{{item.title}}

{{item.text}}

{{item.text}}

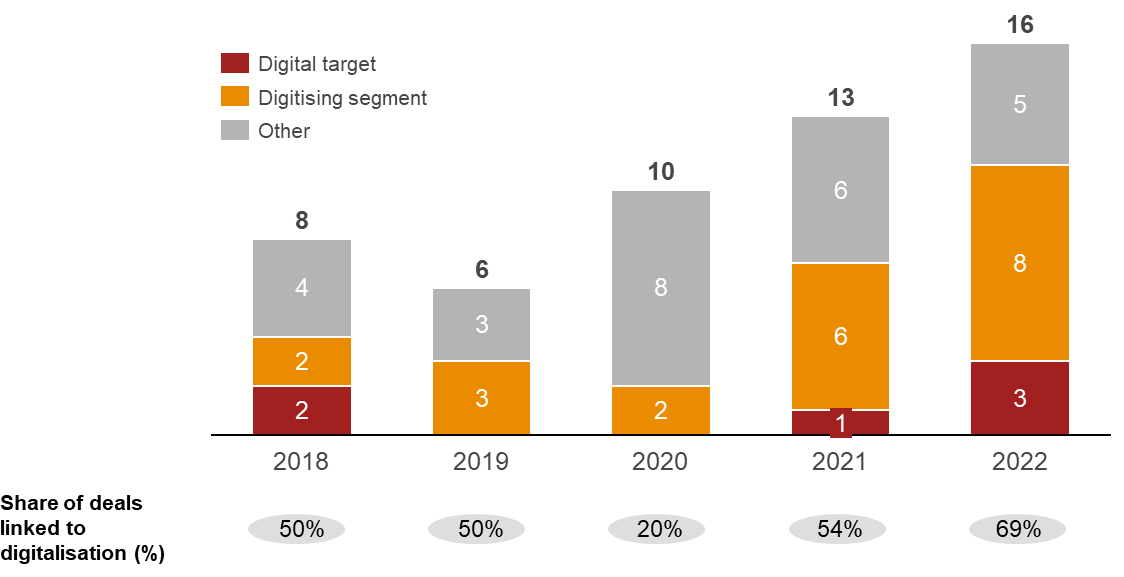

Swiss healthcare providers, like their counterparts elsewhere in Europe, are increasingly pursuing M&A to acquire competitors and suppliers. The rate of consolidation has accelerated, especially post-COVID, and that’s largely been driven by robust valuations, the growing involvement of (private) investors and the overall need for scale to navigate a complex, digitising healthcare landscape.

Graph 1: Number of transactions by Swiss healthcare providers, 2018 to 2022

Digitalisation of healthcare often yields both medical and operational benefits. These include more efficient business planning and management, enhanced collection and processing of patient information and, ultimately, better patient outcomes.

But there are a number of barriers limiting the adoption of digitalisation. The highest of these is simply the level of investment digitalisation requires. For a start, the initial shift to cloud-based storage is often a costly prerequisite. And in some segments (especially lab testing and diagnostic imaging), upgrading just a single machine can cost millions. Further barriers include, to name just a few, the extent and depth of doctors’ digital education, the lack of digital care models (including established principles and standards) and regulatory limits on the storage and use of medical data.

These reasons and more show why digitalisation isn’t easy and why it’s often best adopted in organisations that possess sufficient scale and ability to invest. And it’s why we often see consolidators (backed by investors) taking the lead in digitising their respective segments.

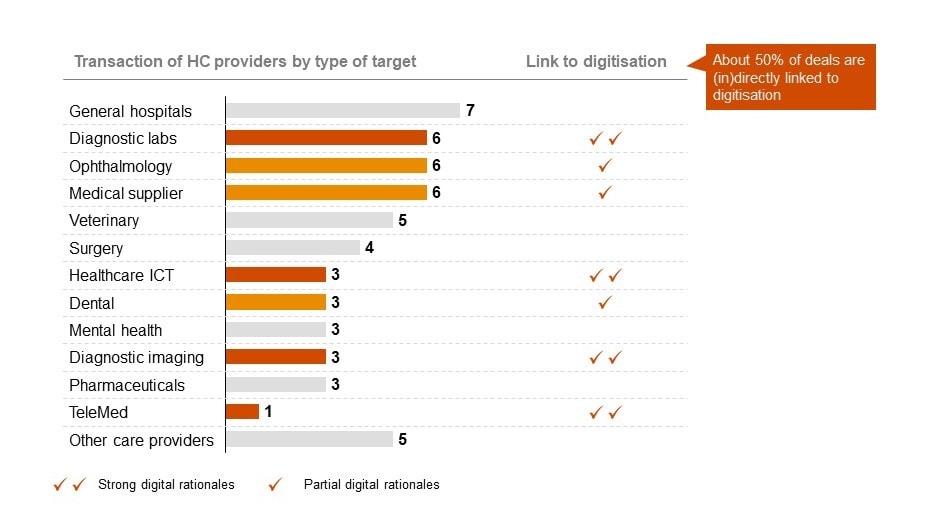

Segments with the greatest potential for digitalisation require the scale and investment that can best be obtained through consolidation. And it’s in many of these segments where we also see considerable M&A activity.

PwC’s analysis indicates that deal activity is strongest in those segments where digital transformation presents the greatest opportunities. These include diagnostic imaging and diagnostic labs, where nine deals have closed since 2018. In particular, online storage and digital machines enable remote care, efficient processes and better patient outcomes powered by AI models. Taken together, these are transforming the value-add of care services.

Ophthalmology and dental services have already benefited from automation and robotisation in recent decades. These innovations drove up margins which, in turn, attracted the interest of investors. Going forward, these segments are expected to further consolidate, extending digitalisation based on AI and further equipment innovations.

Graph 2: Deals by healthcare providers grouped per segment, linked to digitalisation, 2018-2023 Q1

Because of the high costs of digitalisation across healthcare segments, providers and investors alike are looking for M&A opportunities to consolidate market share and increase scale. Generally speaking, providers backed by investors have deeper pockets and are more able to invest in digitalisation.

Digitalisation within the hospital segment has traditionally been slow. It’s been limited by organisational complexity and hospitals’ ability to support the substantial investments in digital transformation, such as the transition to cloud-based data management.

However, we’ve recently seen deal volumes increasing in the hospital sector. Owing to sustained pressure on margins, most deals aim to realise cost synergies by consolidating patient flows and increasing operating leverage. The hospital groups that emerge from consolidation should have the scale required for standardisation and digitalisation. Swiss Medical Network SA (SMN) is such a company. It continues to acquire various local clinics and hospitals that it then integrates into its operational blueprint. With five deals completed since 2018, the group is building the platform required for further digitalisation. More specifically, SMN launched Project ‘Reseau de l'Arc’, an integrated care organisation that connects providers, regulators and payers. The digitalisation across services it enables should bring a range of efficiency and quality benefits.

Beyond traditional M&A, hospitals are starting to form partnerships that can achieve the scale needed to invest in digitalisation. For example, from 2023 Lucerne Cantonal Hospital will be the first public hospital to participate in the digital platform Compassana having already, in 2017, become the first hospital in Switzerland to implement EPIC’s information system.

M&A activity is expected to remain strong, driven by innovation and growth prospects.

As mentioned above, care providers increasingly acquire digital solutions from technology companies, such as healthcare ICT software, to improve healthcare efficiency and the quality of care.

In addition, providers from outside the healthcare industry, such as Migros or Swiss Post, have identified technological opportunities within the care segment, and are also starting to invest in their health capabilities through targeted M&A. For example, Swiss Post acquired 75% of xsana AG with the aim of strengthening its e-health platform. Ultimately, cross-industry deals could help accelerate the sector’s digital transformation, as technology capabilities from outside of the healthcare sector are brought in.

According to the PwC CEO Survey 2023 and the PwC annual finance study for hospitals, the answer to many of the healthcare sector’s challenges lies in digitalisation. As digital capabilities aren’t always available in-house, partnerships and M&A continue to be a key route to digital transformation. And as key bottlenecks in this transformation include organisational scale and ability to invest, consolidators should continue to take the lead.

M&A will continue to fuel digital transformation, with consolidators playing a key role in the sector’s digital transformation.

{{item.text}}

{{item.text}}

Managing Director, Leiter Deals Gesundheitswesen, PwC Switzerland

Tel: +41 58 792 15 08

Partner, Digitale Transformation Gesundheitswesen, PwC Switzerland

Tel: +41 58 792 77 90