Time to act for on the regulatory landscape

Sustainable finance regulation

Sustainable Finance is now in the focus of public and political attention. This is because the global financial system has an important role to play in the implementation of the United Nations 2030 Agenda (Sustainable Development Goals) and the Paris Climate Agreement. By directing financial flows into sustainable activities and integrating environmental, social and governance (ESG) criteria into business and investment decisions, the financial sector has great potential to change markets and to shape sustainable economic systems.

In March 2018, the European Commission’s Action Plan on Sustainable Finance provided decisive impetus to the topic of sustainable finance. The Action Plan sets out a comprehensive strategy to connect sustainability and finance, by amending financial regulations and policies and explicitly introducing sustainability aspects.

The European Commission’s Action Plan on Sustainable Finance

According to the plan, sustainability standards will be incorporated to a varying extent into the following major regulatory frameworks:

- Benchmark Regulation

- Markets in Financial Instruments Directive II (MiFID II)

- Alternative Investment Fund Managers Directive (AIFMD)

- Directive on Undertakings for Collective Investment in Transferable Securities (UCITS)

- Directive on the Activities and Supervision of Institutions for Occupational Retirement Provision (IORP II)

- Directive on the Taking-up and Pursuit of the Business of Insurance and Reinsurance (Solvency II)

- Insurance Distribution Directive (IDD)

- Capital Requirements Regulation / Capital Requirements Directives (CRR/CRD)

- Credit Rating Agencies Regulation (CRA Regulation)

In addition, the Action Plan envisions new legislative initiatives such as:

- Regulation on Disclosures relating to Sustainable Investments and Sustainability Risks

- EU Taxonomy Regulation for Sustainable Activities

The creation of various standards and labels for green financial products, such as an EU Ecolabel for Financial Products and EU Green Bond Standard, is also on the regulatory agenda. In addition, the Commission is looking into providing guidance on the disclosure of climate-related information considering standards such as those by the Task Force on Climate-related Financial Disclosure (TCFD).

Given the large number of regulations concerned and the pace by which sustainability is entering the mainstream of financial markets regulation, all banks and financial institutions that are active in the EU markets need to keep up with new legal requirements, and there is an inherent risk of taking required actions too late.

At the same time, financial market participants are confronted with increasing expectations of different stakeholders, which expect transparency and disclosure of the company's services in terms of sustainability.

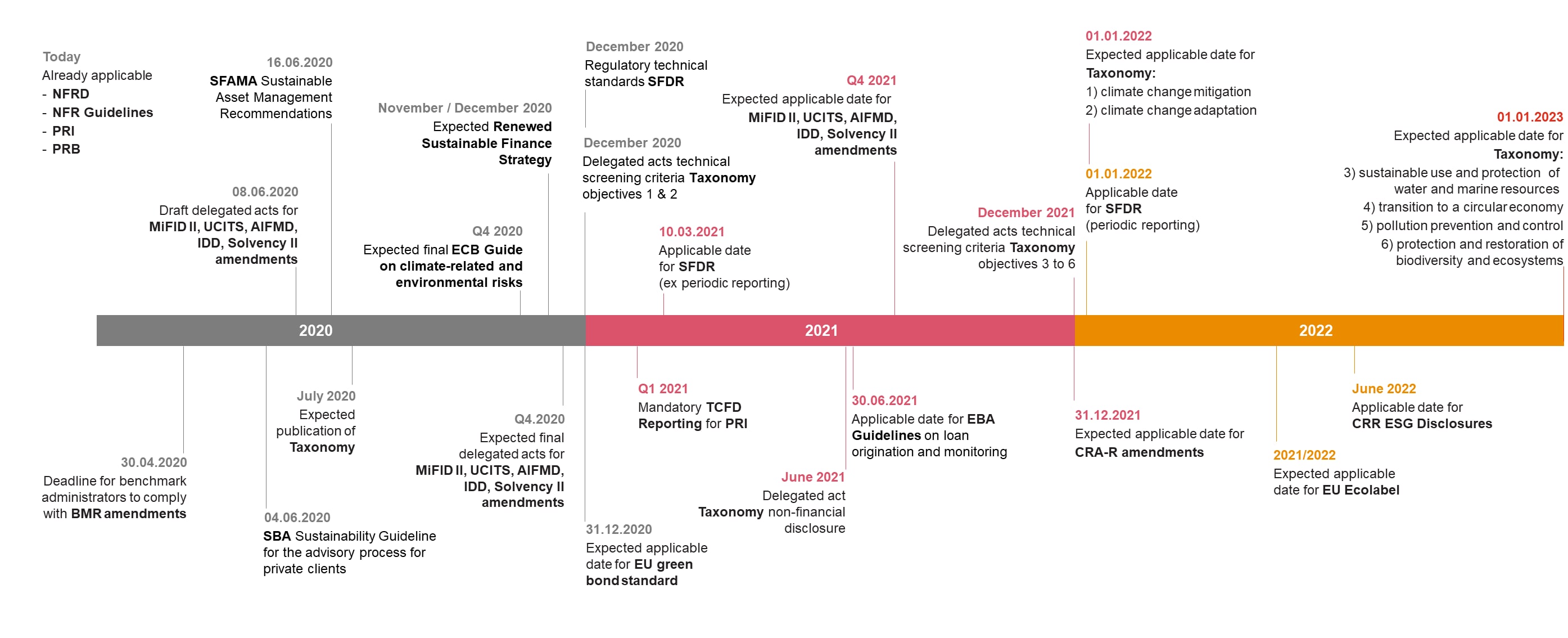

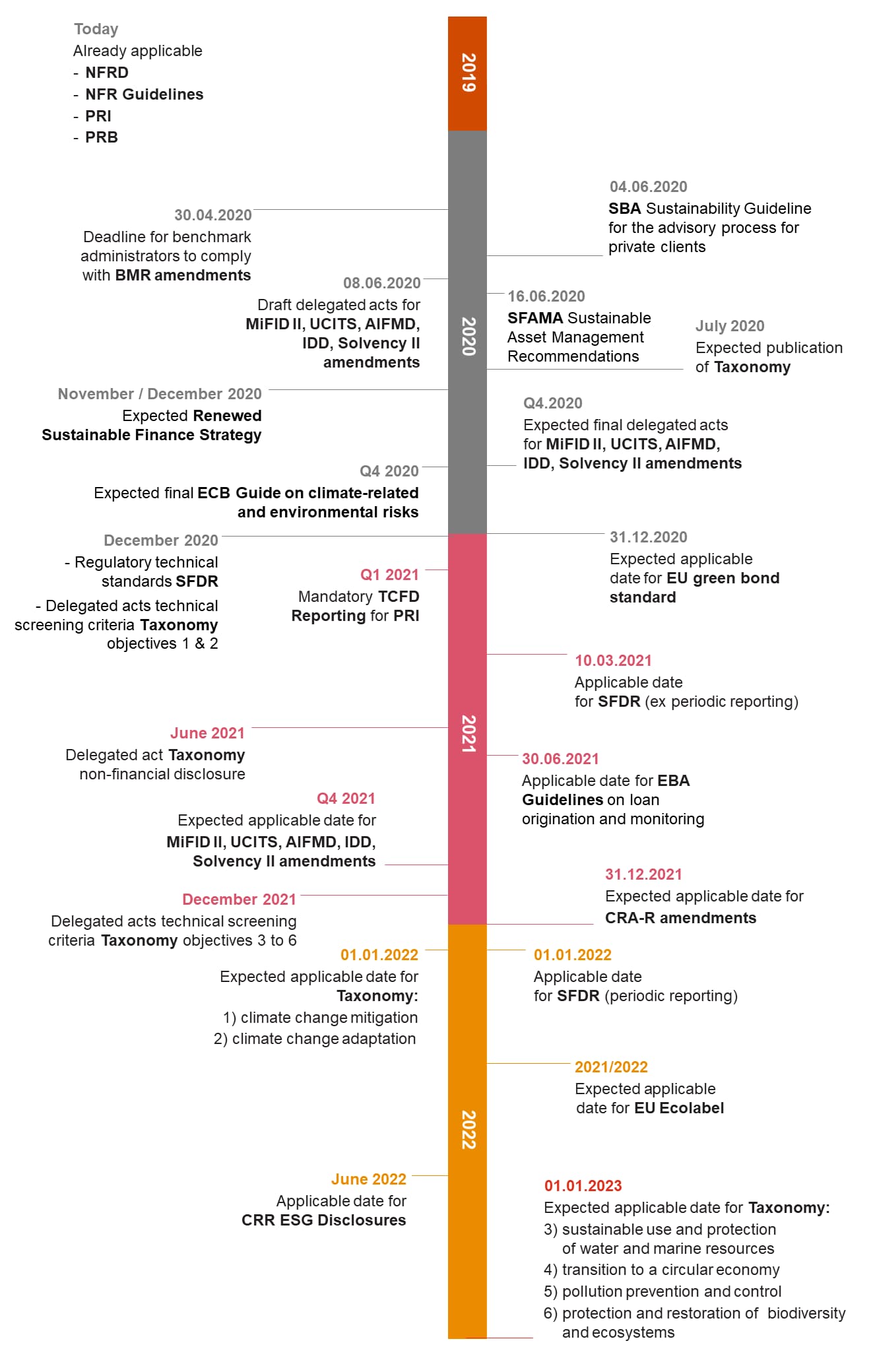

The Action Plan timeline

Our services

Legal is a market and thought leader in the field of Sustainable Finance and we can make the most of extensive know-how from various successful projects with financial institutions. We help you meet the regulatory requirements while harnessing the business potential of sustainable finance.

We have specialist teams to help you address your environmental, social and governance (ESG) challenges as well as subject matter knowledge, combined with an in-depth understanding of the local regulatory landscape.

- Strategic impact assessment of the EU Action Plan and definition of sustainability TOM

- Regulatory impact assessment

- Amendment of risk management methodology

- Integration of taxonomy criteria into investment decisions

- Implementation of TCFD / PRI and PRB standards

- Definition of top-down sustainability strategy

- Bottom-up portfolio quantification on asset level

- Product governance and target market definition

- Labelling (setup and registration process)

- Analysis of investment strategy of funds

- Structuring impact & ESG investing funds

Our pillars to be compliant with Sustainable Finance

- Regulatory Radar

- Strategic Regulatory Gap Analysis

- Regulatory Transformation

- Risk Management and Control Framework

- Corporate Governance Structure

- ESG Rating Methodology

- Macro- and microprudential ESG framework

- EU-SFDR disclosure

- EU-Taxonomy portfolio assessment

- Climate Risk Reporting

- PRIIPs KIDs go ESG

- Compensation and Corporate Governance

- EQUAL-SALARY Certification and Gender Equality

- Diversity & Inclusion

Regulatory Radar

Sustainable Finance Regulatory Radar

Given the green regulatory tsunami, there is an inherent risk of missing out on critical topics or taking required actions too late. The Sustainable Finance Regulatory Radar, a web-based platform, is our response to the regulatory avalanche, allowing users to keep track of the latest sustainability-related trends worldwide. We use it to provide clients with a comprehensive overview of the latest regulatory developments in various jurisdictions globally, including impact assessments and recommended actions.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

Strategic Regulatory Gap Analysis

Strategic Regulatory Gap Analysis on Sustainable Finance

Adapting to the constantly changing sustainable finance regulatory landscape and being compliant is key for financial institutions. In order to implement the various new requirements, institutions must be aware of the required changes. Therefore, we offer to conduct Regulatory Gap Analysis comparing status quo and the changes required by law as well as the specific impact of regulatory changes on organisations. By analysing the regulatory gap, we lay the foundations for all of the next steps (e.g. implementation).

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

Regulatory Transformation

Regulatory Transformation of Sustainable Finance

The implementation of the many new regulatory requirements for Sustainable Finance is a highly challenging task for financial institutions, requiring sustainable finance regulation expertise, in-depth understanding of the business requirements and careful planning with consideration of all relevant aspects. We accompany our clients’ strategic regulatory transformation, providing an integrated approach that aligns the regulatory business requirements with the institution’s specific and strategic priorities complemented by excellent regulatory and market expertise in the field.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

Risk Management and Control Framework

Designing ESG-compliant Risk Management and Control Framework

Sustainability risk management is one of the central pillars of the new regulatory and market developments in Sustainable Finance and is one of the most challenging topics for financial institutions in relation to sustainability. We support our clients in designing an ESG Risk Management and Control Framework for the effective management of ESG risks throughout their organisation.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

Corporate Governance Structure

Designing ESG-compliant Corporate Governance Structure

With increasing regulatory and market pressure on sustainable finance, financial institutions need a strong and efficient corporate governance structure in relation to sustainability. We help you define the sustainability structure that best suits your needs and ambitions.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

ESG Rating Methodology

ESG Rating Methodology on Sustainable Finance

The new sustainability-related regulatory requirements put significant pressure on financial institutions to find the best suitable solutions for their business. This includes exploring the opportunity to use their own ESG rating methodologies to comply with the requirements, as well as providing added value to their clients. We support you with this opportunity.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

Macro- and microprudential ESG framework

Support in the review of macro- and microprudential ESG framework

Within their micro- and macroprudential mandate, regulatory bodies have to address climate-related risks. We offer to review/analyse the current framework and the corresponding instruments at their disposal with a view to including sustainability considerations. In addition, we support authorities by providing a market study, which: a) highlights their new supervisory tasks towards market actors, b) stresses their duties towards other regulatory bodies (e.g. providing information) and c) provides an in-depth market overview of key developments in sustainable finance.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

EU-SFDR disclosure

Implementation of the EU-SFDR (Sustainable Finance Disclosure Regulation)

The EU-SFDR obligates you as a financial market participant to disclose to clients and investors how green your financial products are. Moreover, it stipulates that you must disclose how sustainability risks are integrated into the provision of services, for example, portfolio management and investment advice. Under the EU-SFDR, you must classify your financial products into one of three categories: mainstream, light green or dark green. Additionally, it is required that you carry out a due diligence process to consider the “principal adverse impacts”.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Dr. Astrid Offenhammer, Financial Services Consulting

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

EU-Taxonomy portfolio assessment

Portfolio alignment review regarding the EU-Taxonomy

You are required to carry out an alignment assessment of your portfolio against the EU-Taxonomy, which defines which economic activities of your underlying investments (companies and projects) are considered as sustainable. By doing so, you are allowed to brand your investments as sustainable. The EU-Taxonomy fights greenwashing and improves transparency for sustainable investments.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

- Dr. Astrid Offenhammer, Financial Services Consulting

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

Climate Risk Reporting

Assessment of climate risks (FINMA circular, TCFD)

Correctly assessing and evaluating climate risks is key to protecting your company value. Therefore, a third-party review of your integrated climate risk framework reduces the risk of being blindsided by any climate risks you have not yet considered and ensures compliant regulatory reporting. Moreover, we are seeing a shift whereby regulators are transmitting current soft laws into strict regulations that need to be adhered to.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Christophe Bourgoin, Sustainability Leader

- Dr. Astrid Offenhammer, Financial Services Consulting

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

PRIIPs KIDs go ESG

PRIIPs KIDs GAP assessment

A tsunami of green regulation is sweeping through the finance industry. The EU Action Plan on Sustainable Finance impacts financial service providers and the real economy. The newly introduced EU Taxonomy, which classifies sustainable economic activities, and the Sustainable Finance Disclosure Regulation (SFDR), which provides guidance for determining the greenness of financial products, must be taken into account when classifying your PRIIP according to ESG criteria (ESG PRIIP). The PRIIPs Regulation already requires that any applicable ESG information must be included in the ‛What is this product’ section of the KID. To ensure consistency and transparency and to counteract greenwashing, the ESG information for a PRIIP must be disclosed in the KID, with reference to the EU Taxonomy and SFDR requirements.

Contacts:

- Dr. Antonios Koumbarakis, Sustainable Capital and Sustainability & Strategic Regulatory Leader

- Dr. Astrid Offenhammer, Financial Services Consulting

- Sofia Jaccard, Strategic Regulatory & Sustainable Finance

Compensation and Corporate Governance

Designing, reviewing and implementing compensation systems

Companies are all unique – and so are their compensation systems. If it’s to do what it’s meant to do, a compensation system should be a good fit with the company’s strategy. A well-balanced compensation system helps to motivate staff, to foster loyalty and to attract new talent. Our services focus on the “G” dimension of ESG and particularly include:

- defining reward strategies and developing total compensation frameworks (incl. systematic integration of company-specific ESG aspects)

- implementing compensation systems (incl. plan rules, tax rulings, etc.)

- assessing incentives schemes from a tax, financial, regulatory and governance perspective

- reviewing compensation reports for regulatory compliance and value reporting purposes

- drafting compensation reports

Contacts:

- Angela Bucher, People and Organisation

- Johannes Smits, People and Organisation

- Roman Schneider, People and Organisation

EQUAL-SALARY Certification and Gender Equality

Demonstrating commitment to gender equality

Gender equality is one of the cornerstones of the “S” dimension of ESG. Our data scientists and multicultural experts are extremely experienced in all matters relating to equal pay. Furthermore, our longstanding partnership with the EQUAL-SALARY Foundation enables us to support organisations from all industries and of all sizes and complexities to close their gender pay gap. Our specific services include:

- EQUAL-SALARY certification (Learn more)

- equal pay analysis, guidance and external audits to be compliant with the revised Gender Equality Act (Learn more)

Contacts:

- Johannes Smits, People and Organisation

- Jasmin Danzeisen, People and Organisation

- Roman Schneider, People and Organisation

Diversity & Inclusion

Helping you attract, motivate and retain the diverse talent your business needs to flourish

Diversity & Inclusion (D&I) is one of the key topics in ESG and becomes more and more an essential focus point in sustainable finance. Based on our experience, we have evolved an approach that systematically addresses the four key components of D&I management: (i) strategy, (ii) analytics, (iii) awareness and education and (iv) inspiration. Our specific services include:

- D&I strategy design

- D&I maturity assessment

- HR dashboard with D&I analytics

- D&I training and workshops

- gender pay compass and parental leave compass

Learn more

Contacts:

- Johannes Smits, People and Organisation

- Jasmin Danzeisen, People and Organisation

Contact us

Partner, Sustainable Capital and Sustainability & Strategic Regulatory Leader, PwC Switzerland

+41 58 792 45 23

Sofia Jaccard

Elena Prässler

Marc Lehmann

Juliane Welz