Where is my organisation today?

Tax disruption risk assessment

In the coming years, tax functions will face significant challenges simultaneously: the changing supervisory environment and the digital transformation of the tax function. As the world of tax changes, we will see many new regulations from local authorities. Each authority will have different expectations of the companies that they supervise: for some, taxpayers will be expected to be able to provide data on a real-time basis, whilst others will require detailed analytics to be conducted before they accept any tax related submissions. With all of these external factors pulling companies in different directions, it can be difficult to determine where to invest.

It is clear that you cannot focus in all areas at once, so you need to prioritise.

We believe that the first step to prioritising investment is to understand how authorities in your main jurisdictions are developing, and how your current position compares to them. This is the starting point for a tax disruption risk assessment, modelled on the original COSO framework for organisational risk management and visualised in the format of a cube.

The tax disruption risk framework

(tax disruption cube)

The main goal of the tax disruption risk framework (tax disruption cube) is to strategically determine where and when to invest in digital capabilities, addressing the prioritisation and resource allocation problem faced by all management teams.

In our experience, areas of digital transformation within businesses are often defined by employees tweaking existing systems or by searching for politically acceptable ‘quick wins’. Such changes typically focus on a very particular field, trying to improve internal capabilities, free up workforce or simply reduce costs. The novel and important risks that digital tax administrations pose are often overlooked or underestimated with this approach. This has prompted us to develop the tax disruption cube to help you monitor these novel risks in a simple manner and plan your digitalisation efforts throughout the organisation.

Like a sound weather forecast, it’s intended to prepare you for the likely future in the best way possible. Although a weather forecast is never perfect, in most cases it helps you avoid the worst effects of the weather.

As we are convinced that prevailing weather conditions are going to change, our model compares the progress of tax administrations around the world to your own planned digital capabilities. By differentiating for tax sub-type, area of activity and jurisdiction, the cube visualises where next to invest.

The tax disruption risk framework should put you in a position where you can see more clearly and prepare for the new world of tax.

Assessing your position

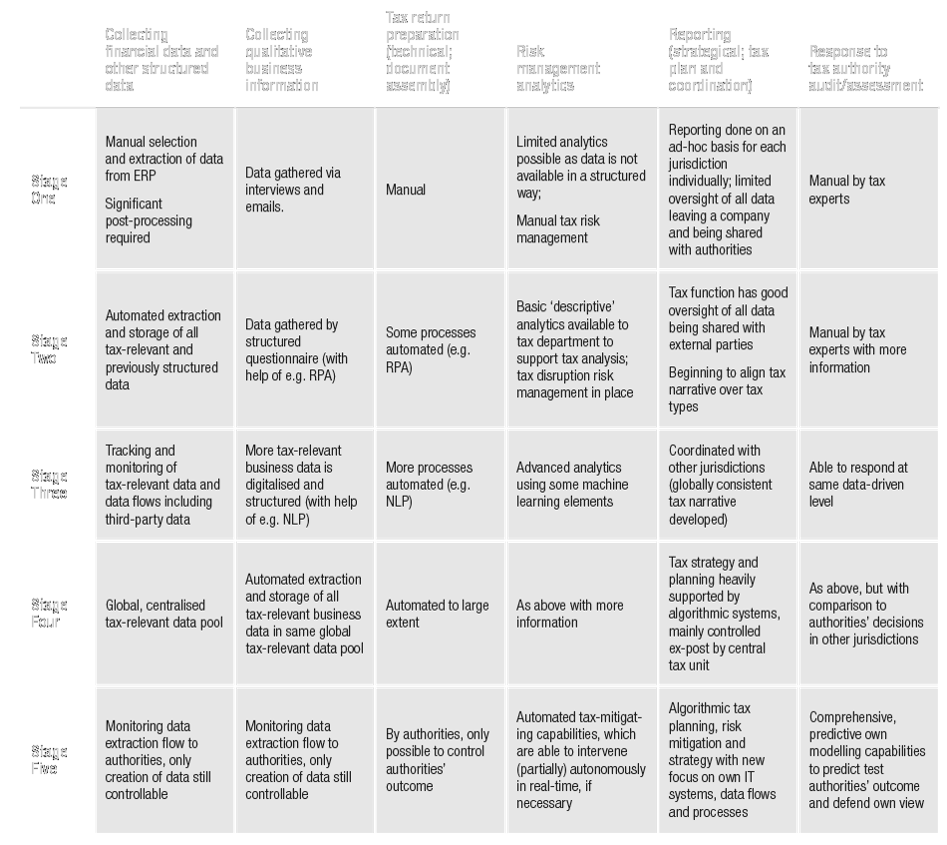

To assess your position, you need to think about what stage you are at on the tax disruption maturity model:

To help you think about how your company fits into this model, think about how you would answer the following questions:

Talk to our experts

Would you like to read more about Tax Disruption in general?

Contact us

Christoph Schärer

Tax and Legal Innovation, Transformation & Disruption Leader, PwC Switzerland

+41 58 792 42 82

Stuart Jones

Dr. Christian R. Ulbrich

Manager, Tax and Legal Technology, Strategy and Applications, PwC Switzerland

+41 58 792 23 16

Jean-Luc Wichoud