, that many deal makers have speculated about and counted on, has finally been tapped.

Source: Refinitiv, Deal Logic, PwC analysis

The strategic motives for transactions are reflected in a number of notable deals in 2023: The purchase of Chinook Therapeutics and DTx Pharma by Novartis, Roche’s takeover of Carmot Therapeutics and Telavant from Roivant, or Boehringer Ingelheim’s acquisition of Basel-based T3 Pharmaceuticals are dominant examples of portfolio additions aimed at replenishing the pipeline for the next decade. With these targeted portfolio extensions, leaders in Swiss Big Pharma have decided to act in the face of the nearing patent cliff and secure future profits through small to medium-sized deals, which drive the Swiss statistics. In addition, the completion of the spin-off and separate exchange listing of the former Novartis generics subsidiary Sandoz is a perfect example of the pursued refocusing on core competencies.

| Buyer | Target | Deal value ($m) | Timing |

| Roche Holding AG | Telavant | 7’100 | Q3 |

| Novartis AG | Chinook Therapeutics Inc | 3'250 | Q2 |

| Roche Holding AG | Carmot Therapeutics Inc | 3'100 | Q4 |

| Bausch + Lomb Ireland Ltd | Novartis AG-Dry Eye Pharmaceutical Asset | 2'500 | Q2 |

| Ironwood Pharmaceuticals Inc | VectivBio Holding AG | 1'155 | Q2 |

| Boehringer Ingelheim GmbH | T3 Pharmaceuticals AG | 509 | Q4 |

| Novartis AG | DTx Pharma Inc | 500 | Q3 |

| Lonza Group AG | Synaffix BV | 171 | Q2 |

| Sonic Healthcare Ltd | SYNLAB Suisse SA | 167 | Q2 |

Beyond the apparent awakening of the corporate M&A machine, the trend of growing private equity dominance over the past five years has now plateaued at an impressive level: In 2023, 53% of M&A deals in the Swiss health industries have involved a PE or VC house. Like corporates, PEs and VCs have been more active overall and seem to have taken their permanent seat at the Swiss negotiating tables. PEs and VCs are still equipped with sufficient funds at their disposal and are increasingly seeking successful exits to release cash and avoid expensive debt financing. In terms of sectors, PEs have been eyeing predominantly targets in pharma services and medtech while their attraction to Swiss health service businesses – which have historically commanded higher PE involvement – has cooled somewhat down. Biotech has remained the realm of VC funds, where Switzerland has held up remarkably well.

Source: Refinitiv, Deal Logic, PwC analysis

All in all, in Switzerland, 2023 marked the return to an M&A world the way we knew it: Swiss Pharma & Life Science deals have showed their power in replenishing and refocussing patent pipelines and in aligning market needs with corporate strategy. As the obvious hunger for additional transformative deals and the need for creativity will need to be satisfied, we can expect a strong outlook into 2024.

{{item.text}}

{{item.text}}

Luca Borrelli