Multiple crises over the past 18 months have delivered a stark wake-up call to the world. If we are to prevent further pandemics, reduce the risks of climate change, build a more equitable society, and still generate growth, we’ll have to create more sustainable economies and systems.

The allocation of financial resources – and therefore investors – will play a significant role in this transformation as they encourage corporate behavioural change by favouring companies that are considering environmental, social, and governance (ESG) criteria in their activities. Businesses all over the world move ESG issues to their strategic agenda, acknowledging sustainability as a driver of value creation, and are adapting a proactive ESG mindset.

Global Private Equity Responsible Investment Survey 2021

PwC’s latest Global Private Equity Responsible Investment Survey demonstrates that private equity (PE) is on this same journey and is well-placed to provide leadership, thanks to decades of experience prioritising a strategic, long-term, activist approach to value creation.

However, some ESG aspects are not fully engrained into the entire PE deals cycle yet. Furthermore, it is a challenge to measure the value created or eroded due to the (lack of) availability of data and suitable information – especially when addressing ESG risks for whole company portfolios.

In this year’s Global Private Equity Responsible Investment Survey we have interviewed 209 firms from 35 countries and territories, mostly from Europe. The findings show how PE firms are best adopting sustainable investing and explain:

- that firms are entering a new age of ESG maturity,

- why ESG is becoming key to value creation, and

- what is driving enduring business success.

Entering the age of maturity

Over the past seven years, PE firms have radically reassessed the importance and value of ESG to their business. It has gone from being considered a tangential area of compliance, or a specialist product for a small minority of investors, to becoming an overarching framework that is impacting the strategic thinking of the entire firm. Thereby, the attitude and approach of PE firms has matured in many important areas, including how they value ESG performance; how ESG influences investment decisions, enterprise value and/or multiple; and engagement with investors and public reporting. ESG is also commanding significantly more attention at board level.

This new maturity is driven by several factors. There has been a marked improvement in the performance of ESG-focused funds, as investors have changed their own ethical standards, become more demanding, and have also considered the financial impact of factors such as consumers’ shift to more sustainable products, potential of new ESG regulations, and the reputational influence of diversity and inclusion policies. Recent reports found that most ESG funds outperform the wider market over ten years.

65%

of survey respondents have developed a responsible investing or ESG policy and the tools to implement it.

72%

always screen target companies for ESG risks and opportunities at the pre-acquisition stage.

38%

have identified United Nations' Sustainable Development Goals (SDGs) that are relevant at a company portfolio level.

Creating value for investors and society

In our 2019 survey, risk management was the biggest driver of ESG activity, but this year it dropped to fourth place, and respondents put value creation at the top instead. This shows that PE firms are embracing a far more proactive ESG mindset today. However, many PE firms are not able yet to report a measurable positive impact of ESG factors on value creation or investment performance due to a lack of data or challenges in reporting and scoring.

Major sustainability trends such as decarbonisation, circular economy, climate technology, nature-based solutions and inclusive recruitment are disrupting the status quo throughout the business world – reshaping both consumer tastes as well as the investment and acquisition strategies of leading PE firms.

Another reason for this shift from risk mitigation to value creation could be that managing partners have come to consider ESG offers as a real business opportunity, and they don’t want their firms to miss out. There’s an increased recognition among these leaders of the value creation opportunities that arise from aligning a business with the transition to sustainability, and there’s acknowledgement that ESG is a lever for transformation, alongside digitisation and internationalisation. Overall, the idea of investing for impact is becoming a mainstream strategy within PE.

40%

rank value protection as one of their top three drivers of responsible investing or ESG activity.

49%

say they integrate highly material ESG issues into commercial due diligence when making investment decisions, albeit on an ad hoc basis.

17%

have a dedicated impact fund or say they plan to launch one in the next year.

45%

do not have an impact fund but consider the impact of their investments.

The drivers of sustainable success

Employing a comprehensive ESG strategy requires PE firms to consider a wide range of specific, but often interconnected factors that could negatively or positively affect portfolios and the overall success of the business.

Significant gaps remain between concerns about individual ESG issues and the actions being taken to address them, especially in areas that are fast becoming business-defining, such as net zero, climate risk, biodiversity, and emerging technologies.

The UN’s Principles for Responsible Investing (PRI) 2021–24 Strategy also makes it clear that topics including climate and human rights will become ever more important for investors, especially in the context of the post-pandemic recovery.

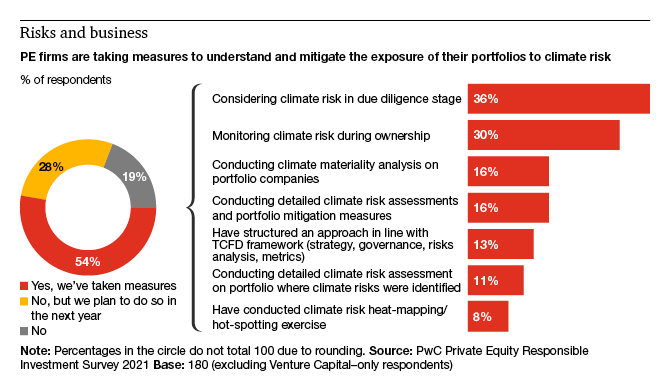

36%

of survey respondents consider climate risk at the due diligence stage to understand and/or mitigate the exposure of portfolios.

47%

have not undertaken any work in understanding the climate risk exposure of portfolios, but more than half of those respondents say they intend to in the next year.

Easy as ESG: The drivers of sustainable success

E – climate risk

In 2019, a vast majority of PE firms said they were concerned about climate risks in their portfolio. But most appeared to be slow in addressing the issue. This year, more than half of the firms in the survey are already taking action, and more than one third say they consider climate risk when making investment decisions. However, evaluating the climate risk of a portfolio is complicated. To chart the right course, PE firms will need both more data and tools and a greater level of knowledge and sophistication.

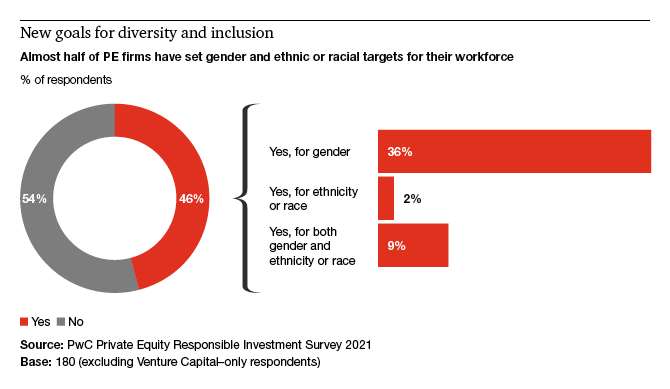

S – diversity and inclusion

The past five years have seen a new resolve to improve diversity and inclusion within the workplace, particularly in terms of gender equality. A majority of survey respondents believe that diverse teams generate business benefits – notably in the field of innovation. Improving diversity and inclusion is becoming a higher priority in a globalised workforce where firms compete for a new generation of talent that considers diversity as the norm, not the exception. Throughout Europe, PE firms are signing on to diversity initiatives and chapters promoting gender equality.

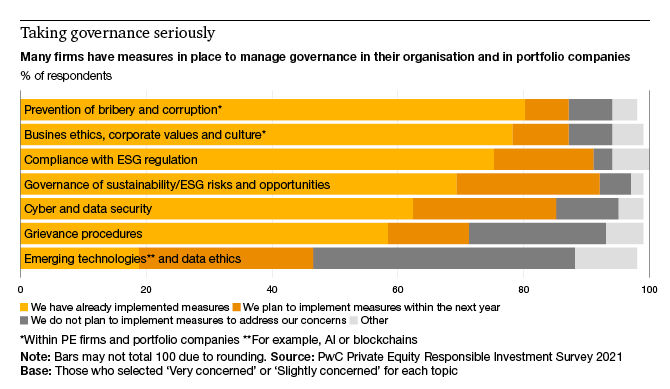

G – governance

Prevention of bribery and corruption has long been a top governance concern for business. Interestingly, the next three issues of concern that are being addressed by PE all relate to the future of sustainable business. The connection to compliance with ESG regulation and governance of ESG risks and opportunities is obvious. However, as PE firms address business ethics, corporate values and culture, they will increasingly do so through the lens of responsible investing or ESG strategies.

Next steps

- Set a strategy, both as a company and as an investor

- Set a clear road map and targets for sustainable value creation

- Build a team equipped to face the challenge

Set a strategy, both as a company and as an investor

ESG issues will reshape the global economy in the coming years and affect the investment success of PE and the entire financial services sector. Furthermore, these issues are interconnected. So it’s crucial for PE firms to incorporate responsible investing and ESG into their general business strategy and no longer consider it as a side issue or specialist offering. Some ESG issues—such as climate risk, net zero, diversity and emerging technologies—will have an overarching influence on firms and their investment portfolios. Other issues might be more specific to individual companies, sectors or geographic locations. Understanding both the big picture and specific portfolio ESG risks and opportunities will help shape a strategy that will deliver sustainable value creation.

Set a clear road map and targets for sustainable value creation

PE firms should approach responsible investing and ESG the same way they would other strategic issues with direct impact on their investment returns. At the portfolio level, PE firms should engage with their portfolio companies’ management teams to truly integrate ESG into their transformation and value creation plans.

When assessing new investment opportunities, PE firms should not look at the ESG risks only during diligence, but should start thinking about the value creation opportunities early on and bake those into the value creation plan. They should consider how ESG might be treated in the commercial, finance and tax due diligence. Fundamentally, leaders should ascertain whether there’s an opportunity to align the business with the sustainable transition that could form part of the investment thesis and truly unlock potential sustainable value creation. If ignored, sustainability issues can erode value, hinder growth and block access to finance. Conversely, if addressed properly, they can drive value creation across the spectrum.

Build a team equipped to face the challenge

Paradigm shifts require a rethink of accepted ways of doing things, to ensure resilience. An understanding of ESG issues will be a fundamental necessity for successful private equity investors. Operational training is essential for investment teams if they are to prepare quickly and truly comprehend the topic.

Firms will also need to recruit the right talent to deliver sustainable value creation. That will involve hiring people with sustainable business expertise and, in general, hiring more diverse teams in terms of gender, ethnicity and age, as well as socioeconomic background and training. The good news is that the firms that demonstrate a commitment to ESG will likely be best placed to attract and retain that talent.

Download the survey

https://pages.pwc.ch/core-asset-page?asset_id=7014L000000Pj2nQAC&lang=en&embed=true

Contact us

Partner, Finance Transformation Platform Leader and Sustainability Platform Leader, PwC Switzerland

Tel: +41 58 792 25 37