{{item.title}}

{{item.text}}

{{item.text}}

Reto Brunner

Partner, Advisory, PwC Switzerland

Dr. Michael Betz

Senior Manager, Commercial Excellence in IM&A, PwC Switzerland

Being a small country in the global economic network, Switzerland is particularly exposed to global forces and uncertainties. This is especially true for the industrial manufacturing and automotive (IM&A) sector with its international interdependencies. Being aware of these uncertainties is crucial to actively shaping the future. With the aim of creating awareness of future scenarios in the Swiss IM&A sector, we discuss what the world could look like in 2030 and how IM&A companies can prepare today.

With the rise of the global pandemic in early 2020, hardening walls between superpowers and their economic exchange, the world is becoming a smaller and more fragmented place. Limited supplies and shifting supply chains facing a changed demand pattern leave the IM&A sector empty-handed when serving their global customers.

An important adaption to reduce the dependence on global supply chains is the recognition and establishment of regional and local structures by means of production networks of highly-specialised and technologically dominant niche players. Shortages of shipping capacities and increasing tariffs point to structures that support short and controllable supply chains within reach.

“Made in Switzerland” is not just a globally accepted indicator for the highest quality standards, but also a strong supporter for the decision to buy domestic.

Therefore, the future of Swiss manufacturing will be a combination of local product design and engineering with regional network structures in various global clusters, supporting cost-efficient production and near-shore supply chains. This shift ultimately leads to changing job profiles and business models.

From globalisation to glocalisation

The Swiss manufacturing industry must reinvent itself

There are very few countries that are more attractive to young professionals and knowledgeable people than Switzerland. The country is highly innovative and has high standards in education, summoning some of the finest universities in the world.

Young talents are attracted to places where they can grow and thrive. Automation, AI, blockchain and robotics are just a few sectors that guide into the future of mankind. Switzerland has the capabilities to become another Silicon Valley – a real valley with mountains surrounding it. The innovation drawn inside the country will become the most important export good, enabling the economy to develop into a major global technology hub, with rising incomes and driving societal change.

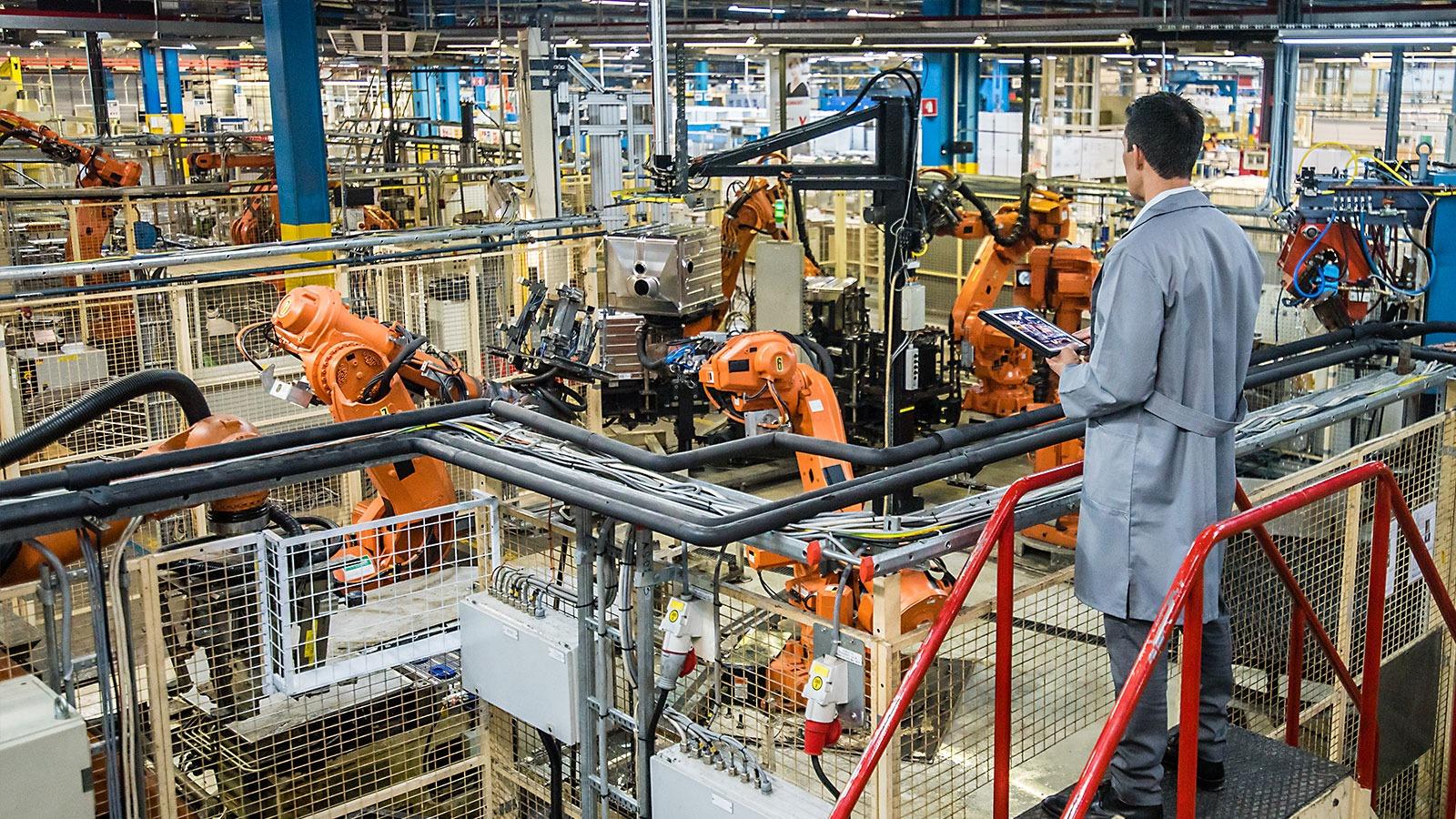

The Swiss IM&A sector needs to focus on how the country really distinguishes itself from other nations: it is ideas and innovation and not large-scale production, even if automation and robotics can ensure international competitiveness in that field to a certain extent.

The growing understanding and demand of the global community for more resourceful thinking and acting establishes a need that companies must follow in order to be respected and recognised as a producer and seller in the coming decade. Energy-efficient manufacturing processes and the circular economy are only two examples in this context. Moreover, this development offers enormous business potential, especially if sustainability and economic benefits can be combined.

Switzerland already has high standards when it comes to environmental protection and sustainability, and its people have an ecological mindset. The country is globally recognised for its natural and geographical heritage. These are the best prerequisites for playing a globally leading role as an ecological and sustainable innovation leader.

Therefore, the Swiss-based IM&A sector should focus on globally exporting sustainable innovation that also adds economic value to customers. But who develops all the innovation?

Sustainability in manufacturing: Delivering net-positive returns

Turn sustainability into a value differentiator by focusing on three areas.

An entire generation of workers is ready to retire – officially. But are they going to? Mastering the challenges of technological disruption out of a pre-digital work environment, a considerable chunk of the workforce which is reaching the official retirement age feels ready and willing to stay in the labor market afterwards. Packed with innovative ideas and experience, they will remain a vital part of the labor market. They are also joined by, and will closely collaborate with, a new generation of skilled workers who prefer to receive pay based on what they contribute instead of how many hours they work. These talents are looking out for challenges and adventures instead of a lifelong relationship with their employer.

For the industrial sector, this means a shift in their workforce demographics. Firms will need to establish know-how management tools to keep up with changes in their employee base and not lose out on technical capabilities. HR must tackle the challenge of attracting employees who want to contribute based on interest, rather than securing employment over long periods of their life. Payment models will then follow. Getting paid what one contributes is summed up by the term ‘value-based salary’. If you have one brilliant idea per month that can make the company money and it only takes one hour of work, you can take the rest of the month off.

Swiss industrial firms have a lot to adapt to – but they can leverage a vast amount of experience, fresh know-how and disruptive ideas if they are willing to embrace it.

Customer needs in industrial goods markets are changing faster and faster, and customers are becoming more demanding. They expect nothing less than a high level of customer-centricity, solutions tailored to their individual needs, and products and services which add value.

These high demands come up against IM&A companies which currently do not pay much more than lip service to the idea of customer-centricity. The product and technology-oriented business models are outdated, where customer needs are disregarded, silo thinking prevails, and customer orientation is delegated to marketing.

To remain competitive in the future, IM&A companies must make customer centricity part of their DNA. This includes a reinvention of business models, the establishment of a customer centric culture, a re-design of the operating model, the installation of workflows around the customer and their needs as well as building and maintaining trustful and long-lasting relationships with customers, to name a few.

Today, customer orientation is perhaps still a differentiating factor. In the future, however, it will be nothing more than a basic prerequisite for being allowed to play at all.

A video series on trends in sales and technology-led transformations

Check out our video series, hosted by Dr. Michael Betz and Florian Greiner, and learn how to future-proof your business.

To remain competitive and reliable in the future, companies need to understand that technologies that are still in their infancy today will eventually define the standard of tomorrow. Here are a few examples:

IM&A companies should consider early on how they can best benefit from these technologies.

Of course, everything could also turn out quite differently. However, there are already strong indications of much of what has been described above, which is partly already supported by technological advancements.

#social#

According to our outlook, Swiss IM&A companies can only remain competitive in 2030 if they follow these five rules:

Do you agree with what we see? Or does your crystal ball show different scenarios? We look forward to hearing your views and to discuss the future of the Swiss IM&A sector and your company together with you. Just get in touch.

https://pages.pwc.ch/core-contact-page?form_id=7014L000000PpJhQAK&embed=true

Senior Manager, Customer Transformation, PwC Switzerland

Tel: +41 58 792 27 20